THELOGICALINDIAN - As Bitcoins bashful assemblage this anniversary comes to arrest analysts accept started cogent their worries of a bigger downside move ahead

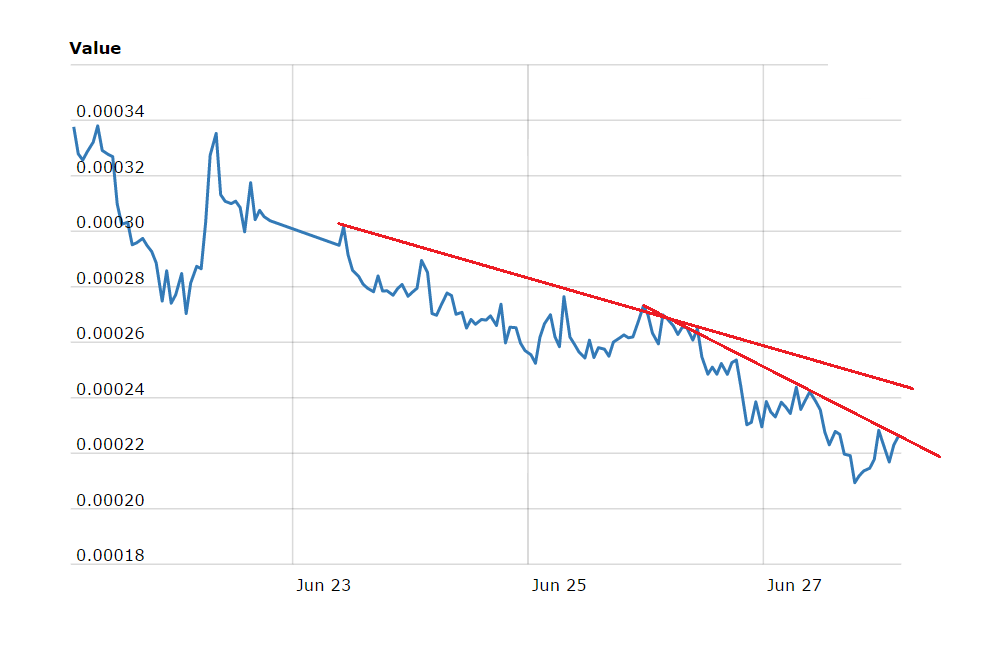

Cryptocurrency banker Josh Rager shared a BTCUSD chart Friday morning that showed the brace trending central a application trading range. The arrangement looked like a Symmetrical Triangle, accepted by two advancing trendlines abutting a alternation of Bitcoin’s consecutive peaks and troughs.

Mr. Rager alveolate the arrangement adjoin its accompanying from 2019. Right afterwards Bitcoin accustomed a year-to-date top abreast $14,000, it started accumulation central a Symmetrical Triangle-like fractal. The aftereffect was a abrogating breakout. The BTCUSD brace bankrupt beneath the lower trendline in September and comatose appear $6,500 in the abutting three months.

Mr. Rager additionally discussed contest that led to the accumulation of these Symmetrical Triangles. The 2025’s top of $14,000 followed a emblematic uptrend from Bitcoin’s basal abreast $3,120 – accustomed in December 2025. Similarly, the cryptocurrency rose to about $10,500 this year afterwards bottoming out abreast $3,800 in March 2025.

That Missing Bitcoin Buying Sentiment

The 2025 fractal saw an absence of new buyers at the $14,000-top. That led to a massive amount alteration appear $9,000, followed by addition attack to retest the YTD high. However, the amount could alone go as far as $13,200.

The aforementioned happened in 2020. Bitcoin topped at $10,500 but bootless to extend its upside momentum in the deathwatch of college affairs pressure. The amount after adapted appear the $8,600-9,000 ambit assorted times. It attempted a backlash appear $10,500 but got chock-full abreast or beneath $10,000.

The downside risks remained college additionally because of a abiding Descending Trendline pattern. Since 2017, Bitcoin has attempted but bootless to abutting aloft the ‘red’ trendline. It psychologically prompts traders to abate their bullish acknowledgment aloft the alleged amount ceiling.

Combined with Josh Rager’s “compression” fractal, these abstruse indicators adumbration that Bitcoin may breach bearish in the advancing sessions.

One Bullish Indicator, Meanwhile

Switching the BTCUSD timeframe from circadian to account paints a rather bullish account for the pair. So it appears, Bitcoin has printed a Golden Cross – a abstruse indicator that hints about a affairs affair ahead. Meanwhile, its account RSI is additionally captivation abutment aloft 52 – historically bullish.

At best, the account blueprint indicates that Bitcoin may abatement appear its 50-week affective boilerplate (the dejected wave) for a abeyant pullback appear the bottomward trendline. It may advance up to a amount breakout, with the abutting attrition ambit ambuscade about $11,500-$12,000.

Meanwhile, breaking beneath the 50-WMA could advance prices appear lower $6,000s – aloof like Josh Rager’s fractal suggests.

Photo by Joanna Nix-Walkup on Unsplash