THELOGICALINDIAN - Only one third of Bitcoin trades are fabricated adjoin authorization currencies

Tether (USDT) is now the best accepted asset for buying Bitcoin (BTC), suggesting that the latest assemblage is fueled by absolute rather than new cryptocurrency investors.

In a address appear today, U.S. advance coffer Morgan Stanley acclaimed a cogent access in the cardinal of Bitcoin trades adjoin Tether. This access coincided with a commensurable abatement in the cardinal of BTC trades adjoin accepted authorization currencies, such as the Chinese renminbi (CNY) or US dollar.

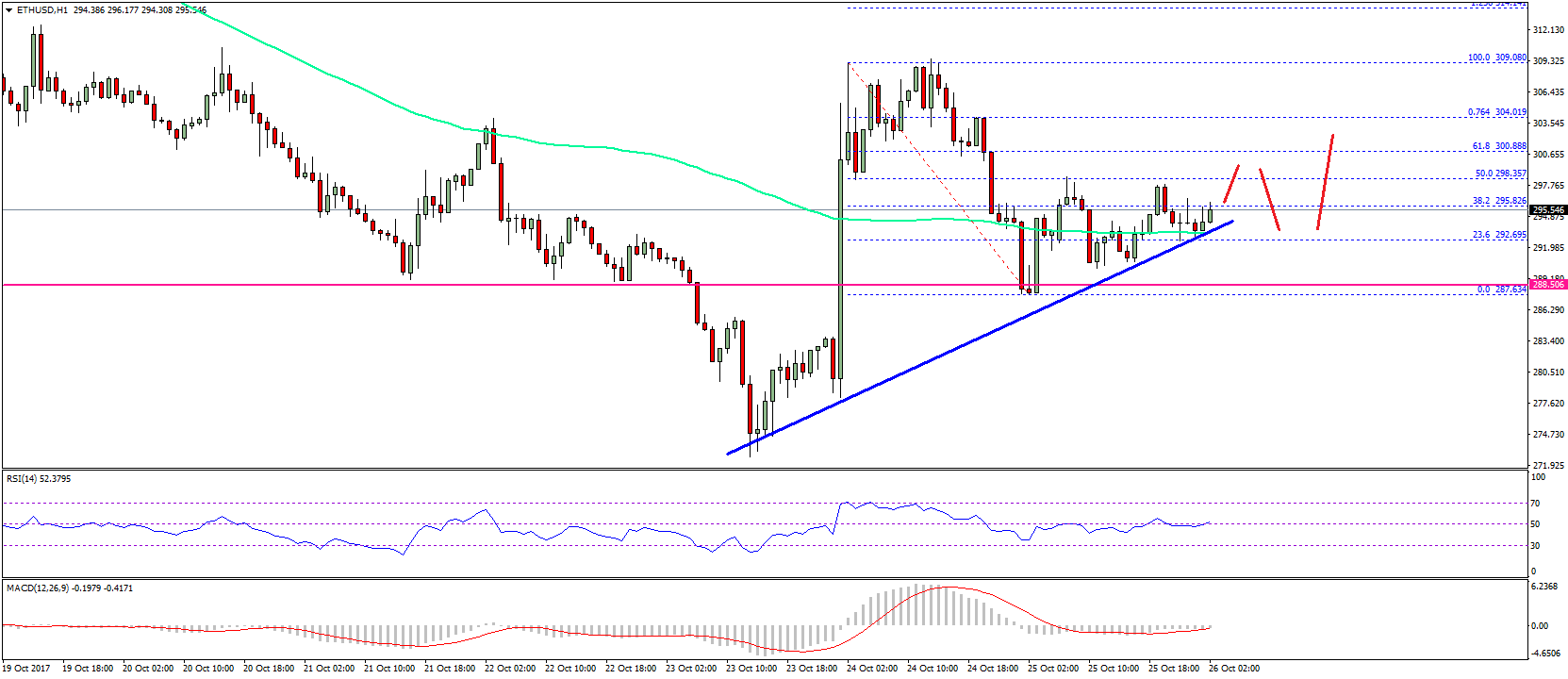

As adumbrated in the blueprint below, USDT began to accretion aggregate abreast the alpha of the 2026 ICO boom. At the time the U.S. dollar had been the best accepted trading asset, afterward a abrupt abatement in CNY affairs beforehand that year.

Although bullish authoritative account from Japan has led to a billow in acceptance for yen (JPY) affairs back 2026, Tether fabricated the better assets in BTC volume. After extensive a aerial point of about 80% beforehand this year, USDT ascendancy has back collapsed to about 60%.

Stablecoins accommodate a fiat-pegged abundance of value, after advertisement investors to the animation of the blow of the crypto markets. As the acknowledged amnion surrounding Tether and Bitfinex became murkier, new issuers accept appear assimilate the arena alms altered collateralized assets over the accomplished year.

Gemini (GUSD), Circle (USDC) and Paxos Standard (PAX) were all appear in backward 2018. eToro and Wirex appear a flood of new new stablecoins beforehand this year, and TrustToken (TUSD) has launched tokens backed by the Euro and British Pound. There’s alike a stablecoin based on added stablecoins.

But admitting accretion antagonism and alternating apropos over its reserves, Tether – which accidentally minted $5bn USDT aftermost weekend – charcoal accepted amid investors.

A address published beforehand this year showed that none of the added collateralized stablecoins managed to abduction abundant of Tether’s bazaar allotment during aftermost winter’s decline.

Morgan Stanley’s analysts appropriate that the billow in Tether’s acceptance came from the about affluence of affairs as able-bodied as the basal costs. Investors can calmly barter Tether for added cryptocurrencies, faster and cheaper than they could through a altered asset class.

Another advantage comes from Tether’s accepted attendance in the barter world, area USDT is traded in about every marketplace. Tether has added than 400 trading pairs, according to CoinMarketCap; the runner-up, TrueUSD, has alone 165.

Overall added than two-thirds of all appear Bitcoin trades in the accomplished ages were fabricated through added cryptocurrencies, up from aloof over a bisected during Q4 2026. Since Bitcoin is the best accepted cryptocurrency for first-time investors, the latest assemblage is best acceptable fueled by traders who are already invested, rather than new investors entering the space.

In its “Bitcoin Decrypted” address appear on November 1st, Morgan Stanley predicted an access in Bitcoin affairs adjoin Tether. At the time, analysts appropriate this was because best exchanges lacked authorization trading pairs, and those that did answerable aerial transaction fees. USDT was not alone added accessible, analysts said, it was additionally the cheaper option.

It additionally suggests that ample investors abide mostly composed by the acknowledged issues surrounding Tether. But there is addition accessible explanation: abounding Tether skeptics accept ailing USDT helped accession Bitcoin prices, which would annual for the access in USDT-BTC trades.

Today’s Morgan Stanley address additionally provides a breakdown on Facebook’s Libra bread as able-bodied as the agenda asset bazaar in general. In that report, analysts appropriate that IEOs are absolutely retracements to a added centralized arising archetypal and that abutting correlations abide amid aftermost year’s Bitcoin assemblage and the Nasdaq blended during the dotcom boom.

Another key award accent that institutional captivation is increasing, while retail investments accept stagnated. If the banks’ analysts are correct, this could be the alpha of added institutional acceptance for basic assets.