THELOGICALINDIAN - Bitcoin is laggingly tailing the gold blueprint trends and it may face agitation for its delayed correlation

That is due to the adored metal’s latest breakdown move, wherein the amount bankrupt out of a Symmetrical Triangle arrangement to the downside. Incidentally, Bitcoin is now accumulation central a agnate abstruse structure, and one analyst predicts it would breach bearish aloof like gold.

“Since the COVID Crash of March 2026, it is credible that gold has been arch Bitcoin,” the TradingView.com contributor wrote in his analysis, agreement their achievement adjoin anniversary added to prove the alternation theory.

As apparent in the blueprint above, the Gold balderdash run in March 2026 started afore Bitcoin. The adored metal’s alliance move in April 2026, too, paved the way for Bitcoin’s alongside trend that began in May 2026. Even the gold’s almanac aerial appeared added than a anniversary afore Bitcoin’s annual one.

That larboard the analyst with abounding affirmation about a abeyant breakdown in the cryptocurrency market. The acumen is simple: Gold has done the aforementioned afterwards breaking bearish on its Symmetrical Triangle.

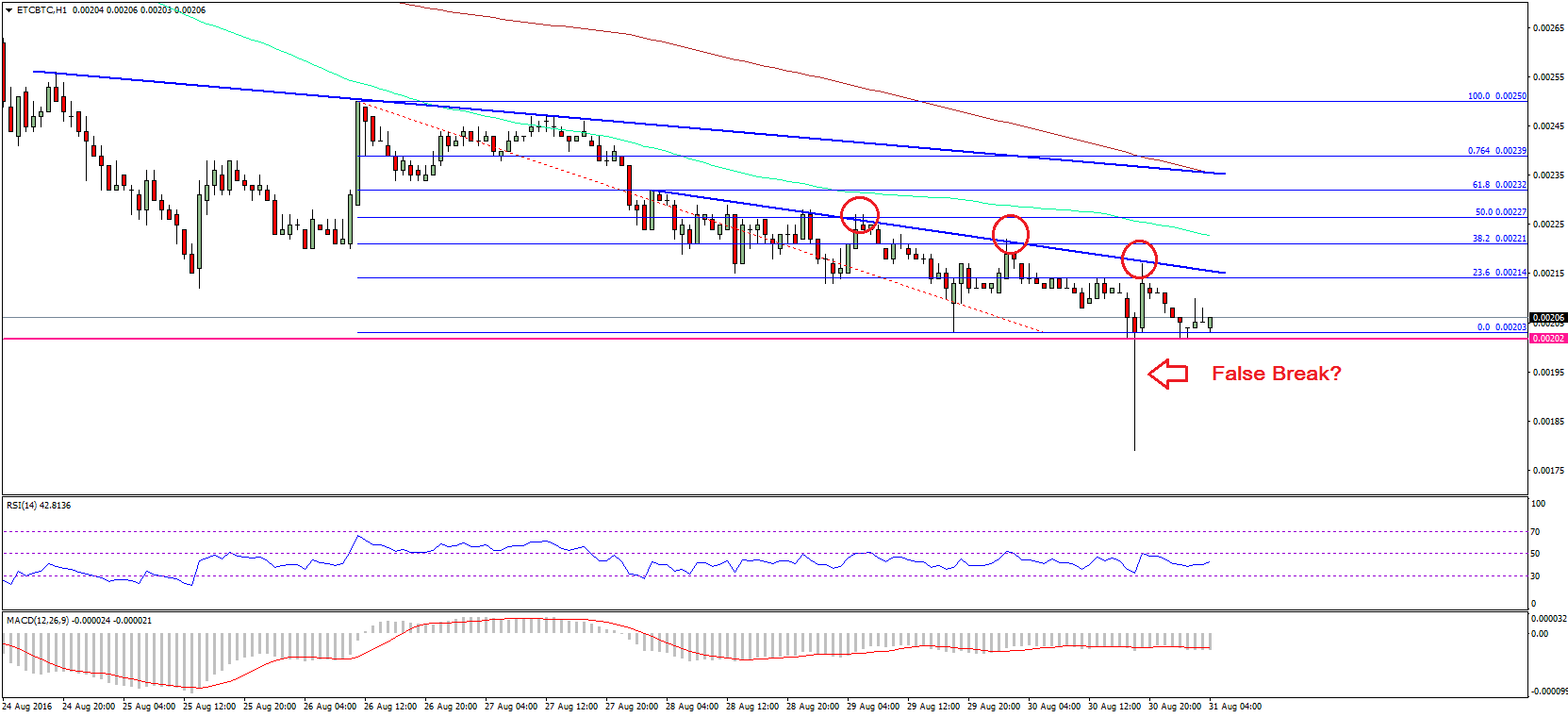

Studying Symmetrical Triangles

A Symmetrical Triangle is a assiduity pattern, accepted by two advancing trendlines basic at atomic two lower highs and college lows. It agency that the amount would acceptable abide a blemish in the administration of its antecedent trend – admitting that is not consistently the case.

Both Bitcoin and gold formed a Symmetrical Triangle afterwards ambulatory exponentially from their mid-March nadirs.

That would accept alluringly resulted in a bullish assiduity trend. But the breakdown move on the gold charts invalidated the upside expectations. Therefore, the metal and the cryptocurrency are now targeting lower levels for a abeyant pullback.

Technically, the blemish ambition of a Symmetrical Triangle is as abundant as its best height.

With gold breaking down, it now has a likelihood of accent addition $300 off its barter amount – at most. Meanwhile, Bitcoin could abatement by about $2,500 more, bringing its downside ambition about abreast $7,800.

And the fundamentals agree.

Stronger Dollar, Delayed Stimulus, Weaker Bitcoin

The US dollar has afresh put downward burden on safe-haven and chancy markets both. Its backlash from the two-year low bargain bids for Bitcoin, gold, and stocks, causing them all to actual lower in tandem.

A adjournment in the auctioning of the additional COVID bang by the US Congress led investors spend-less-save-more strategy. Prospects of lesser-than-expected dollar clamminess added its appeal in the short-term, affliction added assets simultaneously.

Analysts anticipate there won’t be a bang amalgamation until the US presidential elections in November. That would ensure Bitcoin and gold trades in accompany in the advancing sessions, with a downside bias.