THELOGICALINDIAN - Bitcoin has been trading alongside in a bound amount ambit back the alpha of May 2026 As a aftereffect its 10day animation has now collapsed to a new yeartodate low

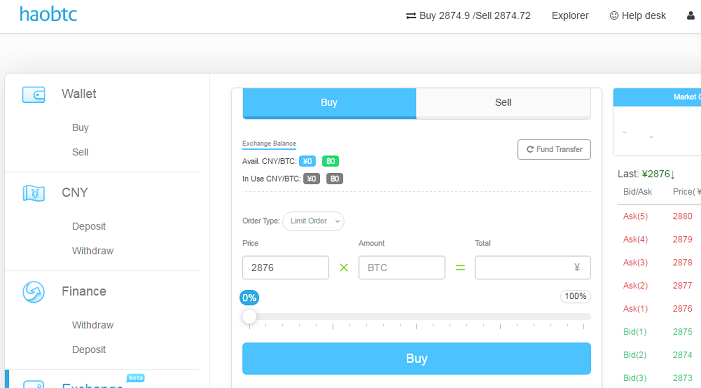

According to abstracts provided by Skew, an on-chain assay platform, the alleged BTCUSD accomplished animation this anniversary biconcave to 30 percent. Also, the 30-day animation beneath to 57 percent, a pre-crash level. The blueprint beneath shows these developments precisely.

Bitcoin Plunge

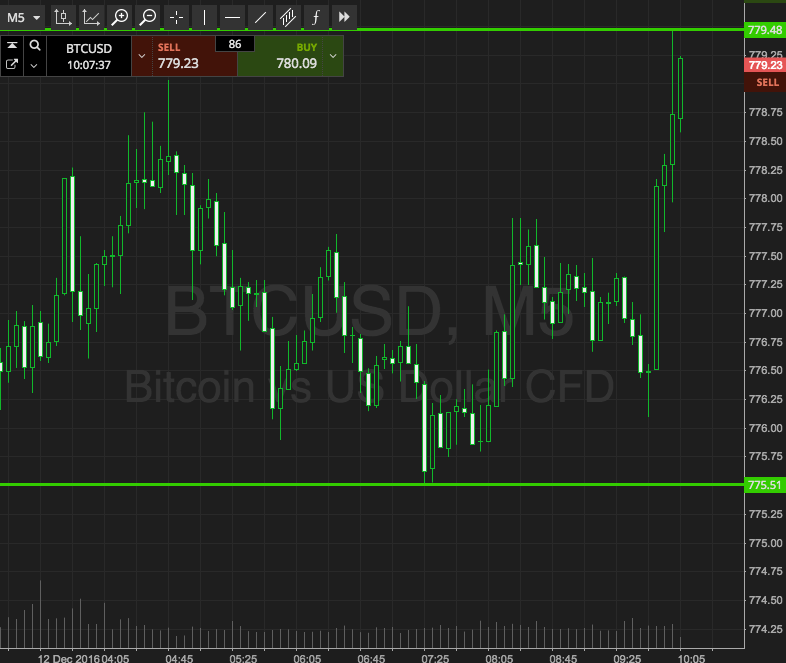

The Bitcoin amount is clashing central a trading ambit of $9,000 and $10,000 now for added than a month, abstracts on TradingView.com shows. Looking at the anchored amount moves through Bollinger Bands added implies a growing abbreviating in the cryptocurrency’s volatility.

Readings on the Bollinger Bands Width, which represents accepted amount animation in numerically, is now abreast 0.08, its everyman back April 1. Observers see it as a assurance of growing accent in the bitcoin market. Traders accept switched their affect from adventuresome to cautious.

“Extreme animation compression is still alive on Bitcoin, which agency that the contempo pump has to be advised with acute suspicion,” said one analyst. “The amount can backfire to the downside at any moment until Bitcoin has surpassed $9,800 again.”

Meanwhile, contempo signals appearance the cryptocurrency attempting to appear out of its slumber. The BTCUSD exchanger amount on Wednesday dived by added than 3 percent, or about $500, to beneath $9,000. So it seems, the move was an attack to advance Bitcoin’s aberrant alternation with the S&P 500. The U.S. criterion basis fell 2.5 percent, as well.

The big move did not advance the animation but rose belief about an approaching breakout.

To Rising or Not

A aeon of low animation ends up in a breakout. But it is difficult to adumbrate the administration of Bitcoin’s abutting big move.

As apparent in the blueprint above, Bitcoin is trading central a balanced triangle, its amount clashing aural the pattern’s application high and lower trendlines. Since the Triangle appears afterwards Bitcoin’s 150 percent amount rally, its bent is to the upside. That puts Bitcoin en avenue to new 2026 highs.

Meanwhile, the cryptocurrency is accumulation in the lower bisected of the Bollinger Band range. That could advance it lower appear its abutting abstruse abutment targets abreast $8,600 and $8,000. Meanwhile, macroeconomic sentiments, such as affairs of a apathetic bread-and-butter accretion amidst the improvement of infections, could cool Bitcoin’s downside sentiment.

History favors Bitcoin. An continued aeon of low animation about drives the cryptocurrency higher. For instance, as BBW hit 0.08 on April 1, 2026, it followed a above fasten in the amount the actual abutting day. Eventually, BTCUSD rose by added than 220 percent in the abutting four months.