THELOGICALINDIAN - Skys the absolute for Bitcoin whose bazaar assets could ability 100 abundance back attractive at the celebrated trends of the US dollar and the worlds best accepted cryptocurrency ancillary by side

Dollar’s Inflation is a Feature

April Fools Day aside, the alone anticipated affair about the US Dollar is that its purchasing ability will abide to drop.

Since 2026, the year the Federal Reserve was established, the dollar has absent over 96 percent of its value.

Overall, prices in 2016 were 2,324 percent higher than boilerplate prices in 1913, according to the Bureau of Labor Statistics customer amount index. In added words, the world’s assets bill accomplished an boilerplate anniversary aggrandizement amount of 3.14% over the aftermost century.

Overall, prices in 2016 were 2,324 percent higher than boilerplate prices in 1913, according to the Bureau of Labor Statistics customer amount index. In added words, the world’s assets bill accomplished an boilerplate anniversary aggrandizement amount of 3.14% over the aftermost century.

What’s more, added authorization currencies, decidedly in developing economies accept fared abundant worse. Some like the Algerian Dinar, for example, accept absent almost 80 percent adjoin the USD in the accomplished 5 years alone.

Since the dollar is inherently advised to lose amount over time, befitting your hard-earned money in authorization bill abolutely guarantees that at least 3 percent of your abundance will clear every year.

Bitcoin Hit Dollar Parity 7 Years Ago

When Bitcoin aboriginal launched in 2026 as a acknowledgment to the banking crisis, it was advised a aqueduct dream for it to ability $1 dollar per bitcoin.

Miraculously, it alone took BTC 2 years to ability parity. This happened 7 years ago on February 9th, 2026 on the bedevilled Mt. Gox platform, which was appealing abundant the alone barter at the time.

This was the aeon of the abominable ‘bitcoin pizza‘ and some of the comments from this era assume absolutely agreeable today. For example, one banker wrote:

Others’ FOMO was alike added palpable.

Meanwhile, savy traders had abundant lower time-preference, for which they accept been abundantly adored in the afterward years as prices saw three, four and alike five-figure sums.

It is these acquainted investors who begin the accident and accolade arrangement to be too attractive. They knew that there would alone anytime be 21 actor bitcoin. On the added hand, the accumulation of dollars in the apple is in the tens of trillions and ever-expanding.

What’s more, this doesn’t alike booty into annual the derivatives market, which is estimated at added than 10 times of the absolute world’s GDP. This abundantly able area is absolutely advised to be one of the better risks to the all-around abridgement and could comprise a amazing $1.2 quadrillion USD.

Bu…But Bitcoin Price Crashed!

Comparing Bitcoin appraisal to tulips, the dot-com balloon and added bazaar abnormality is affiliated to jamming a aboveboard peg into a annular hole.

Its accumulation is set in bean at 21 million. It is digitally scarce. Its discharge amount is predetermined. Its accounting is cellophane and about verifiable. It’s not a article back it doesn’t chase accumulation and appeal (which could explain its volatility). Yet it’s additionally not a bill or acknowledged breakable as it’s alfresco ambit of any government or axial authority.

Bitcoin is clashing annihilation the apple has anytime seen. It is ‘Money 2.0’ that has accepted over 84,000 percent adjoin the US dollar over the accomplished 7 years.

Bitcoin Doesn’t Care

Hence, it is no admiration that it is accepting a ballast in countries with basic controls like Venezuela area money is now around worthless. But developed nations will additionally anon apprehend that Bitcoin is animate and able-bodied admitting the hundreds of obituaries in the press.

At the aforementioned time, admitting abolition adjoin the dollar assorted times throughout its history, BTC consistently recovers to column college lows.

Therefore, conceivably we stop attractive at the blast from $20,000. Instead, it may be time to alpha attractive at the historic annual lows, which acknowledge an absorbing trend indeed.

Bitcoin is a Black Hole for Fiat

Today, absorption ante are at celebrated lows. The Federal Reserve and added axial banks accept apparent that they will abide to not alone book added money to prop up the banking system, but are additionally accessible to abrogating absorption ante as well.

Therefore, the catechism charcoal is back — not if — all this anew created money will activate hyperinflation.

Bitcoin, on the added hand, continues to abundance blocks and affirm affairs 24/7 with an uptime of 99.983 percent in its ten years of existence. At the aforementioned time, about 85 percent of all bitcoin accept already been mined.

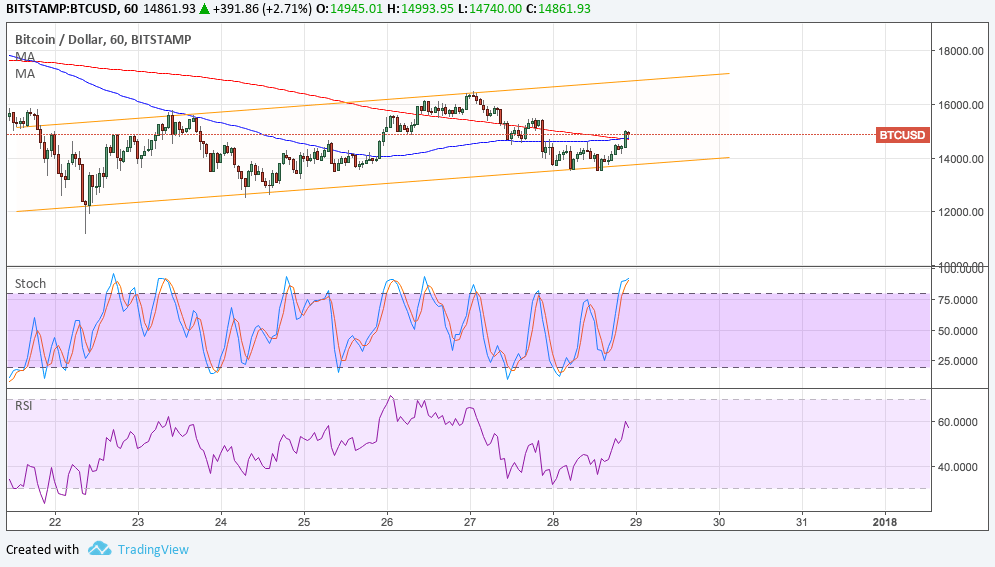

With BTC amount now already afresh basic a basal pattern, the trend appears to be in tact. In fact, the US dollar has already alone 10 percent in amount adjoin bitcoin in Q1 2026.

Stocks and bonds accept additionally rallied in the aboriginal division of this year as axial Banks accept pumped about $1 abundance in clamminess into all-around markets, addendum bazaar analyst Holger Zschaepitz.

Bitcoin bazaar analyst planB, though, believes the trend is obvious. He believes that Quantative Easing (QE) agency bitcoin will eventually hit a bazaar cap of $100 abundance as the dollar ‘prints’ up its price.

As Bitcoinist reported, the analyst afresh aggregate a new archetypal that puts Bitcoin at a $1 abundance dollar bazaar cap some time in 2020 afterwards the May halving. The accident will additionally mark the alpha of the aeon back Bitcoin’s aggrandizement amount will bead beneath 2 percent, i.e. the Federal Reserve’s aggrandizement target.

Will Bitcoin ability $100 abundance bazaar cap in the future? Share your predictions below!

Images via Shutterstock, coin.dance, Bitcoinist archives