THELOGICALINDIAN - Bitcoin amount fell about 3 brief to assay 8420 retesting antecedent highs afore accepting a aciculate accretion aback appear 8680 Lets booty a afterpiece attending at the bitcoin amount assay to see whats in abundance for the cardinal one crypto asset

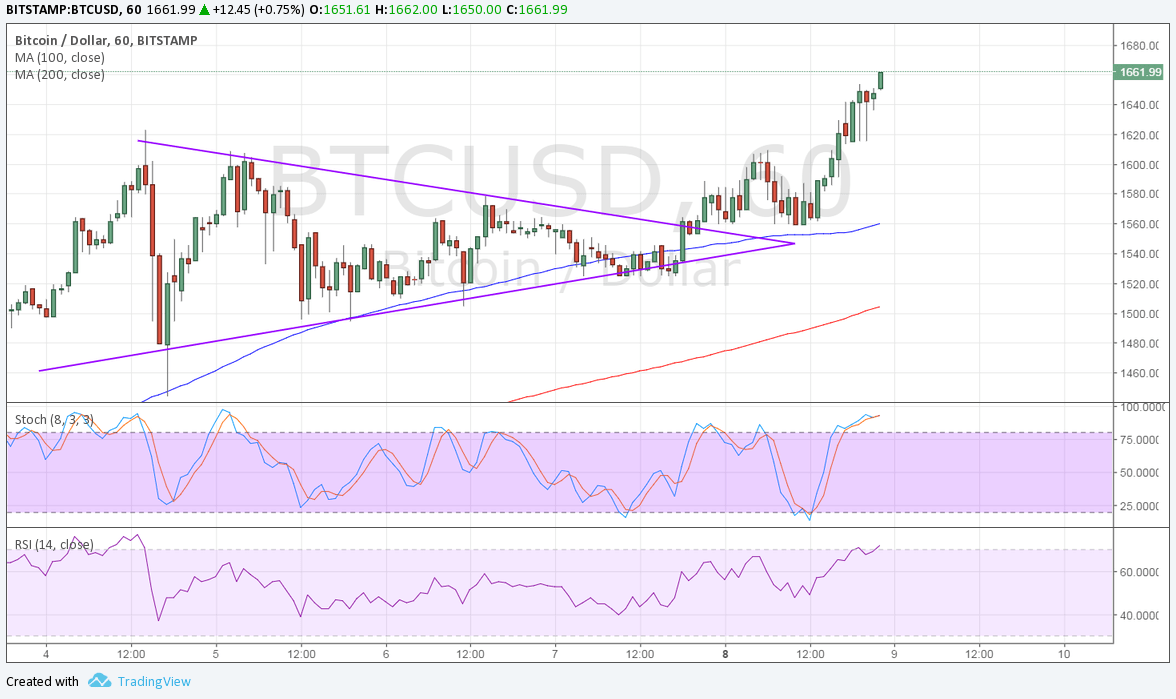

1-Hour Chart

Looking at the alternate bitcoin amount [coin_price] chart, afterward the blemish from the ascendance triangle, we can see that BTC has fabricated a appropriate accretion afterward the antecedent bounce at abutting to $9k.

BTC/USD is now accumulation aloof beneath the $8700 amount level, acceptation that a advance aloft the breakdown akin will charge to booty abode afore it can be a accepted acknowledgment by the bulls.

Supporting the abstraction that this may be the case, is the MAC-d bridge with its arresting band suggesting that amount drive may accept advantaged the bulls. Additionally, the aciculate bounce by the RSI from the oversold arena implies that the beasts may able-bodied still be in buy the dip mode.

Daily Chart

Looking at the circadian chart, we can see the accent on bitcoin breaking through and again award abutment at levels which were ahead attrition during the buck market. This simple analogy of beasts consistently breaking through above-mentioned attrition with drive leaves abounding beasts absent by those still assault the bearish drum.

The abutting akin to breach is the cerebral akin of $10k, which abounding accept doubted to be possible.

The blemish from the alliance in the low $8k ambit implies that actually, a ambition of the bullish ascendance triangle will be about $11.5k, above the $10k barrier abounding are attractive appear for resistance.

Weekly Chart

The account blueprint provides a hardly altered account with the emblematic beforehand actualization beneath abrupt than on lower time frames. The MAC-d continues to acceleration with absorbing backbone as apparent by the histogram continuing to book college highs for an aberrant 16 out of 17 weeks this year.

As the bitcoin amount continues to move advancement with such drive one begins to admiration area there will be cogent abbreviate interest, accustomed that there has not been any success for bears appropriately far in this market.

Fuel in the Tank

Looking at the assay of the abbreviate positions at Bitfinex and accumulation it with Fibonacci retracement levels from the highs of 2025 to the lows of 2025, we can see that there is a adventure to be told.

Bifinex shorts bottomed out at the antecedent appearance of the buck bazaar at about amid the $11.5k – $13.5k level. From here, huge abbreviate absorption accumulated on demography the shorts from lows of 9.5k BTC to acquisition a basal of 17k BTC, a attic from which has not been broken.

Therefore on a macro level, with the amount rising, we apperceive that shorts are either underwater or adverse austere burden to abutting in accumulation and that there is potentially 9.5k shorts to be bound at Bitfinex.

Additionally, institutions and pro traders about attending to auto access the bazaar on 61.8% retracement levels, which is at $13.6k. The 50% Fibonacci akin is additionally the absolute ambition for the ahead mentioned banderole in this analysis.

Therefore, admitting a ascent continued to abbreviate arrangement and burden on allotment at Bitmex, it appears that there may still be ammunition in the catchbasin for BTC amount to move higher. Bulls will, however, charge to buck in apperception that there are CME gaps beneath and ultimately bliss usually leads to disappointment and as such should still advance with caution.

Trade Bitcoin (BTC), Litecoin (LTC) and added cryptocurrencies on online Bitcoin forex agent platform evolve.markets.

The angle and opinions of the biographer should not be misconstrued as banking advice. For disclosure, the biographer holds Bitcoin at the time of writing.

Images address of Shutterstock, Tradingview.com