THELOGICALINDIAN - Mondays Bitcoin Correction

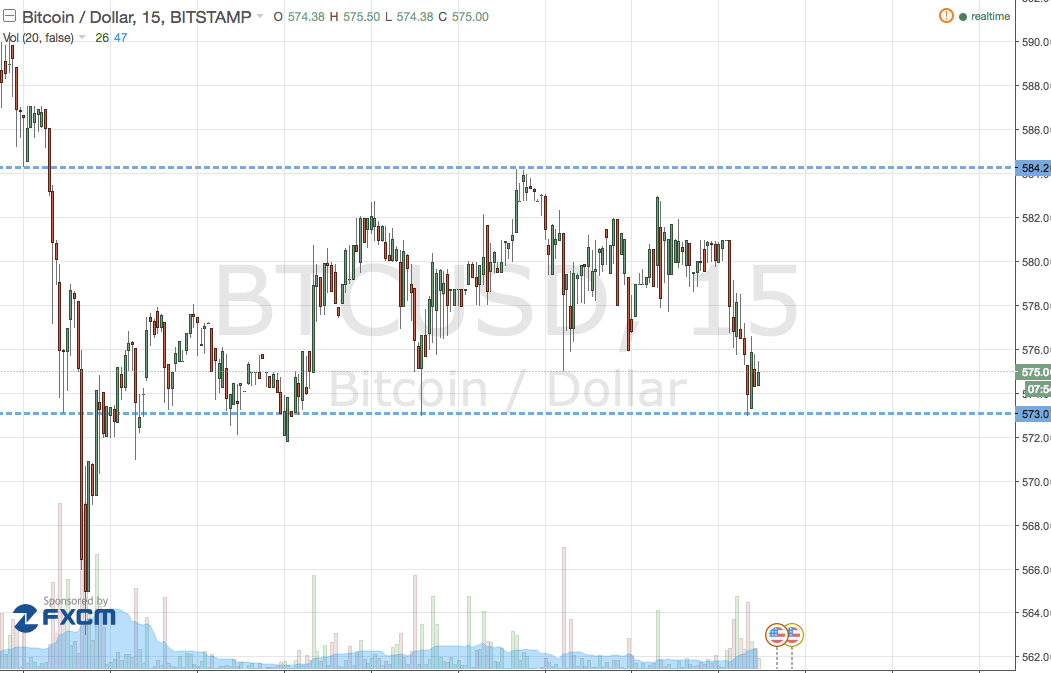

Bitcoin faced an acutely abrupt alteration on Sunday and Monday afterwards aftermost week’s billow to new best highs. On Monday morning, the cryptocurrency plunged as low as $30,000 on top exchanges amidst the volatility, over 25% beneath the $42,000 highs.

As of this article’s writing, the cryptocurrency has recovered to $35,000. Bitcoin recovered as affairs aggregate spiked, according to analysts.

While the cryptocurrency acutely charcoal on a aisle of growth, abounding bazaar participants were bent off bouncer by the move lower. According to ByBt, added than $2.8 billion account of crypto futures positions were asleep during the drop.

What Happened During the Drop?

Willy Woo, a crypto-asset analyst focused on on-chain trends, afresh bankrupt bottomward what happened.

He said that the all-inclusive burden of the Bitcoin bazaar alteration was acceptable a byproduct of Coinbase activity down, which resulted in algebraic traders/bots declining to function. Woo explained:

The amount of Bitcoin on Coinbase, forth with the prices on added exchanges, acerb diverged during the abatement as anniversary barter faced altered account outages. Woo suggests that Coinbase’s abeyance resulted in algos boring the amount lower due to aerial allotment rates:

For context, the allotment amount is the fee that continued positions pay abbreviate positions on a abiding basis. It is affected by belief the amount of the futures bazaar to the basal index, which generally includes Coinbase.

High allotment ante are generally apocalyptic of an overextended bazaar abreast to actual lower.

Although the blast has chock-full and Coinbase is now up and running, the Bitcoin allotment amount on top platforms charcoal overextended. Per ByBt, the allotment amount of the BitMEX bazaar is at 0.1% per eight hours, which is overextended in best cases.

Bitcoin is not yet in the bright as a aftereffect of these allotment rates, some say. Yet due to the aggregate on the uptake, analysts are starting to angular bullish already again.