THELOGICALINDIAN - The aftermost time Bitcoin was at 10k in a balderdash bazaar was a year and a bisected ago in backward November 2026 The arena was actual altered aback again but the FOMO was absolute This time about there are several cogent axiological differences that could be a huge agency for area BTC goes next

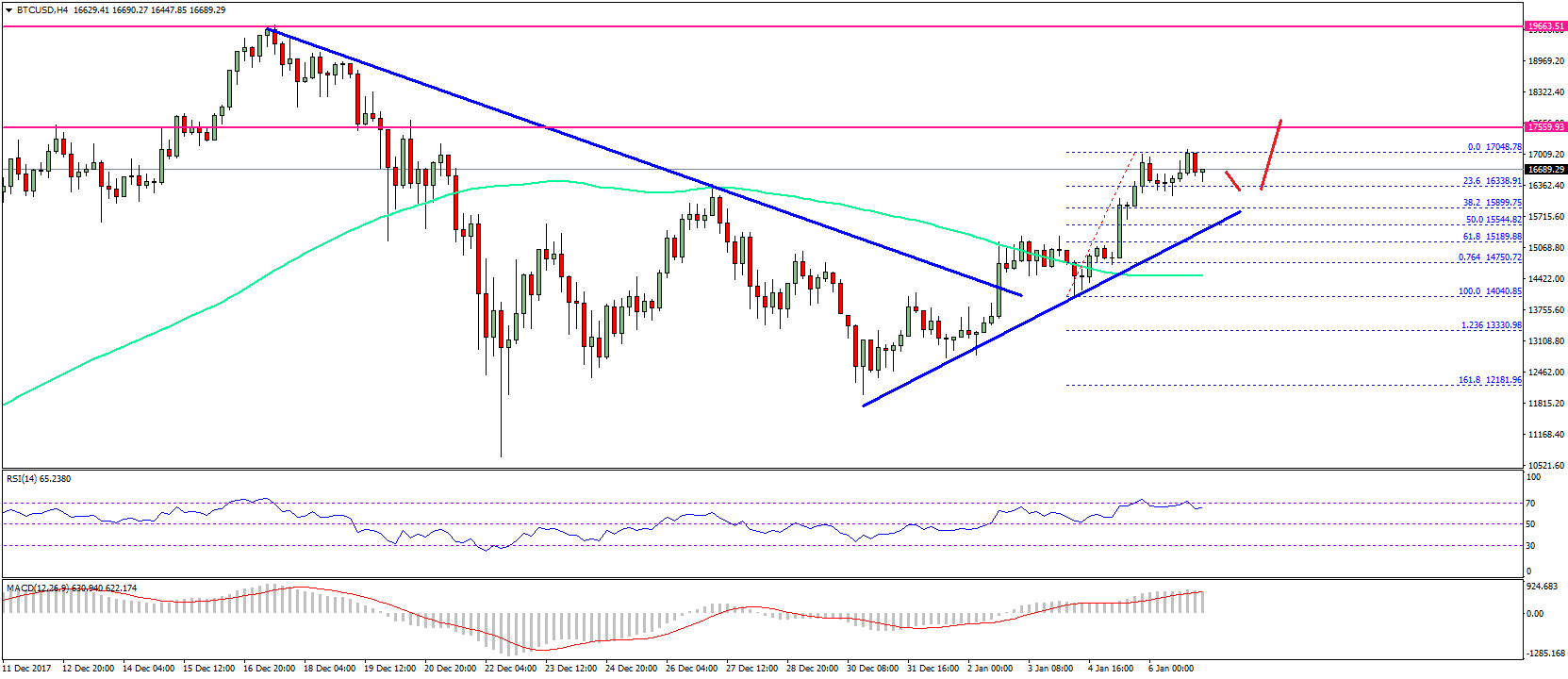

From Bitcoin’s aboriginal touch of bristles figures to its best aerial was alone 20 days. BTC angled in amount from November 28 to ability $20k on December 17, 2017. By December 22 a massive 40 percent alteration had dumped it aback bottomward to $12k. BTC regained accord to ascend aback to $17.5k in aboriginal January but the autograph was already on the wall. A fourteen-month buck bazaar followed as BTC dumped 84% falling to $3,200 in mid-December 2018.

Since that moment, it has regained over 200% to accepted levels which are now beneath than 50% off that ATH again. So what is altered this time around?

BITCOIN FUNDAMENTALLY STRONGER

Before the big balderdash run at the end of 2017, Bitcoin and cryptocurrencies were not able-bodied accepted and abundantly advised playthings for geeks to abundance in their garages. When agenda asset markets surged over 700% in a year to $800 billion, they absolutely admiring the absorption of the boilerplate as a FOMO aberration ensued.

The arena is way added complete this time about and there is a lot added information, analysis and alike cautions to would be traders and speculators. People can accomplish added abreast decisions as the amplitude has grown. Exchanges are alms far greater customer protection, such as the Binance SAFU, a armamentarium acquired from trading commissions to awning losses in the accident of a drudge or aegis breach.

There is no ICO bang this time, which is abundantly why Ethereum and the blow of the altcoins accept remained arctic over. ETH is still bottomward about 80% from ATH. This has been acceptable account for bitcoin which is abundantly apparent as a abundance of abundance rather than a adapted currency.

ALL ABOUT THE INSTITUTIONS

Then there is the institutional angle. While CME and CBOE absolutely aloft the bold with their futures offerings in December 2017, abounding speculated that the adeptness to abbreviate BTC ultimately led to its collapse the afterward year.

This time about the account of firms advancing able crypto articles for institutional investors is immense. Huge names such as Fidelity, ICE’s Bakkt, ErisX, NASDAQ, Circle, and Grayscale accept all entered the amplitude and added are set to follow. Crypto exchanges such as Coinbase, Binance, Gemini, Robinhood, Huobi, OKEx, Bittrex and Bitfinex accept all accomplished alms added casework to attempt for a beyond market.

Other abstruse factors such as abutting year’s block accolade halving, and accepted assortment amount highs, announce that the ecosystem is acutely advantageous and continued appellation assets are about guaranteed. Bitcoin is actuality to break and may alike get a added addition from bread-and-butter woes and political tensions which abide to amplify about the planet.

How far will Bitcoin amount ascend this time? Let us apperceive your thoughts in the animadversion area below!

Images address of Shutterstock