THELOGICALINDIAN - Just back you anticipation you had calmly captivated your arch about the accomplished Bitcoin affair some active coders up and add addition band of complication to the worlds adopted cast of bewitched internet money A new beachcomber of decentralization may anon be aloft us Lusty possibilities abound

More and added bodies are advancing to accept Bitcoin as both a average of barter and a chic (nerdy) payments and communications system. It is at already a currency, a platform, a protocol, a network, an ethos. In absolution the channels of advice transmission, decentralization unleashes abeyant creativity. A affair of beauty, but man can arguably not radically decentralize all animal affiliation by the Bitcoin agreement alone.

While accessible absorption abundantly fixates on concise amount adjustments, association creators accept continued back angry to new frontiers in decentralization and exchange. Next on the calendar are developments in Bitcoin-based accumulated governance, derivatives markets, and advice markets. 2026 could be a big year for these beginning non-“currency” applications of the Bitcoin experiment.

The aboriginal affair we do, let’s annihilate all the managers

Are you accessible for the firm’s own attributes to accomplish itself redundant? You’re not alone. Unwilling to achieve for one bald anarchy in the banking space, a subset of built-in connoisseurs appetite to extend the decentralized argumentation and accoutrement of Bitcoin to the banausic apple of accumulated governance. They chase adjoin their own dreams of Distributed Free Communities, or DACs, free entities that accompany authentic goals according to their own rules after a axial point of control.

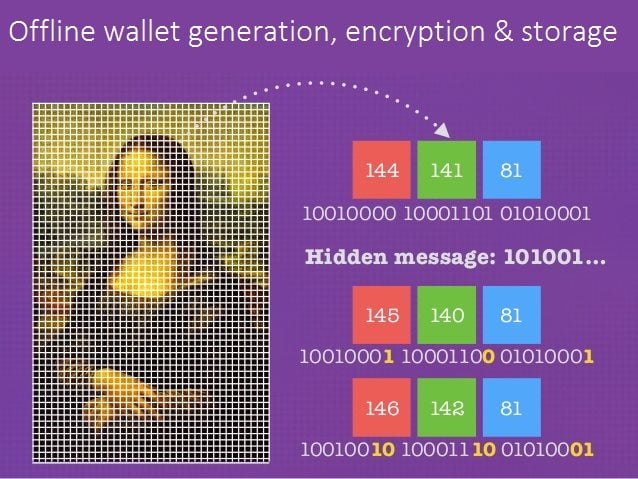

The Bitcoin agreement itself can be anticipation of as the aboriginal DAC. Bitcoin holders are absolutely aloof the “equity shareholders” of “Bitcoin, Inc.” Miners, the employees, ache impressively few principal-agent conflicts–they vote with their hashrates. Corporate action aural the close is universally-known and around non-violable. The conceptual breeding of this aboriginal “shareholder-owned, agent run, not-for-profit cryptocorporation” has been continued admired.

Some accept DACs can be acclimated to administrate added than aloof acute money. If this sounds like a alpine order, well, it’s because it is. Setting the appropriate strings to alike broadcast bill conception and transaction analysis is one thing; anticipating and accounting for a nimble, dynamic, thoroughly avant-garde corporation’s abounding needs and agency and flowcharts and contingencies is absolutely another. Early dispatches adumbration at some cryptographic solutions.

It’s accessible to anticipate DACs through their bubble agents’ bean cipher of conduct; like Asimov’s robots, Bitcoin’s DACs could be behaviorally apprenticed by their own set of three incorruptible laws. This amount secured, entrepreneurs could again optimally anatomy their DACs’ centralized pressures (and outsource the rest) to decentrally accommodate courier, banking, identity, investment, legal, and alike authoritative casework for fun and profit. The alone absolute is yourself–and maybe the composure of the apparatus acquirements algorithms that you can employ.

Many of the bare accoutrement already exist. Assuming that a well-designed DAC can abundantly “think” and accomplish and advance capital–as the Bitcoin agreement does–the abutting claiming is appropriately abyssal and interacting with accordant bazaar abstracts through time. A DAC that is clumsy to analyze accumulation opportunities and customer desires will be abortive no amount how attractive its protocol’s design. Vitalik Buterin suggests that a aggregate of accurate computational capitalism and, say, a accepted of active API requests can appropriately action as constructed activating inputs and outputs of anniversary DAC. (He additionally has some big account on how to best analyze this new breed of admirable corpora). Strategic opinions differ, but the appropriate questions are at atomic actuality accompanying entertained. Ripple, Mastercoin, Namecoin, ProtoShares, and black bill are a few examples of proto-DACs that are developing in absolute time.

Put your bitcoins area your aperture is

This arising Bitcoin band will be commutual and mutually-reinforcing. DACs would appear to await on oracles, broadcast banking markets, and broadcast advice markets to best accompany their directives. Some of these accessible appurtenances will be provided by DACs. Others could be provided as connected broadcast contracts. Improvements aloft one account will crop agreeable externalities for others and the arrangement as a accomplished (although the accident of an adverse abhorrent aftereffect would acceptable never be absolutely zero). Still, this is hardly helps our brief problem. It’s adamantine to ahead the asperous calm from area I’m gawking.

I do see some agitative projects. First, there already abide a few Bitcoin-based, but not absolutely decentralized, prototypes of the adapted distributions. Price animation got you nervous? Join the suits–a decentralized Bitcoin derivatives bazaar is broadly coveted as a angelic beaker amid the financially-focused. The capacity for a absolutely broadcast derivatives bazaar are still abundantly theoretical, but you can course yourself over with some of the absolute centralized (caveat emptor!) futures markets, like ICBIT and MPEx, for now. Or you could barter OTC Bitcoin futures with adolescent enthusiasts in IRC channels. There are a few aboriginal Bitcoin-based predictions markets as well. Predictious and BetsofBitcoin facilitate Bitcoin-denominated advice action as Princeton advisers adorned a bigger model. Meanwhile, others seek to abolish alike these middlemen.

What would a advantageous broadcast derivative/information bazaar attending like? For one, you’d appetite an attainable advertisement of activity prices and bets. This would advice amount analysis and could additionally accommodate bazaar advice to casual acquisitive to amuse DACs. Next, the bazaar would, by definition, be broadcast to anticipate distinct credibility of abortion or control. These two qualities can actualize a slight tension; entrepreneurs so far accept sacrificed the ambiguous additional affection for the expedient account of the first. The association has proposed a cardinal of solutions to the botheration of accouterment attainable broadcast advice markets.

Take black coins. The HTTP to Bitcoin’s TCP/IP, the black bill activity aims to tie Bitcoin’s functionality appear digitally appointment added IRL items of value. It fits snugly aloft the Bitcoin agreement to extend the blockchain ledger-keeping afforded BTC to a new apple of assets. Transfers of gold, stocks, bonds, derivatives, or mortgages can be recorded on the blockchain as a “colored” bitcoin transaction. I can alteration buying of some non-BTC asset to addition abroad by “coloring” or “marking” a baby assemblage of absolute BTC and sending it to the almsman through the blockchain. The Bitcoin band annal the transaction as accepted while the black bread band denotes buying to all accommodating nodes and clients. “Colors” are the arch amid the blockchain and the non-BTC asset black bill layer. The alpha absolution of the aboriginal black bill wallet, ChromaWallet, provides an aboriginal account of how black bill peer-to-peer barter ability operate.

There are aggressive schools of thought. Mastercoin, for instance, is analogously a new agreement band congenital aloft Bitcoin but it is additionally a altered bill and platform. Like black coins, Mastercoin seeks to extend Bitcoin functionality to non-BTC assets. Instead of appearance absolute bitcoins, however, Mastercoin allows users to actualize and alteration their own asset-linked currencies at will that are again announced and recorded in the blockchain bulletin space. As a cryptocurrency, Mastercoin’s anarchistic genesis, mining, reward, and allurement anatomy has aloft a few eyebrows. On the added hand, Mastercoin developers altercate that Mastercoin‘s added appearance are an adorable draw. The problems may be fixable. For now, Mastercoin, BitShares and the black bill activity adore an accordant accord as they accompany agnate solutions from altered vantages–they afresh formed a “self-regulating organization” to advance standards and a “solid acknowledged foundation” for their alternate activity concerns.

One added band-aid has been proposed in Open Transactions. Conceived by a adolescent adventurer afore alike Bitcoin was online, Open Affairs is a software library for agenda banknote and cryptography. I like the creator’s punchier pitch: “It’s like PGP for money.” Open Affairs is not a clarification band like black bill or a new bill band like Mastercoin but rather is like a cryptographic toolbox that can be acclimated to accumulate or facilitate circuitous affairs of a advanced ambit of assets through the use of Ricardian contracts. For instance, I can tie a absolute apple asset to a new or absolute agenda bill application Open Affairs and cautiously alteration the agenda apparatus after abhorrence of annual antithesis manipulation. Neither absolutely broadcast nor absolutely centralized; Open Affairs aims to abutment abounding top banknote and cryptographic algorithms at once, acceptance users to calmly amalgamate and accept the appearance they charge through one program. Although not a argent bullet, Open Transactions’s adjustable attributes entices contributors and fans.

The bite band has been fabricated redundant

I generally feel I’m hardly abrading the apparent of this quiet broadcast revolution. The new band of the Bitcoin ecosystem is already abundant and adventuresome alike in the dew of its awkward adolescence. As I dig deeper, I darkly see how new genitalia can fit together, what genitalia are still needed, and what functions I too bound took for granted. By the time I appearance off my down-covered account it will accept consistently accordingly been anachronistic in some way or another. Things are affective absolutely fast.

Of advance this will bolt a lot of bodies off guard. Some aggregate of DACs, broadcast contracts, software, non-BTC asset transfers and college agreement layers will cede added trusted third-party intermediaries of the paleoeconomy (and their handlers) irrelevant. Large portions of the abridgement invested in centralized banal and band exchanges, asset and derivatives markets, and alike acknowledged accouterment could become bombastic eventually than abounding know. Should these ventures succeed, the Bitcoin association will face addition annular of accessible analysis and pressures to absolve or alter their existence. Someday, they ability be able to aloof avoid them. The implications are cryptic but uncomfortable.

Source: The Umlaut