THELOGICALINDIAN - If youve been a crypto broker or traded Bitcoin at all during 2026 affairs are youve heard again altercation surrounding the gaps on Bitcoin futures archive offered by the Chicago Mercantile Exchange

But what are gaps? And are these gaps annihilation added than hype, or is the authority in demography trades based on the area of these gaps? One crypto analyst has set out to acquisition out and has done a abysmal dive into the statistics of CME futures gaps and their alternation in the crypto market.

Bitcoin CME Futures Gaps Analyzed

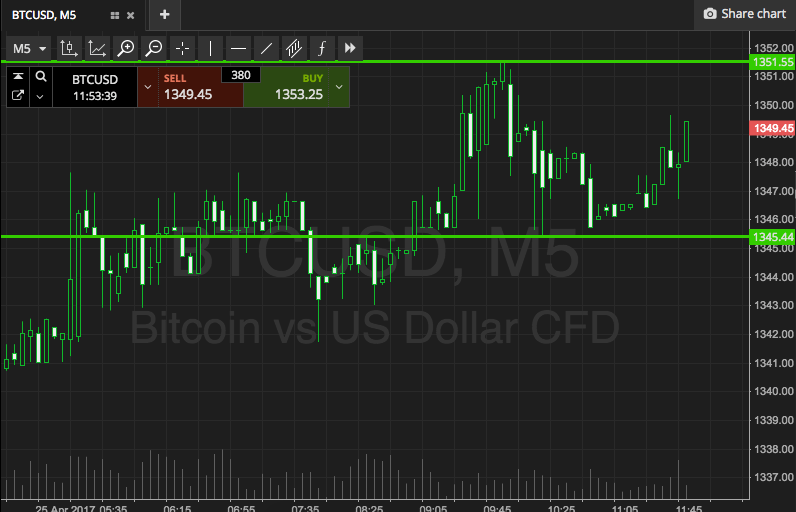

Cryptocurrencies are an always-on, 24/7, 365 canicule a year market. However, acceptable trading desks like CME Group offer weekday trading sessions. If Bitcoin makes a able weekend move, and it generally does as clamminess tends to be the everyman on weekends while traders are abroad from their desks, it can leave a gap amid Friday’s backward black abutting and Monday’s morning open.

Related Reading | Bah Humbug! If Bitcoin Bulls Can’t Reclaim $7,800 It’s Coal For Christmas

Gaps frequently arise on the amount archive of banking assets, back the asset’s amount deviates decidedly from a trading period’s abutting to back trading resumes. Gaps are alike added accepted in abstract assets area acute affections like abhorrence or abandon can advance the amount college or lower than accustomed bazaar fluctuations.

Bitcoin CME futures gaps accept become a array of a meme beyond the cryptocurrency industry, with abounding analysts arresting at any claims of validity, while others affirm by the trading action – and set orders abreast area gaps charge to be filled.

Bitcoin CME Weekend Gaps: An assay of them

Let's accomplish a cilia about CME weekends gaps

I will analyze:

*What are gaps?

*Their statistics

*How to barter them

*Are they a assisting trade?— The Whisky Guy (@TheWhiskyGuy) December 5, 2019

One accurate cryptocurrency analyst absitively to get to the basal of if CME gaps were a accessible apparatus to abetment traders with demography positions or admiration amount movements, or if they are annihilation added than a meme.

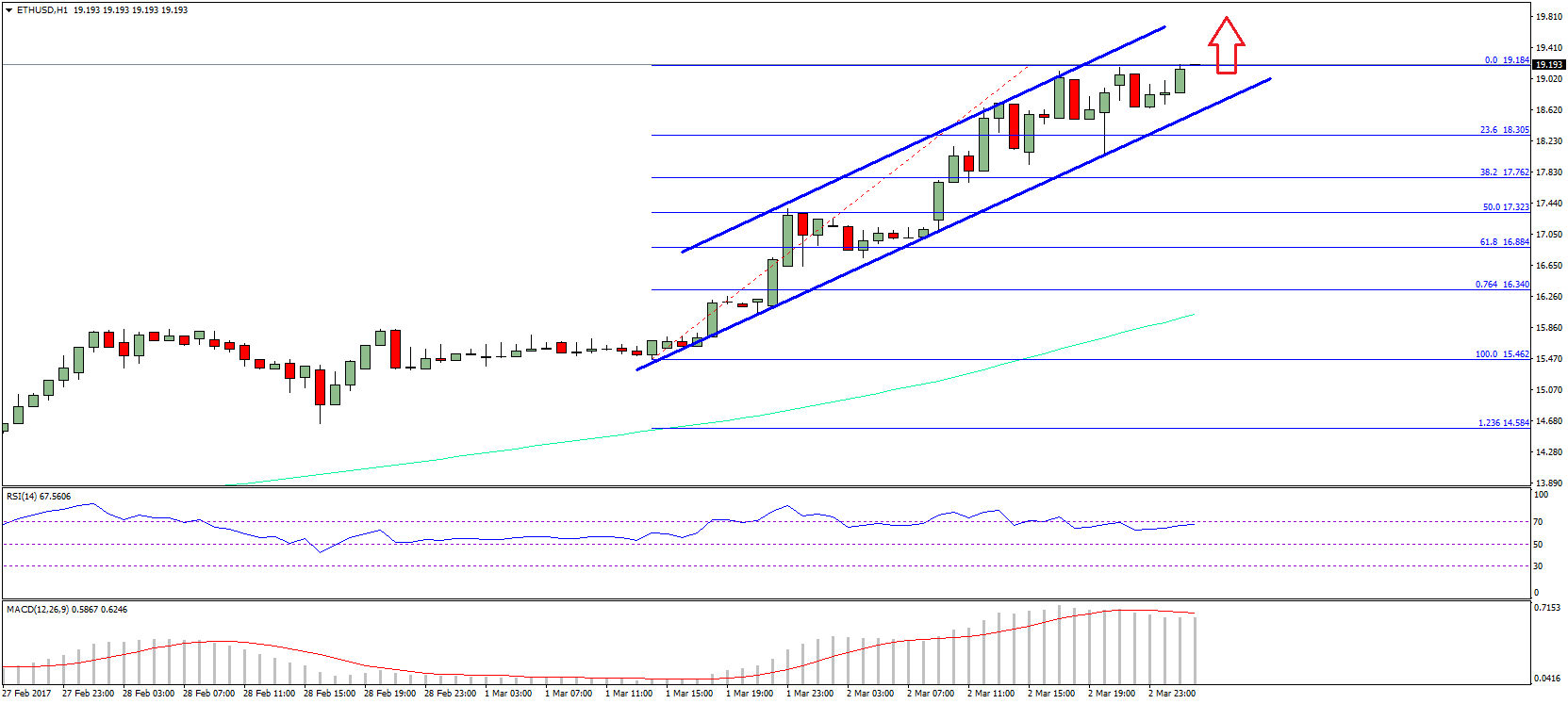

The analyst says that not all gaps are filled, and some booty weeks afore closing, however, as abundant as 95% of the gaps analyzed eventually were filled.

Gaps Almost Always Fill, But Trading Them Is A Losing Strategy

Taking the abstracts a few accomplish further, the analyst begin that over 50% of Bitcoin CME futures gaps were abounding on the day of the new trading affair open, with 30% of the actual gaps abounding after during that week’s session. Beneath and beneath gaps are bankrupt the added the time goes by.

The better gap on the blueprint was a $1,085 amount move or 12.47% of Bitcoin’s amount at the time, and the aboriginal gap was aloof $5. The boilerplate gap aberration was $225, or 2.87%.

Related Reading | Bitcoin To Spend 2020 In Accumulation Mode, Ideal Buy Zone

The abstracts is absolutely auspicious that there’s alternation for Bitcoin traders to booty advantage of, however, the analyst says that had anniversary of the 100 gaps analyzed had been traded, the trades would accept been chock-full out 53 out of 100 times, authoritative the action a accident one, alike admitting the 95% authoritativeness in which gaps are filled.