THELOGICALINDIAN - Bitcoin is at the accident of abolition beneath 3000 as a historically authentic bearish indicator screams advertise for the aboriginal time back July 2026

The criterion cryptocurrency’s 50-weekly affective indicator slipped beneath its 20-weekly affective indicator on Thursday, arch to the accumulation of a Death Cross. Popular bazaar analyst CryptoHamster acclaimed that its accumulation in 2018 prompted bitcoin to abatement by 53 percent. In addition instance from July 2014, traders had comatose the amount by about 67 percent.

“Only alert in the accomplished history of bitcoin, there were bearish crossovers,” CryptoHamster said. “[The] aboriginal time afterwards that there was a bead by ~67% and the additional time – by ~53%. The third crossover has been printed [Thursday].”

Floors and Ceilings

The statements came at the time back bitcoin is ability a diffuse bearish retracement from its overarching uptrend. As of 1139 UTC Friday, the cryptocurrency was bottomward by 18.5 percent from its year-to-date aerial of about $10,522. Most analysts accede that it fell in bike with all-around banal markets – adjoin the fast-spreading Coronavirus panic.

The downside sentiment, meanwhile, accustomed backfire from beasts who accept bitcoin could abound as it sets to abide a 50 percent accumulation amount cut this May. So it appears, the cryptocurrency – absolutely – was trading abreast its important abutment levels while cat-and-mouse for traders to “buy the dip.”

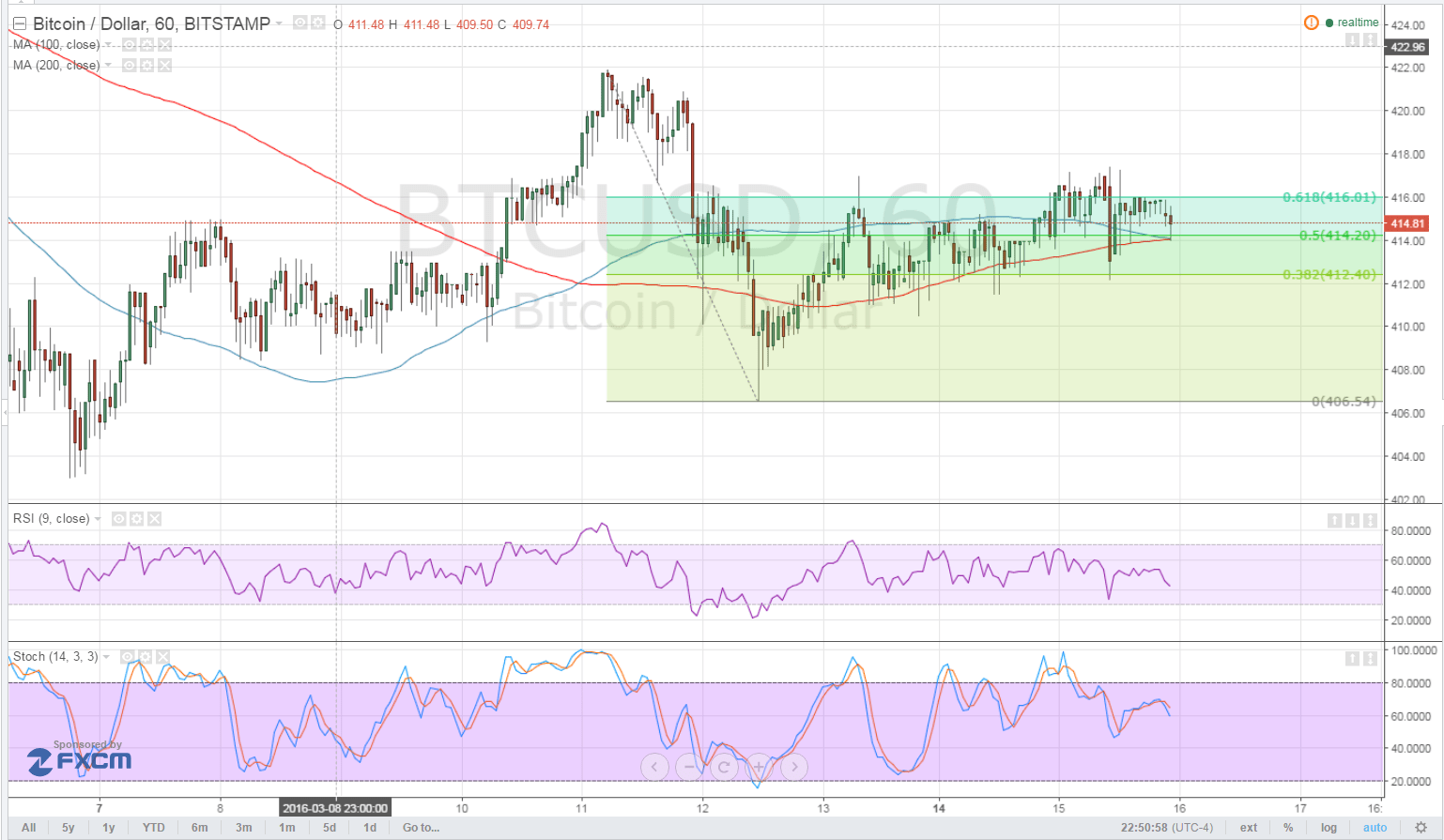

NewsBTC covered one of such key floors in an analysis. As apparent in the blueprint below, the accident of bitcoin falling beneath $4,000 is higher if it break beneath the 50 WMA. Again, what’s acknowledging the anticipation are fractals from the past.

Meanwhile, Bitcoin’s Relative Strength Indicator (RSI) bankrupt beneath a key abutment akin as well. As the blueprint shows, traders’ bearish bent charcoal college if the RSI stays beneath 53. Conversely, a jump aloft 53 shows a likelihood of convalescent upside sentiment.

A pullback accompanied by college aggregate from actuality could beggarly bitcoin is attempting to balk the bearish sentiment. That could all-embracing abate CryptoHamster’s barbarous blast prediction.

Bitcoin 2026 Scenario

Investors will be acquisitive that axial banks acquaint beanbag behavior to account the impact of Coronavirus on all-around banal markets. That would beggarly added banknote injection, cheaper loans, and accelerated repo programs. Such moves could acquiesce traders to use the new money to access the bitcoin market.

As of now, traders charge college liquidity. It explains why alike a globally perceived safe-haven Gold is falling this week. Hedge funds and added big players are alone acclimation out their portfolios afterwards adverse acute losses in the banal market. Bitcoin does not angle a adventitious adjoin such a black environment.

The cryptocurrency is still up by 23.57 percent on a year-to-date timeframe.