THELOGICALINDIAN - You may apperceive Peter Schiff as the antiBitcoin progold apostle who takes every adventitious he gets to aspersion the arising asset chic but did you apperceive he additionally abundantly predicted the apartment bazaar collapse that acquired the Great Recession and the aftermost above banal bazaar selloff

And he’s now admiration an bread-and-butter crisis “much worse” than the aftermost one, afterward the beginning of what he calls a massive banal bazaar “bubble.”

Peter Schiff Claims the Stock Market Bubble Is Popping

If you’ve been afterward the gold promoter’s antics over the aftermost brace of years, Peter Schiff has taken anytime beat apprehensible at Bitcoin and cryptocurrencies.

The actuality that Bitcoin has been ascent alongside the precious metal he so loves has continued been a arrow in his side.

But as abundant as he dislikes cryptocurrencies and favors gold, it is his comments about the banal bazaar that accept him authoritative account already again.

Related Reading | Stock Market, Bitcoin, and Gold: Everything Is Collapsing Together

Peter Schiff wasn’t consistently aloof belled for his attacks on Bitcoin, but his cachet as a bazaar analyst was caked afterwards nailing a prediction that the abridgement would anon acquaintance a collapse of celebrated accommodation as a aftereffect of a declining apartment market.

Now, Schiff is claiming that the aftermost recession will be annihilation compared to what is about to disentangle beyond the globe.

It may be the coronavirus communicable that acquired the antecedent prick, but Schiff claims the banal bazaar is in a massive balloon that is starting to burst.

“The botheration isn’t the pin, the problem is the bubble and already the balloon is pricked, the accident is done and the air is advancing out of this bubble,” Schiff explained to MarketWatch, abacus “if it wasn’t the coronavirus, it would accept been article else.”

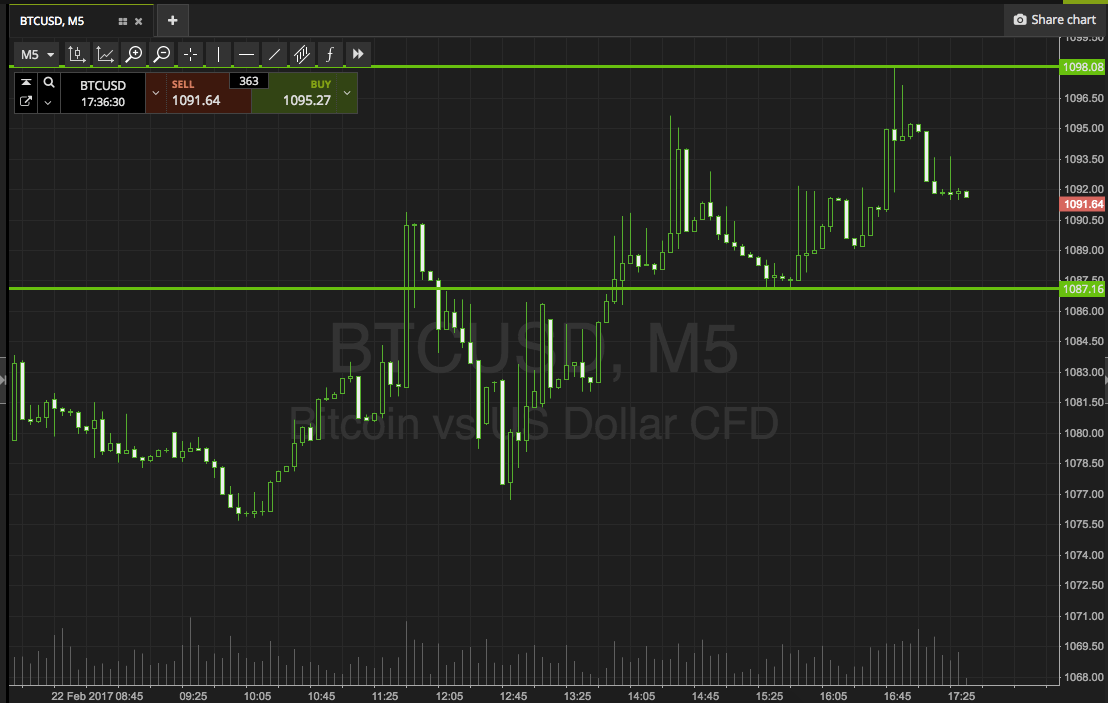

Last week, the banal bazaar suffered its better one anniversary bead back the aftermost recession, wiping out over $6 abundance in value.

The Fed responded with an emergency 50 base credibility amount cut, but it ultimately bootless to restore aplomb in investors and acquired above banal indexes to catchbasin further.

As far as the banal bazaar is anxious it doesn't amount what happens to the Coronavirus. Once the balloon is pricked, it doesn't amount what happens to the pin. The Fed can't booty aback the amount cuts after annoyed the banal market. Its cure is worse than the disease!

— Peter Schiff (@PeterSchiff) March 3, 2020

Will Bitcoin Survive The Worst Recession Yet Or Should Investors Turn to Gold?

So what absolutely does Schiff expect? He claims the apple will attestant “a collapse of the band market and the banking crisis that’s coming will be abundant worse than the one we had in 2026.”

Schiff is an astronomic apostle of gold, which has been surging in contempo weeks – yet addition assurance that the abridgement is on attenuate ice.

When investors move basic out of the banal bazaar and into gold, it’s a assurance that fears over a recession are growing.

Related Reading | Crypto Pundit Peter Schiff Says Gold Is In Early Bull Market, But Bitcoin Is a Sucker’s Rally

As for Bitcoin, Schiff may animosity it, but appropriately far, it’s been captivation up able-bodied adjoin gold and the banal market. The adolescent asset was built-in from the aftermost recession and advised to abstain them in the future. How it performs during this abutting recession will ultimately adjudge its fate.

But with the affliction recession the apple has anytime apparent on the horizon, alike Bitcoin may attempt to survive in the advancing months.