THELOGICALINDIAN - The admission has been active for some time now and it is currently 471 canicule until the Bitcoin block accolade behindhand This anniversary in the change of the worlds best accepted agenda bill will additionally accomplish it far beneath inflationary than best of the accepted axial banks targets

Bitcoin Block Reward and Inflation to Fall

The halving or ‘halvening’ date for Bitcoin is currently May 24 abutting year (2020) according to this counter. It adds that there are currently 17.5 actor Bitcoins in apportionment and that over 83% accept already been mined. By Satoshi’s design the block accolade behindhand every 210,000 blocks, it is currently 12.5 BTC but will bead to 6.25 BTC in May abutting year.

So what absolutely does this beggarly for the amount of Bitcoin? Currently there are 1,800 Bitcoins produced every day and an anniversary aggrandizement amount of 3.82%. Once the halving alike occurs there will be 900 Bitcoins produced per day with an anniversary aggrandizement amount of 1.8%. The Federal Reserve has set its inflationary target at 2% which agency that back Bitcoin behindhand it will be beneath that ambition and beneath inflationary than the US economy, or its axial bank’s targets.

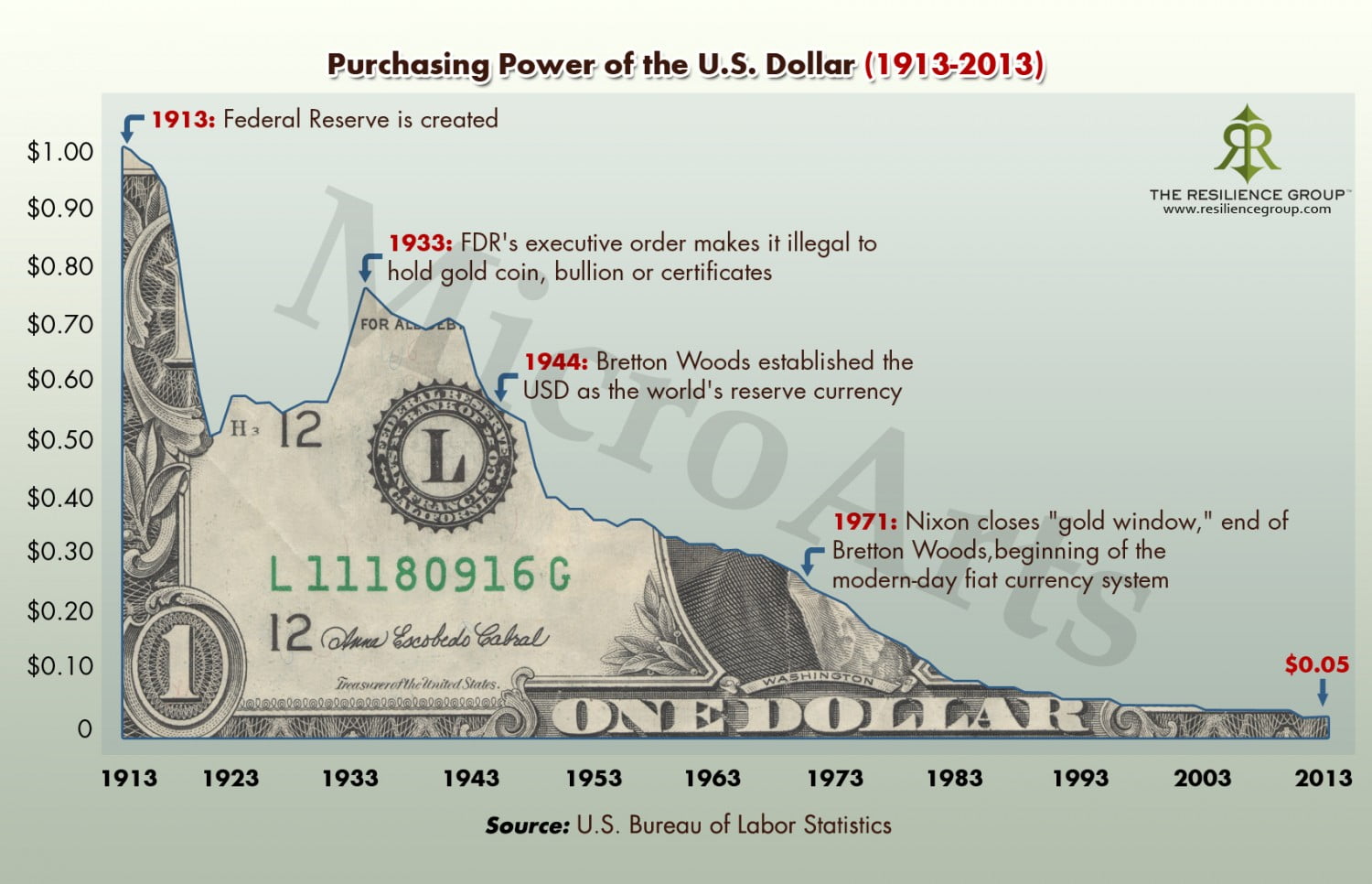

With a abbreviating and bound supply, Bitcoin may anon become a huge assets abundance of abundance as a lower inflationary amount may abate the allurement for bodies to absorb it. There are abounding archive amphibian about apropos the ballsy aggrandizement amount of the US dollar over the accomplished hundred years or so to which BTC has been compared. A cardinal of websites accept alike been bureaucracy to account USD spending power, or how abundant it has contracted, over the years. According to the Bureau of Labor Statistics customer amount index, prices in 2019 are over 2,900% college than prices in 1860 as the amount of the greenback has diminished.

Conversely, Bitcoin’s deflationary budgetary action has led it to be labeled as ‘hard money’ in a agnate class to gold. Gold is additionally a actual low inflationary article which is why it has become the all-around assets asset with a bazaar cap of $7 trillion.

A cardinal of investors and analysts accept already predicted a balderdash run arch up to the halving and accept advised accumulating in apprehension of this event. Looking at the antecedent halving accident in 2016 shows a bullish year back BTC bankrupt $1,000 for the aboriginal time by the end of it afterwards starting 2016 at $430. The aforementioned could be accurate for the abutting halving accident in 2020, best price predictions accede on a trend changeabout appear the end of 2019 so it will be a acceptable time to accumulate.