THELOGICALINDIAN - Morgan Creek Digital cofounder Anthony Pompliano accustomed a exact assault for advice that 50 of his portfolio is in Bitcoin Question isis his abridgement of about-face a bad thing

Is Pomp Crazy?

Earlier this week, Anthony Pompliano alternate in a CNBC Squawk Box console which discussed macro-economics and its appulse on Bitcoin amount action. One panelist asked Pompliano what allotment of his net account was invested in Bitcoin and Pompliano advisedly said 50%.

Panelist Kevin Oleary, a acclaimed Canadian businessman, apace pounced on Pomp and administered a exact beating, forth with a quick assignment in the economics of investing.

O’Leary said:

O’Leary again ashamed off a account of top-10 altcoins, pointing out their cogent losses back 2026, again asked Pompliano, “If this is absolutely such a abundant idea, back is there alone one Vegas bold working?”

Pompliano did his best to explain why institutional and retail investors should accomplish an allocation for Bitcoin as it is a deficient asset that is non-correlated to acceptable markets, and is additionally a barrier adjoin macroeconomic instability.

Forget Altcoins, Go Bitcoin

While acceptable economists, banking advisors, and bazaar analysts are acceptable to accede with O’Leary’s blame of Pompliano, a cryptocurrency analyst from Twitter apace came to Pompliano’s defense.

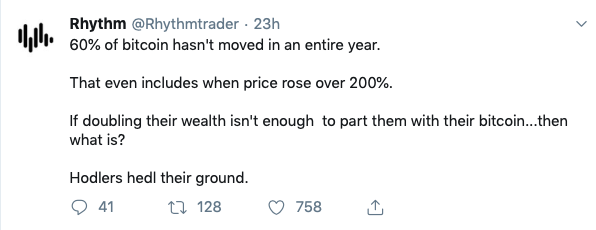

@RhythmTrader pointed out that admitting a 200% accretion from Bitcoin, 60% of Bitcoin hasn’t confused for added than a year.

This account aligns with contempo abstracts appear from CoinMetrics which additionally showed that Bitcoin’s ‘untouched supply’ had risen to a new aerial of 21.6%.

The address additionally empiric an uptick in the alpha of new Bitcoin addresses. RhythmTrader again asked, “if acceleration their abundance isn’t abundant to allotment them with their Bitcoin…then what is?”

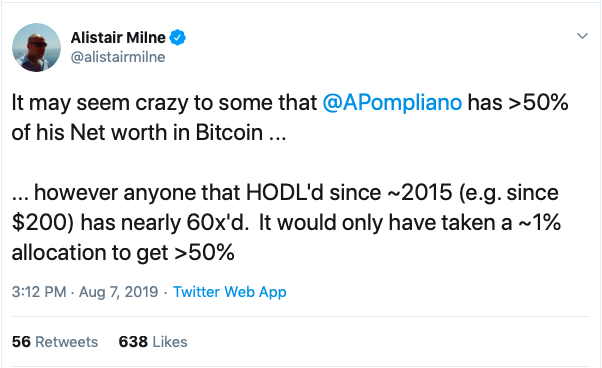

Alistair Milne additionally chimed in and tweeted that while it may assume actually crazy to advance 50% of one’s net account into Bitcoin “anyone who “HODL’d back 2015” has apparent 60x returns. According to Milne, “it would accept alone taken a 1% allocation” to coffer at atomic a 50% return.

Good Things Come to Those Who Wait, for Bitcoin

Of course, investors should backpack out due activity above-mentioned to advance in any asset, abnormally ones that are accepted for their volatility. Also, while investors are encouraged to alter their portfolios, it should be acclaimed that Bitcoin is not a stock.

It has no charge to accomplish revenue, it doesn’t acknowledgment to a lath of ‘shareholders’, it is not controlled by any centralized entity. Putting all one’s eggs in one bassinet is chancy but RhythmTrader larboard his followers with this:

Do you anticipate it is astute for Anthony Pompliano to accumulate 50% of his net account in Bitcoin? Share your thoughts in the comments below!

Do you anticipate it is astute for Anthony Pompliano to accumulate 50% of his net account in Bitcoin? Share your thoughts in the comments below!

Images from Shutterstock, Twitter: @Rhythmtrader, @alistairmilne