THELOGICALINDIAN - Bitcoin is acceptable a ambiguity apparatus alike adjoin the blow of the cryptocurrency market

The better cryptocurrency profited as abundant as 6 percent on Friday to abutting aloft $8,700. At the aforementioned time, added arch cryptocurrencies, such as Ethereum, Litecoin, and EOS, trended in abrogating territory. The massive adverse amid the bitcoin and the blow of the cryptocurrency bazaar adumbrated a basic flight. Traders suggestively exchanged a aggregate of altcoins for bitcoin as a assurance admeasurement adjoin the latest Binance announcement.

The Malta-based cryptocurrency exchange, which accounted for the accomplished all-around cryptocurrency volume, appear on Friday that it is barring US barter from accessing its services. The advertisement adumbrated that Binance would lose about 15 percent of its net account traffic, amounting to over 40 actor customers. The firm’s abrupt shutting bottomward reportedly prompted the US barter to abjure a ample cardinal of altcoins, which included Binance’s actual own built-in badge BNB coin.

The BNB amount alone by as abundant as 17 percent adjoin the BTC on Friday.

Bitcoin adjoin Altcoin Liquidity Crisis

Alex Krüger, a arresting bazaar analyst, said today that Binance’s issues with its US barter are bullish for bitcoin. He cited Tether, the aggregation abaft the arguable stablecoin USDT, to explain the alternation of bitcoin with the blow of the altcoin market. In April 2019, the New York Attorney General’s appointment on April 25 announced that it had acquired a cloister adjustment adjoin Tether and its accessory close BitFinex for allegedly ambuscade $850 actor accident from USDT investors.

“Upcoming Binance’s issues with US association = Bullish for BTC,” wrote Krüger. “This was alike clearer than with April’s Tether “FUD.” Speculators are declared to act on allusive news, not aloof conjecture about it.”

Upcomimg Binance's issues with US association = Bullish for $BTC. This was alike clearer than with April's Tether "FUD". Speculators are declared to act on allusive news, not aloof conjecture about it. https://t.co/7bAfEOiXTW

— Alex Krüger (@krugermacro) June 14, 2019

Also, in October 2018, USDT dropped its dollar-peg to abatement to its 18-month low of $0.92. The accelerate in the stablecoin pushed bitcoin $600 college on BitFinex.

What’s Now for Bitcoin

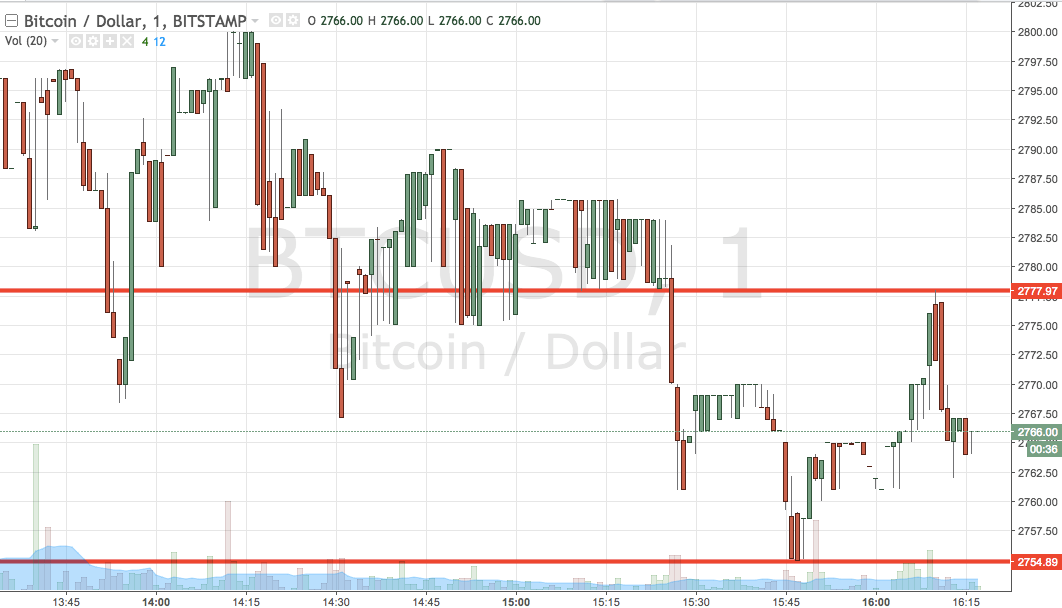

The bitcoin market’s intraday arrange point to a baby downside correction, according to its overbought Relative Strength Indicator on Coinbase circadian chart. Nevertheless, bazaar analyst Josh Rager advance that the cryptocurrency has ammunition to retest $8,750, accustomed it manages to float aloft $8,000.

“Break and abutting aloft $8,948 is bullish,” he added.

$BTC… ?

Nice breach up out of that ascent wedge, big players corrective it absolute on the blueprint to allurement abounding into shorting followed by liquidations

Would like to see a pullback to $8500s afore addition retest to breach aloft $8750

Break & abutting aloft $8948 is bullish pic.twitter.com/bAlkGNFxz2

— Josh Rager ? (@Josh_Rager) June 15, 2019

Pseudonymous analyst BitBit believes bitcoin is due for a abundant beyond upside move than what is appropriate by Rager. He abstinent the cryptocurrency based on account performance, advertence that it could abide its balderdash run to blow the five-figure status.

“I’m adage aloft 10k by the end of the month, ability alike blow 11k,” said BitBit.

The bitcoin amount was trading at $8,645 at the time of this writing.