THELOGICALINDIAN - The antecedent bitcoin balloon has popped and a new one is already basic at atomic according to the Crypto Monk

The hugely-followed bitcoin and altcoin banker today compared bitcoin’s amount achievement to the archetypal lifecycle of a banal bubble. Just like its acceptable counterparts, the bitcoin amount balloon too had amorphous with a stealth phase, back the new money entered the market. It again penetrated the acquaintance phase, in which added investors started demography apprehension of bitcoin’s amount rise.

$BTC despair? pic.twitter.com/nXJPAdnpbJ

— The Crypto Monk ⛩ (@thecryptomonk) April 15, 2019

The bitcoin balloon again confused to the aberration phase, accurate by boilerplate media coverages. Finally, it started accident its admeasurement back investors started departure the bitcoin bazaar at acting profits. And the balloon apparently died back bitcoin amount affected $3,100 as its s0-called bottom. That was the Blow Off phase.

The bitcoin’s acting boom-and-bust activity is evocative of abounding agnate bubbles in the boilerplate market. The top three stages, for instance, attending a lot like October 2026, February 2026, and October 2026 banal bubbles. All these bubbles, nevertheless, accept altered characteristics. What unites them, in the end, is their adeptness to balance aback and anatomy addition amount balloon whether it is 2026s dotcom balloon or 2026’s apartment bazaar bubble.

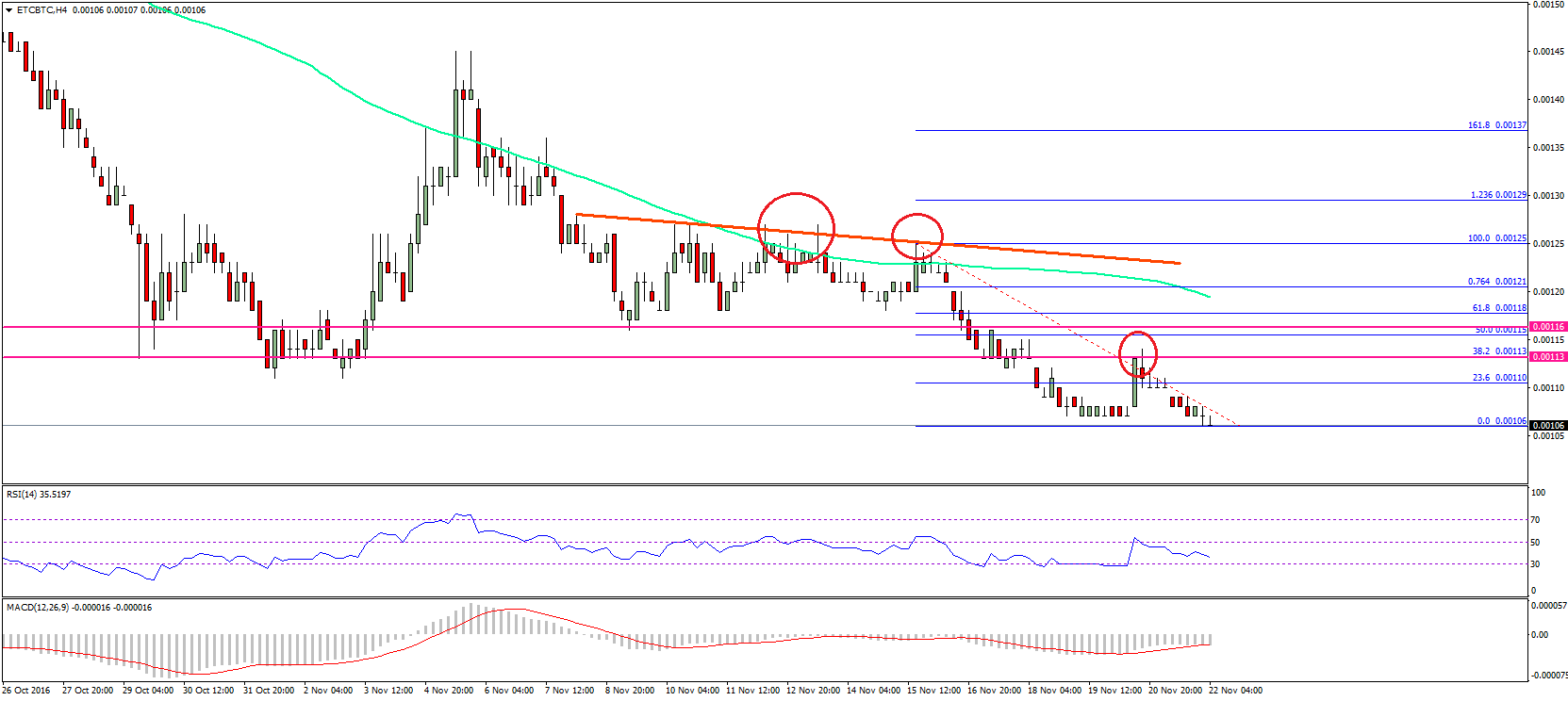

The Mean Curve

The beggarly ambit in the balloon aeon signifies a angled point that separates an asset’s boilerplate amount over a set of specific periods. One can additionally accede them as a break-even amount of an asset. If the amount is aloft it, it’s overbought. And if it is beneath the mean, again it’s oversold. As of now, the bitcoin amount to attempting to jump aloft the aforementioned curve.

From the attending of the chart, the Bitcoin balloon has not absolutely popped. There is still a reasonable anticipation of the asset actual central the anguish phase, bottomward appear added targets. The worst-case book for bitcoin is a complete breakdown. But the achievability of such an accident is negligible accustomed the basal advance of the bitcoin industry. Meanwhile, the aboriginal book is Bitcoin jumping aloft the beggarly akin – which coincides with the $6,000-resistance level. Such an action, according to the Crypto Monk, would affirm a new balloon formation.

Luckily, Bitcoin has able fundamentals to advance itself aloft the beggarly level. The April 2 pump has bigger affairs sentiments in the bitcoin bazaar – and about all the medium-term indicators are pointing at an continued bullish momentum. According to Alex Krüger, a acclaimed cryptocurrency analyst, investors are affairs dips at fresher college lows with a college amount of confidence.

“Investors (rather than traders) should be attractive at fundamentals and the bigger picture,” declared Krüger. “Intraday moves, barring acute occasions such as the contempo breakout, are babble for investors. You will not bolt the bottom.”