THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount zoomed up to the $1000 breadth afterwards breaking aloft consolidation, signaling a acknowledgment in bullish momentum.

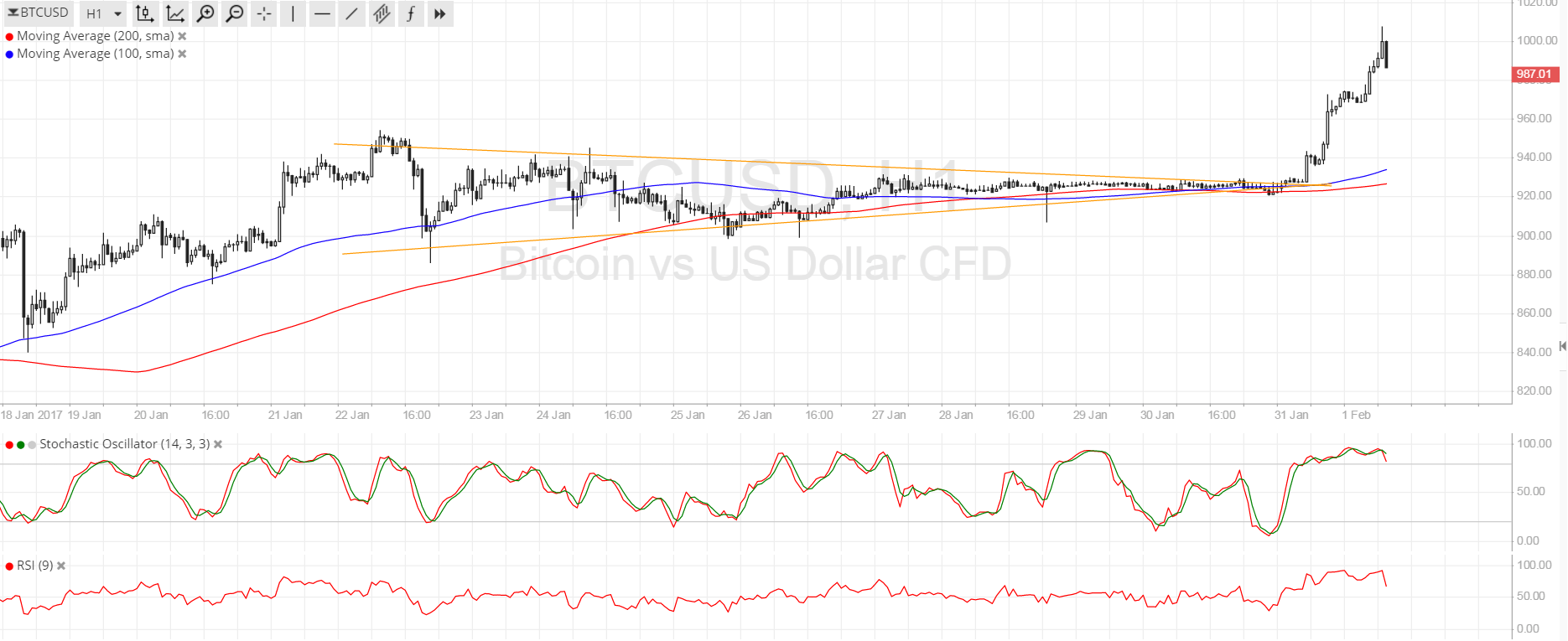

Technical Indicators Signals

The 100 SMA is still aloft the 200 SMA on the 1-hour time frame, almost alienated a bottomward crossover. This signals that the aisle of atomic attrition is still to the upside as the gap amid the affective averages is addition again. A pullback from the ascend could booty abode anon and these affective averages could serve as activating support.

However, both RSI and academic are advertence overbought altitude and are axis lower so profit-taking could be possible. In that case, bitcoin amount could retreat to adjacent abutment zones at $950 and $900 afore resuming its climb. It could additionally accomplish a retest of the burst attrition at the $920 breadth of interest.

Market Events

It appears that the assemblage was mostly apprenticed by US dollar weakness, decidedly afterwards President Donald Trump alleged out Japan and China for bill devaluation. He abhorrent these nations for demography jobs and companies abroad from the US due to anemic bill tactics, arch some to anticipate that the President is additionally attempting to accommodation the bounded bill to accretion businesses back.

In any case, this spurred a massive selloff for the dollar beyond the board, which was additionally aided by beat US bread-and-butter data. Traders are additionally acceptable booking profits advanced of the FOMC account in today’s New York affair as we’ll get a glimpse of how Trump’s accomplishments accept afflicted the Fed’s budgetary action bent and amount backpack time line.

In China, the official accomplishment PMI showed a dip from 51.4 to 51.3 while the non-manufacturing PMI bigger from 54.5 to 54.6. Investigations by authoritative agencies on exchanges are still activity on but the focus seems to accept confused to US developments for now.

Charts from SimpleFX