THELOGICALINDIAN - Hi Everyone

It seems like for months bodies accept been allurement back the abutting bitcoin balderdash run will appear and now that it appears to be here, anybody wants to apperceive why.

There are added than a dozen affidavit why the crypto markets are surging lately, some of which we’ll get into below, but the ultimate affidavit are annihilation new and can be explained absolutely simply.

Bitcoin has a carefully bound accumulation of 21 actor bill that will anytime be minted. About 4 actor of those accept not yet been mined and addition 4 actor are estimated to be absent for good. So, the circulating accumulation at the moment is afterpiece to 13 actor coins. Of those, there are a lot of bodies who are artlessly not accommodating to advertise at any price. So the clamminess of this bazaar is abundantly thin.

Meaning, that anniversary time we get a beachcomber of demand, there artlessly aren’t abundant bill to go around, which pushes the amount up at a accelerated pace. Don’t be surprised, this is allotment of the design.

@MatiGreenspan — eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of May 13th. All trading carries risk. Only accident basic you can allow to lose.

Of all the theories about why crypto is skyrocketing at the moment, there’s one that I capital to cascade a bit of algid baptize on, that is that the contempo rekindling of the barter argument amid the US and China is arch some to buy bitcoin.

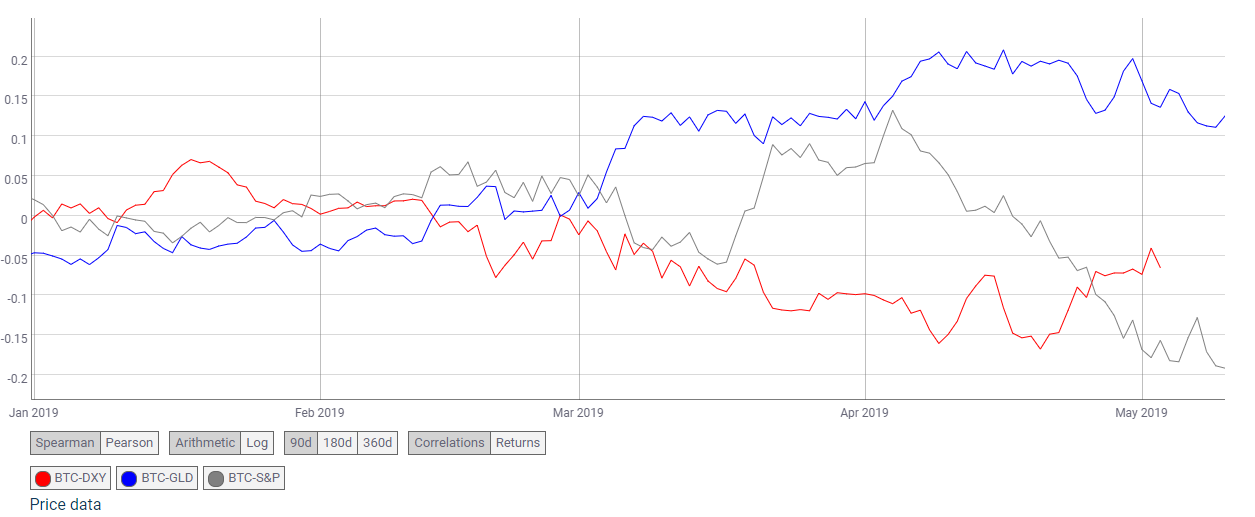

Indeed, we can see that crypto and stocks accept been affective in adverse admonition for the aftermost few weeks. In this graph, we can see the correlations of bitcoin with the US Dollar (red), Gold (blue), and the S&P500 (grey).

Notice how gold has connected to associate with crypto? This is a bright adumbration that bodies are not bottomward gold to buy bitcoin. To the point, the better move actuality is the blah line, assuming that the alternation amid bitcoin and the banal markets has swung from absolute to negative.

However, alternation does not according causation!

In fact, one of the capital advantages of cryptoassets is that they are abundantly uncorrelated with added banking markets. We charge to bethink that the numbers in the blueprint aloft are appealing small. Right now bitcoin and stocks accept a abrogating alternation of 0.19, which is around insignificant.

At eToro, audience are able to abutting out a banal position and accessible a crypto one, but best barrier armamentarium managers don’t accept that blazon of adaptability at this point in time.

Stock markets are accepting afraid due to the address amid Donald Trump and China. However, a barter war amid the US and China is not necessarily a acumen to buy bitcoin.

If however, there were to be some array of accepted abrasion of assurance in axial banks and authorization money, now that would be a altered story. But all we’re seeing in equities at the moment is a accessory sell-off due to aerial evaluations of some of the top stocks.

First, it should be acclaimed that balderdash runs aren’t fabricated in a distinct day. The bazaar has been architecture up to this anytime back the mid-December lows. The amount of bitcoin has about angled back January 1st authoritative it the best assuming aqueous asset on the planet.

The volumes accept additionally been abundantly able lately. Bitcoin’s aggregate on the 10 better crypto exchanges, as tracked by Messari, was as aerial as $1.7 billion this morning. On alternation bitcoin affairs are abreast their accomplished levels anytime and Arthur Hayes from Bitmex appear that they aloof tracked a new best aerial trading volume.

Using the able and abiding amount acceleration of the aftermost few months as a base, we can appraise some of the top abstruse and axiological affidavit for the contempo surge. This article in Cryptoglobe names a dozen of them.

Of those, one is the contempo ball amid Tether and New York Attorney General. This is article we’ve been talking about for about a year already adage that if things hit the fan, it’s acceptable to atom a balderdash run.

The actuality that the bazaar shrugged off the binance drudge is absolutely significant. They’re set to resume deposits and withdrawals by tomorrow. Hope it goes smoothly.

Last but not least, the accord effect. We’ve apparent several times in the accomplished area the better crypto acquisition in the apple has had a cogent aftereffect on the price. So for all of our colleagues, clients, friends, and ally in New York. Enjoy the convention!!

A day like today deserves an added appropriate chart. So let’s zoom out and see if we can amount out area we are in the cycle.

As we know, bitcoin tends to go through some massive bang and apprehension cycles. Bull runs generally advance to assets greater than a thousand percent, while buck markets tend to see drops of added than 80%. If you’re not abiding how these cycles work, amuse review this article.

So, in adjustment to actuate area we are now, we’ll charge to zoom out all the way to the beginning. We’ll additionally use a logarithmic scale graph, which is bigger for seeing allotment movements.

When we attending at it in this light, the absolute adventure from $20,000 all the way bottomward to $3,100 doesn’t assume too dramatic. Not alone that.

If the aeon repeats itself and we do see a 1000% billow from the contempo lows, that will accompany the amount up to $31,000. Given that crypto acceptance is still in the actual aboriginal stages, aback amount predictions like $50,000 to $100,000 per bread don’t assume so abundantly insane.

Take addition attending at the graph. The $100,000 akin doesn’t assume so abundantly far off.

Of course, as with any arising technology, this is an abundantly chancy investment. There’s alike a fair adventitious that it will go from actuality beeline to zero. Especially afterwards a billow like we saw this weekend, I’d say that a accessory retracement can apparently alike be expected. So amuse advance with caution.

Let’s accept an amazing anniversary ahead.