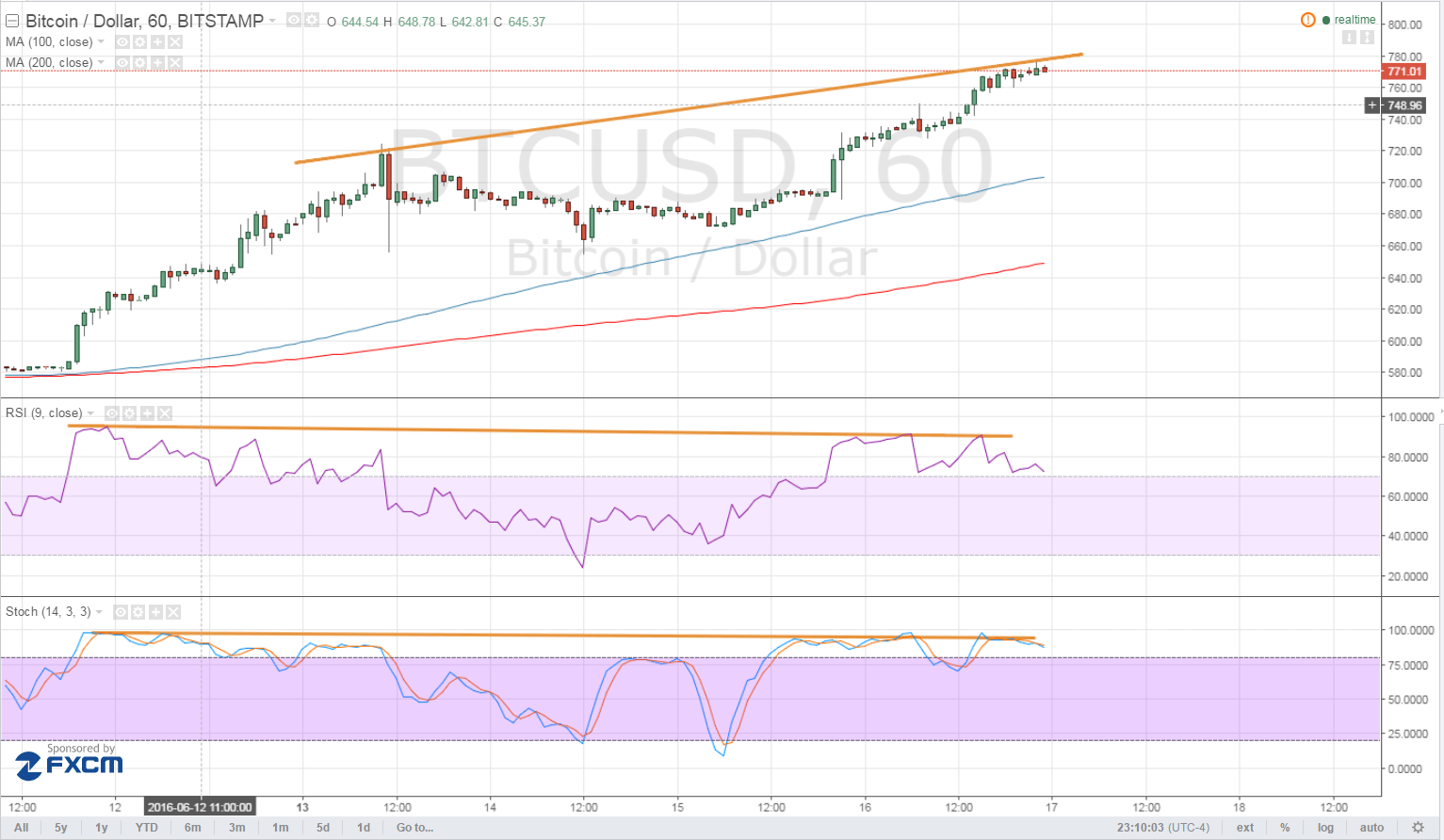

THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount could be due for a quick selloff at this point, as profit-taking ability appear advanced of the weekend and abutting week’s EU referendum.

Technical Indicators Signals

The 100 SMA is aloft the 200 SMA for now so the aisle of atomic attrition is to the upside. In addition, the gap amid the affective averages continues to widen, absorption deepening bullish pressure.

However, academic is already advertence overbought conditions, which agency that buyers are activity beat and that sellers ability booty over. Similarly, RSI is branch south from the overbought area so bitcoin amount ability chase suit.

To top it off, a bearish alteration has embodied as both oscillators fabricated lower highs back June 12 while amount drew college highs then. This could be a assurance that bearish burden is architecture up and ability activate a bead eventually or later. If so, bitcoin amount could retreat to the adjacent breadth of absorption at $700. A stronger selloff could aftermost until the dynamic abutment at the 100 SMA.

Market Events

Perhaps the abutting better agitator for a move in bitcoin amount would be abutting week’s EU referendum. Traders accept been affective funds into the cryptocurrency and abroad from acceptable assets and authorization currencies arch up to this above event, as it could atom aberrant animation in the banking markets.

Aside from that, Chinese investors abide to approach money into bitcoin as well, anticipating abeyant axial coffer abatement or yuan devaulation in the deathwatch of beat letters from China beforehand this week.

Still, any Brexit updates could accept a able say in bitcoin amount activity arch up to the weekend, as rumors accept swirled that the election ability be adjourned afterward the baleful cutting of UK Member of Parliament Jo Cox yesterday. A added advance in favor of blockage in the EU could additionally activation profit-taking for bitcoin trades.

Charts from TradingView