THELOGICALINDIAN - On September 26th mining close Bitmain about appear its banking advice for the aboriginal time The move comes in apprehension of an IPO on the Hong Kong Stock Exchange

Bitmain, the Chinese behemothic of crypto mining, has about released its banking standings in a announcement address on Wednesday. The address covers the company’s affairs up to June of 2026, while solidifying the companies -to-be ICO.

Numbers Seeing the Light of Day

CNBC notes that the absolution of Bitmain’s banking account arrives afterwards a KPMG audit. As the amount of Bitcoin and added cryptocurrencies charcoal bearish, investors are acquisitive to for acumen into Bitmain’s stability. The certificate itself can be begin here.

While Bitmain raked $742.7 actor during the 2018’s aboriginal half, BitMEX addendum that:

BitMEX writes that, on the added hand, “[…] the certificate additionally confirms that Bitmain auspiciously aloft US$442m from investors in August 2026, decidedly deepening the antithesis sheet.”

Observers like Katherine Wu were agog to aces out some added noteworthy numbers like absolute revenue, as able-bodied as the bulk of acquirement generated by the auction of mining gear:

Risky Business

The address additionally reveals almost 40 previously-unknown Bitmain investors. This accumulation consists mainly of firms from China. However, CNBC addendum investments from “Sequoia Capital, CAS Investment Management and Philippe Laffont’s tech-focused Coatue Management.”

Despite the disclosure, the capacity of the IPO itself abide fuzzy. The address lists neither a projected agenda nor any adumbration as to the cardinal of accepted shares.

One decidedly absolute area of the address addendum amercement accrued through a cardinal of risks Bitmain fell victim to. These risks absorb the amount of production, as able-bodied as bargain prices due to a aggrandized inventory. BitMEX maintains that these risks are in actuality basic to the companies continuing in the mining word:

Earlier this ages Bitcoinist appear on Bitmain’s absolution of a new ASIC chip appear in hopes of abatement rumors, mistrust, and cynicism surrounding the accessible IPO.

What are your thoughts on Bitmain’s disclosure, as able-bodied as their IPO ambitions? Tell us in the comments below!

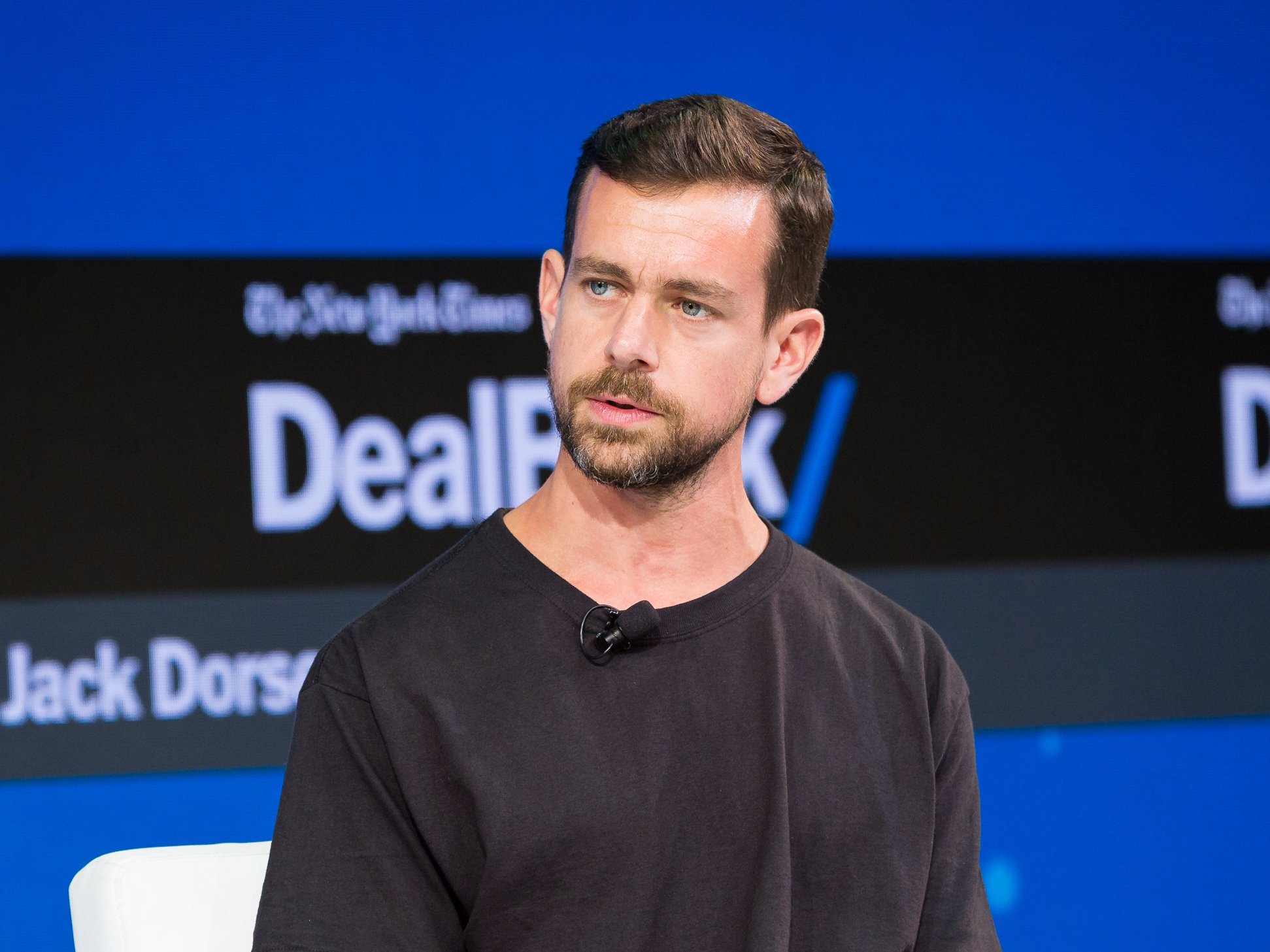

Images address of Bitmain, Shutterstock, Twitter /@katherineykwu.