THELOGICALINDIAN - Bitcoin Price Technical Analysis

Bitcoin amount could be due for a able breach out of its alliance pattern, but traders still assume to be ambivalent which way to push.

Technical Indicators Signals

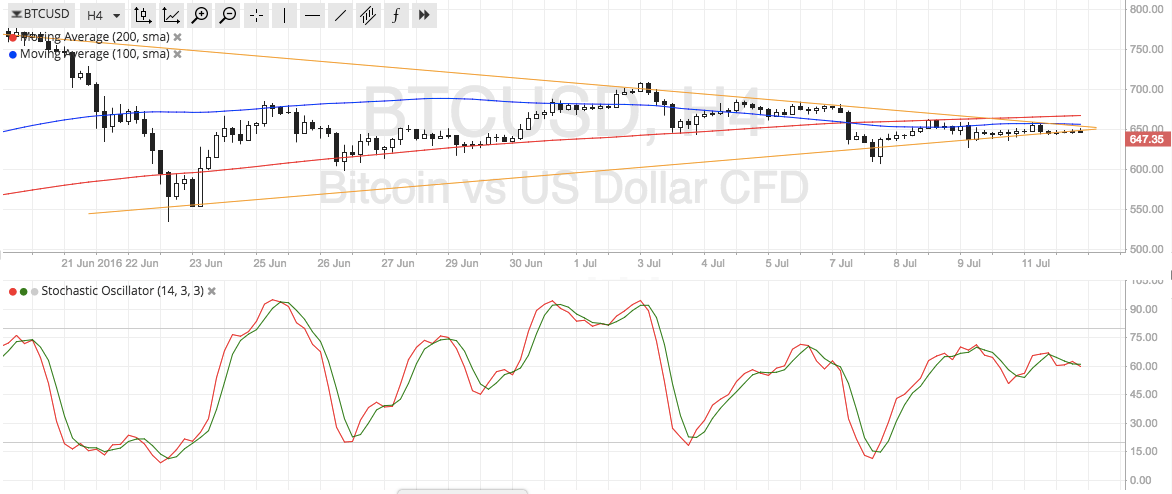

The 100 SMA is beneath the 200 SMA so the aisle of atomic attrition is to the downside. A candle abutting beneath the $640 akin could be abundant to affirm a breach lower, triggering a longer-term bead to the triangle basal abreast $550. On the added hand, a continued blooming candle closing aloft $650 could announce an upside blemish and alpha a ascend to the triangle top at $775.

Stochastic hasn’t absolutely accomplished the overbought arena yet but appears to be axis lower, advertence a acknowledgment in affairs pressure. In that case, bears could advance for a breakdown of triangle abutment if affairs drive keeps up.

For now, affective averages additionally arise to be aquiver so range-bound altitude could persist. These affective averages ability additionally authority as activating attrition areas as well.

Market Events

The new PM administration of Theresa May has aerial a bit of ambiguity off the European markets, as the UK can move on to Brexit negotiations. This could restore action in disinterestedness and bill markets, active investors abroad from bitcoin for the time being.

Still, there’s still a lot of bread-and-butter ambiguity in the arena and the talks amid UK and EU admiral could still accumulate traders on edge. In addition, the accessible bread-and-butter releases from China should accommodate added clues on how the world’s additional better abridgement is faring.

Keep in apperception that the weakness in Chinese abstracts over the accomplished few months has spurred bitcoin amount rallies as investors move abroad from bounded banal markets and yuan holdings. Chinese GDP is accepted to apathetic from 6.9% to 6.8% in Q2 while automated production, anchored asset investment, and retail sales could additionally weaken.

Charts from SimpleFX