THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount could be accessible to resume its dive back abstruse signals are advertence that bearish pressure is in play.

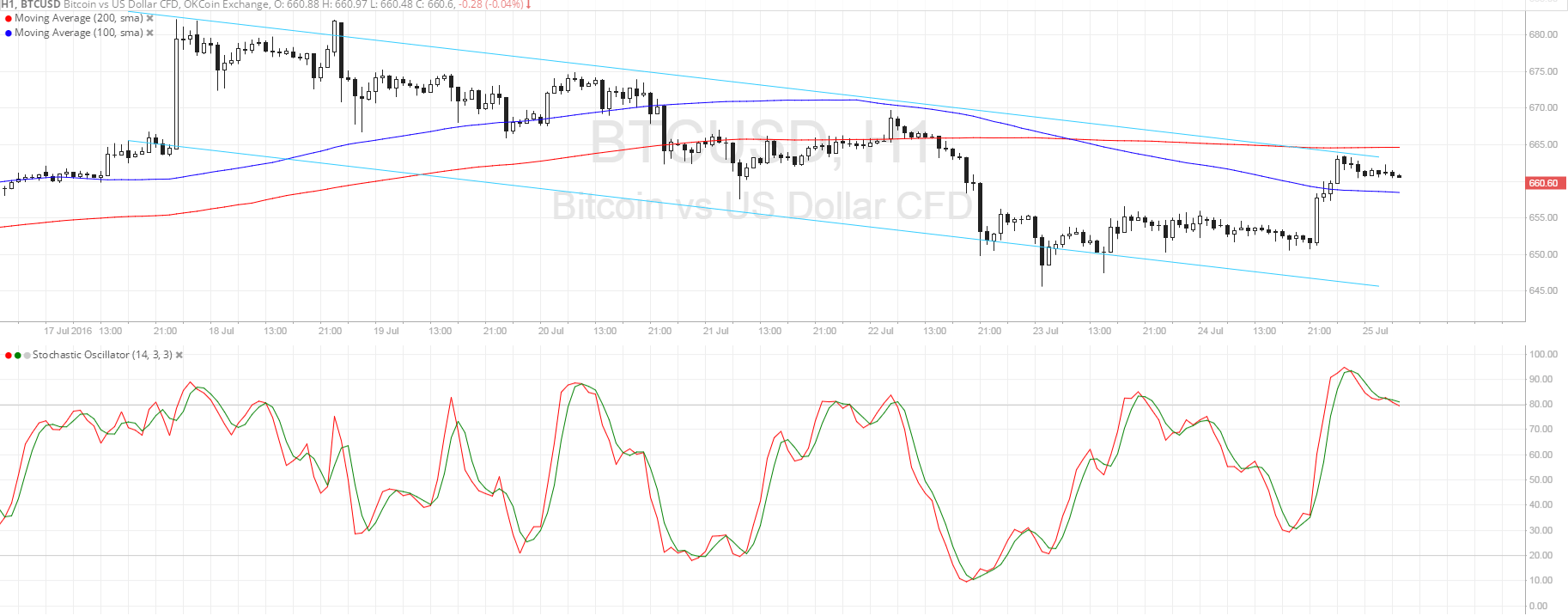

Technical Indicators Signals

The 100 SMA aloof afresh beyond beneath the longer-term 200 SMA to announce that the aisle of atomic attrition is to the downside and that the selloff could backpack on. In addition, the 200 SMA appears to accept captivated as a activating attrition zone, befitting assets in check.

Stochastic is already advertence overbought altitude and is axis lower, which agency that buyers are beat and that sellers are accessible to achieve control. A bit of bearish alteration can be seen, as amount formed lower highs back July 22 while academic had college highs back then.

If the selloff resumes, bitcoin amount could revisit the approach lows at $645-650 while a breach accomplished the attrition could acquiesce the uptrend to return, demography amount up to breadth of absorption at $670.

Market Events

Central coffer contest could accommodate animation for bitcoin amount activity this week. In particular, the FOMC account could actuate dollar trends, alike admitting no absolute absorption amount hikes are accepted for now. Still, the Fed’s bent for the blow of the year could actuate whether or not the US bill could abide to advance.

The US avant-garde GDP account for the additional division is additionally up for absolution this week, with analysts assured stronger advance for the aeon compared to the aboriginal division of 2026. In that case, the US dollar could draw stronger appeal compared to added assets, buoyed by banal bazaar assets as well.

The Bank of Japan is additionally set to advertise its budgetary action accommodation this anniversary and an abatement advertisement could activation assets for bitcoin amount if traders ahead added ambiguity in all-around markets.

Charts from SimpleFX