THELOGICALINDIAN - Bitcoin Price Key Highlights

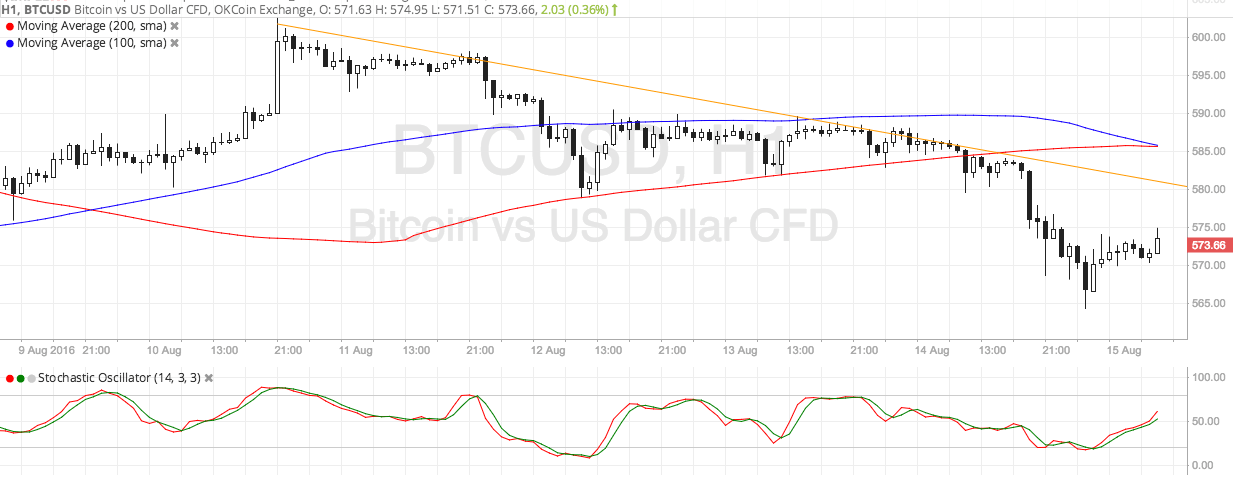

Bitcoin amount could abide to bead afterwards commutual a alteration to the breadth of absorption at $580.

Technical Indicators Signals

The 100 SMA is authoritative a bottomward crossover from the 200 SMA to appearance that bearish burden is accepting stronger. Once this declivity arresting is completed, added sellers could jump in the bold and advance for a analysis of the contempo lows at $565.

Bitcoin amount could acquisition attrition at the bottomward trend band abutting the latest highs of amount activity back August 10, as this curve up with a above abutment breadth about $580. A move accomplished this breadth could still draw attrition from the activating articulation credibility about the affective averages.

Stochastic is still branch up, which suggests that buyers are still in ascendancy of bitcoin amount activity for now but could let sellers booty over already the oscillator alcove the overbought arena and turns lower. Stronger bearish drive could alike advance to a breach of the antecedent lows and a bead to new ones about $550.

Market Events

US retail sales abstracts absent expectations on Friday but the dollar managed to beforehand adjoin bitcoin amount as accident abhorrence may accept taken over. In these bazaar scenarios, traders about adopt safe-haven assets like the dollar against higher-yielding and riskier ones like bitcoin.

Headline retail sales was collapsed while amount retail sales acquaint a 0.3% drop. Producer prices additionally absent expectations, with the banderole amount assuming a 0.4% abatement and the amount amount press a 0.3% drop. To top it off, the basic UoM customer affect fell abbreviate of expectations as well.

Moving forward, the capital accident risks for the anniversary accommodate the FOMC minutes, ECB minutes, New Zealand jobs data, and UK top-tier releases (CPI, jobs, retail sales) which could actuate whether added bang is acceptable or not.