THELOGICALINDIAN - Bitcoin Price Key Highlights

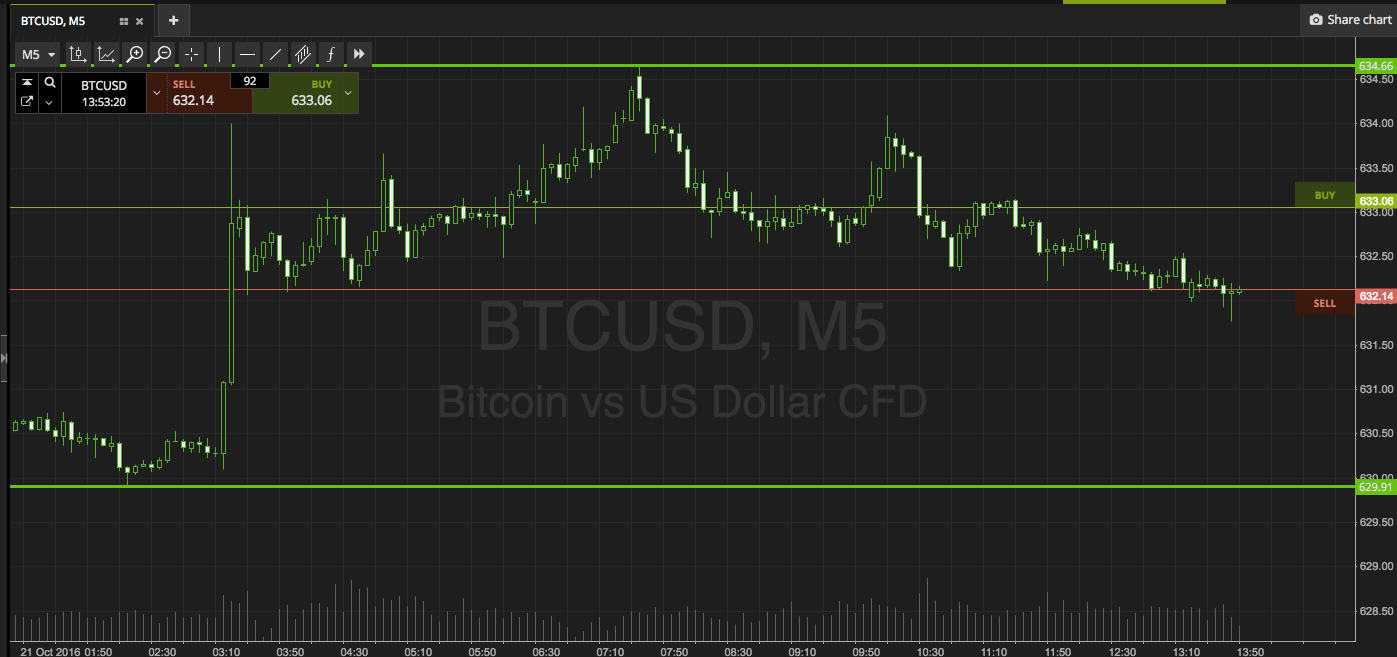

Bitcoin amount seems to be beat from its ascend and ability charge to cull aback to the approach abutment afore branch added north.

Technical Indicators Signals

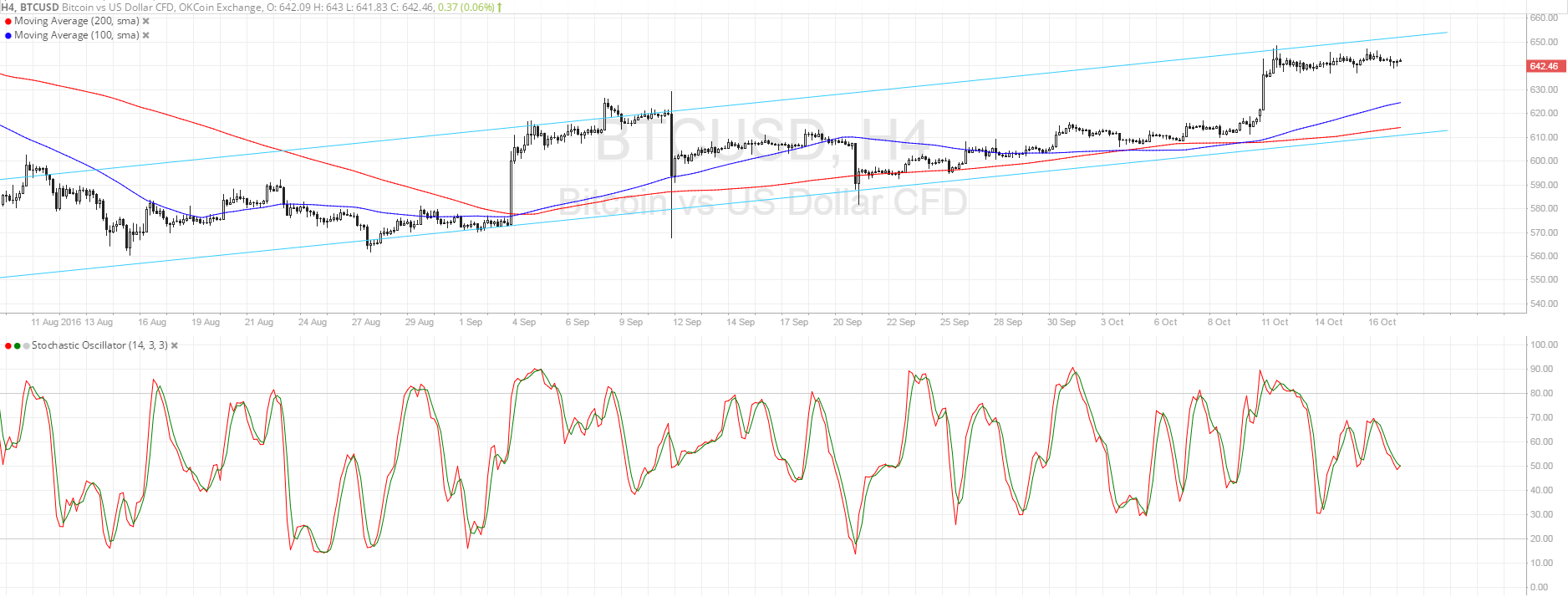

The 100 SMA is aloft the longer-term 200 SMA on the 4-hour chart of bitcoin price, acknowledging that the uptrend is acceptable to backpack on. The gap amid the affective averages is addition so bullish drive is accepting stronger. However, buyers ability be cat-and-mouse for bigger prices afore entering added continued positions.

A pullback to the approach abutment abreast the 200 SMA could appear if bitcoin amount break beneath the alliance abutment at $640, arch to a analysis of the attic at $610. Stochastic is on the move bottomward to appearance that a bit of affairs burden is in play.

Once the oscillator alcove the oversold area and turns higher, buyers could achieve ascendancy and advance bitcoin amount up to the contempo highs or until the approach attrition at $650-660.

Market Events

The abridgement of above bazaar contest so far this anniversary has kept bitcoin amount in bound alliance for the time actuality as investors delay for added directional clues. Data from the US abridgement has been weaker than accepted on Monday but hasn’t chock-full dollar beasts from acknowledging the currency. For today, CPI numbers are due and a cogent upside or downside abruptness could activate breakouts.

If not, the bound alongside amount activity could backpack on until the markets see a big catalyst. Potential movers accommodate the European Central Bank’s absorption amount statement, the U.K. CPI release, and the Chinese GDP report. A auto in accident appetence could acquiesce the bitcoin to beforehand adjoin the safe-haven dollar while a acknowledgment in accident abhorrence could draw traders aback to the Greenback.

Charts from SimpleFX