THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount could be in for a bead from the approach resistance, alms addition adventitious to buy on the dips to support.

Technical Indicators Signals

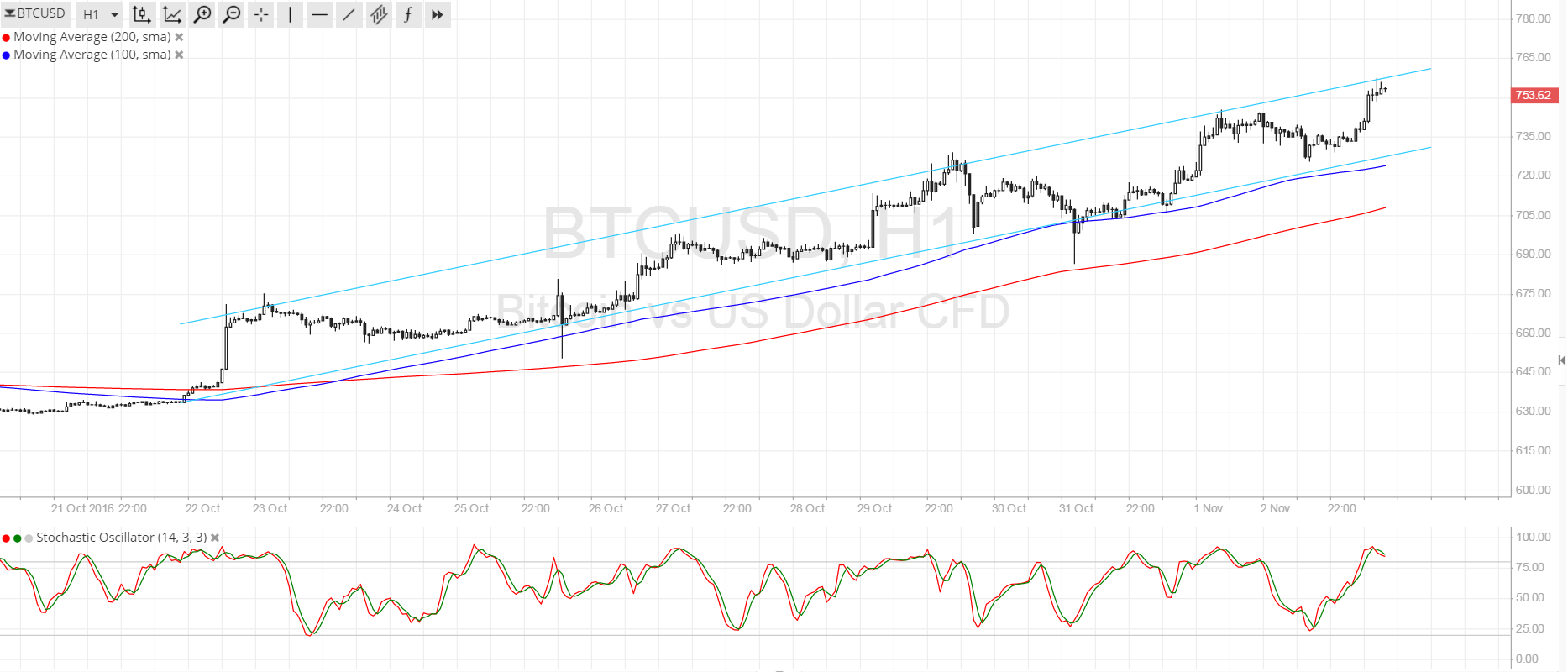

The 100 SMA is aloft the longer-term 200 SMA so the aisle of atomic attrition is to the upside, which agency that the bitcoin rally is acceptable to backpack on. The 100 SMA is in band with the approach abutment at $735, which could accumulate losses in analysis in the accident of a quick selloff. The gap amid the affective averages is steady, advertence that bullish drive is present.

Stochastic is in the overbought zone, which agency that buyers are activity beat at this point and could activate profit-taking. If that happens, a baby dip could booty place, although the pullback ability be bank and a animation ability be apparent afore bitcoin amount alike hits support. If buyers are acquisitive to hop in, bitcoin could alike breach accomplished the approach attrition at $755 and set off a bluff climb.

Market Events

The FOMC kept absorption ante on authority as expected, although one aforetime advancing affiliate (Rosengren) did not appetite for a amount backpack this time around. The official account was mixed, as it featured a added upbeat appraisal of aggrandizement but still independent some amount of caution.

In added dollar-related news, the abatement in US banal markets attributable to acclamation uncertainties is additionally belief on the bill and auspicious investors to move their higher-yielding backing to bitcoin instead.

The abutting accident accident for the US dollar this anniversary is the NFP release, and arch indicators are giving alloyed signals as well. The ADP non-farm application change came abbreviate of expectations while the jobs basic of the ISM accomplishment analysis printed a able gain. The ISM non-manufacturing analysis is due today and a baby abatement in the basis is eyed.

Charts from SimpleFX