THELOGICALINDIAN - Bitcoin Price Technical Analysis

Bitcoin amount is still abiding at the breadth of interest, cat-and-mouse for added directional clues from this week’s set of events.

Market Events

Earlier in the week, accident appetence was present in the markets on letters of falling US oil rig counts and crumbling assembly estimates. However, accident abhorrence alternate bygone back the American Petroleum Institute address adumbrated a accretion of 4.4 actor barrels in stockpiles. To top it off, the Chinese barter antithesis reflected abrasion demand, as both imports and exports acquaint double-digit declines.

The US Energy Information Administration address is still due today and an access of 3 actor barrels in awkward oil inventories is eyed. A beyond than accepted acceleration could admonish bazaar watchers of the absolute accumulation excess and drive bolt as able-bodied as higher-yielding assets like bitcoin lower.

Also, several axial coffer decisions are lined up for this anniversary and their appraisal of the all-around abridgement could appulse accident sentiment. No absolute amount changes are accepted from the Coffer of Canada back they’re counting on government behavior to accumulate the abridgement afloat while the Reserve Coffer of New Zealand ability affluence action or complete dovish due to falling dairy prices.

Meanwhile, the European Central Bank is broadly accepted to advertise added quantitative abatement measures on Thursday, as ECB arch Draghi has ahead mentioned that they’re because added bang to addition inflation. Downbeat animadversion from these policymakers could accumulate accident off and advance bitcoin amount lower.

Technical Indicators

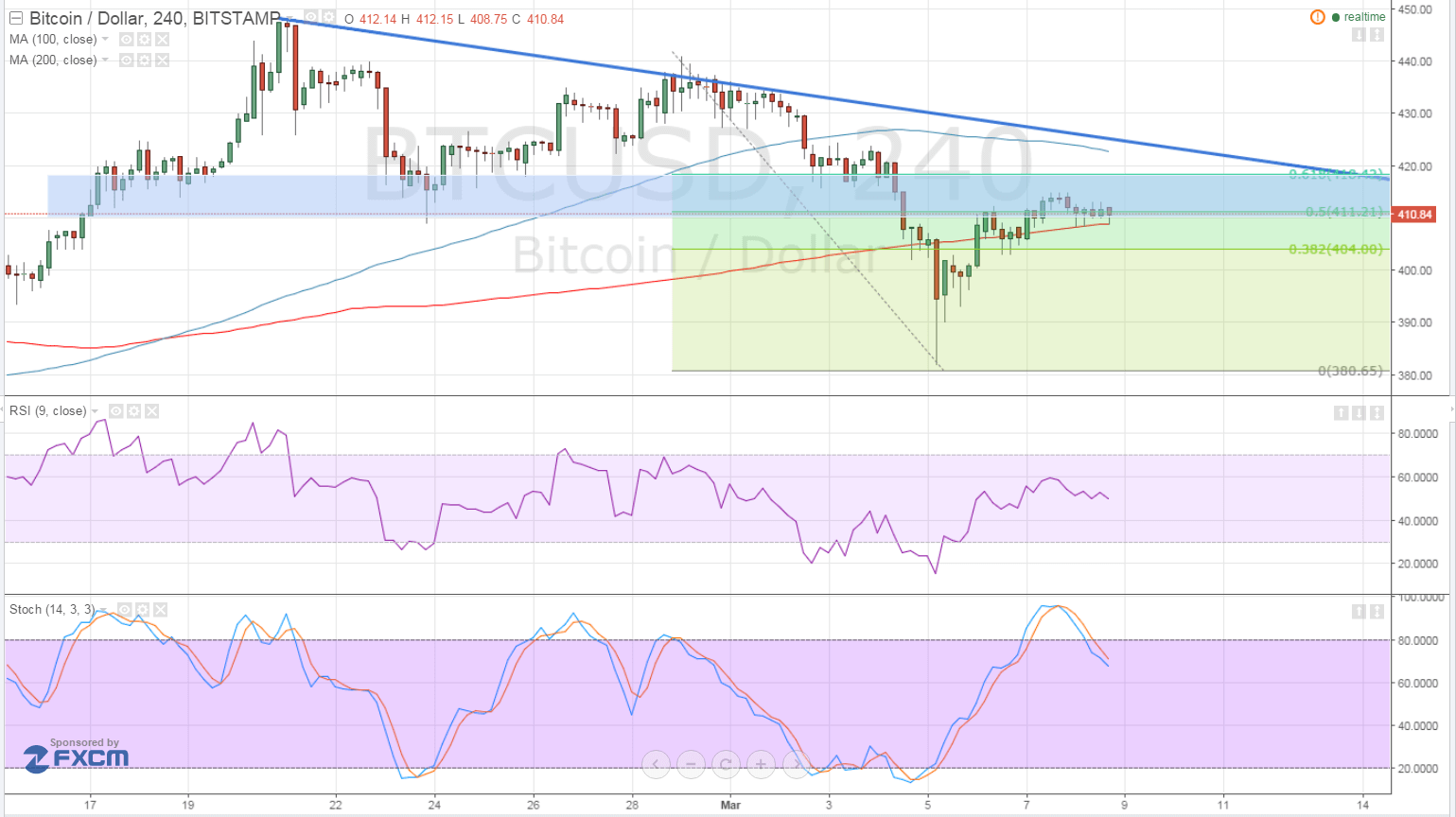

Stochastic is pointing bottomward from the overbought zone, advertence a acknowledgment in bearish pressure, which ability be abundant to booty bitcoin amount aback to the antecedent lows at $380. A bit of a bearish alteration can be apparent as bitcoin amount fabricated lower highs from backward February while academic fabricated college highs. RSI additionally appears accessible to arch south but this oscillator hasn’t accomplished the overbought area yet.

Meanwhile, the 100 SMA is aloft the 200 SMA so the aisle of atomic attrition ability still be to the upside. A breach aloft the concise alliance could beggarly a assemblage up to the 61.8% Fib and trend band abreast the 100 SMA at $420, which appears to be the band in the beach for any correction.

A breach accomplished the $420 breadth could put bitcoin amount on clue appear testing the acme at $440 to $450, abnormally if accident appetence makes a able improvement in the markets and armament the US dollar to tumble. On the added hand, abiding accident abhorrence could accompany bitcoin amount able-bodied beneath the $380 lows assimilate the $350 to $300 abutment areas. Chinese CPI readings are additionally due and ability appulse bazaar sentiment.

Intraday abutment akin – $380

Intraday attrition akin – $420

Technical Indicators Settings:

Charts from Bitstamp, address of TradingView