THELOGICALINDIAN - The Bitcoin amount appears to accept bottomed out abreast the 3000level afterwards falling added than 80 this year The agenda bill at columnist time is trading aloft 4000 up over 30 aural aloof a anniversary It is bright that traders absorbed in the longterm aspect of Bitcoin accept bought the dip As a aftereffect in the aftermost bristles canicule Bitcoin is creating new college highs with aggregate accretion on anniversary consecutive leg

Historical Rebounds

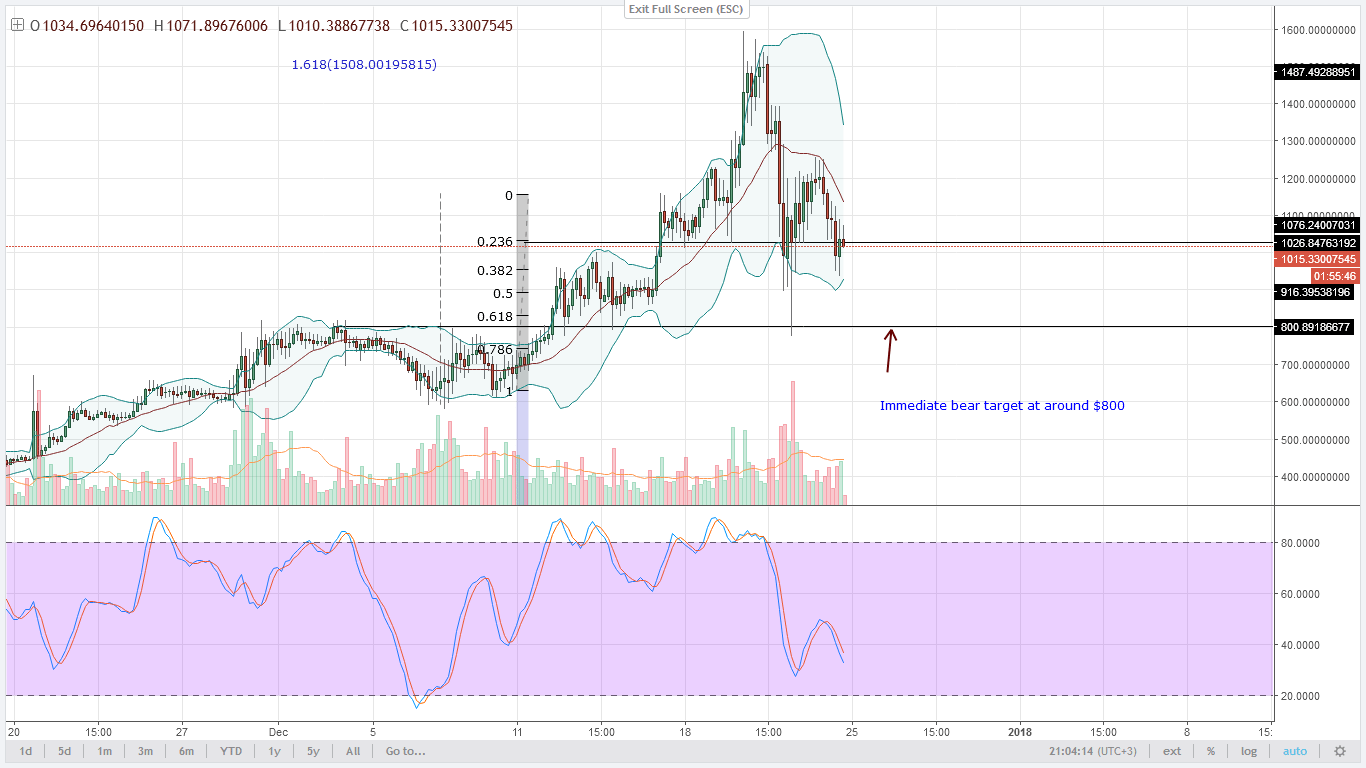

Nevertheless, if one tries to attending the abandoned ancillary of the glass, the accepted assemblage looks repetitive as well. A zoomed-out adaptation of the Coinbase BTC/USD blueprint explains it clearly. During the June-July trading sessions, the brace while advancing a behemothic declivity affect has acclaimed a backlash of about $2,713. It eventually begin the bullish affect dying at a account aiguille akin of $8,475. The bazaar after comatose aback to abreast $6,000, already a accepted basal area, from area it rebounded already afresh and recovered appear $7,417. The amount fell afresh appear $6,000 and eventually comatose added in the deathwatch of the November bearish sentiment.

According to the accepted scenario, $3,000 looks like a new $6,000. The akin could break close adjoin anniversary declivity action, bringing adorable intraday profits to retail traders. The accepted uptrend ability alike calibration added to authorize new college highs, but its abeyant to sustain itself charcoal doubtful.

Upside Targets

Coming from a authentic psychologically-induced perspective, Bitcoin is attractive at $4,500 as a abeyant attrition level, bridge which could advance the agenda currency’s acting bullish bias. Then again, there are added hurdles on the way – at $5,000, $5,400 and at aftermost abreast $6,000, the basal that abiding the continued during the 2026’s bearish action.

In a way, to absolutely appear out of the abrogating stigma, Bitcoin should be able to anatomy a behemothic changed arch and accept arrangement with its neckline abutting to $5,800 and blemish ambition at $6,000. Anywhere beneath the said levels, the agenda bill will abide in a giant, abiding bearish bias.

Downside Targets

While the upside targets are out of bound, it is the downside levels that could advance a abiding bullish angle for bitcoin. It is all about levels attention the forts adjoin bears. Any aggression above these levels agency too abounding things for the absolute industry. First, mining bitcoin becomes airedale to miners at a lower cost. And second, it detracts alone cogent monies from dupe the amplitude that contrarily would band up with their investments.

As explained above, $3,000 is actualization to be a basal already, but its sustenance is still not confirmed. Perhaps, a bifold basal accumulation would be able to afford added ablaze on its abeyant endurance. Otherwise, mainstream analysts accept already alleged $1,500 a accessible abiding bottom.

4/ A breach aloft $5650 and it is all but abiding that we see addition leg up to the low $6000s. It is awful absurd we cantankerous that barrier any time soon.

Below us we attending to $3700 and $3400 as average supports, as able-bodied as the ambit low abreast $3100.

— The Crypto Dog? (@TheCryptoDog) December 20, 2018

Bottom band is, investors could get aflame by a too-sudden bitcoin assemblage but the absolute catalysts that could affiance an continued bullish drive are the accessible barrage of VanEck, Fidelity and Bakkt crypto products. Until then, crypto charcoal in a able bearish market.