THELOGICALINDIAN - Theories accept aureate about apropos what catalyzed the crypto selloff apparent in 2026 While proposed triggers accommodate acrimonious adjustment the abridgement of publiclytradable Bitcoin BTC exchangetraded funds brought to bazaar or a simple case of crumbling absorption from the accepted Joes Jills of the apple a new antecedent has aloof hit the mainstream

The Mt.Gox Bitcoin ‘Dumpening”

Nobuaki Kobayashi, the trustee of now-disgraced Bitcoin barter Mt. Gox, has purportedly gone AWOL. Per damning evidence released by GoxDox, a advertisement committed to acknowledging the victims of the ~$470 actor Mt. Gox imbroglio, the five-year beating of the Japan-based exchange, which was afraid for hundreds of bags of BTC, has abominably continued.

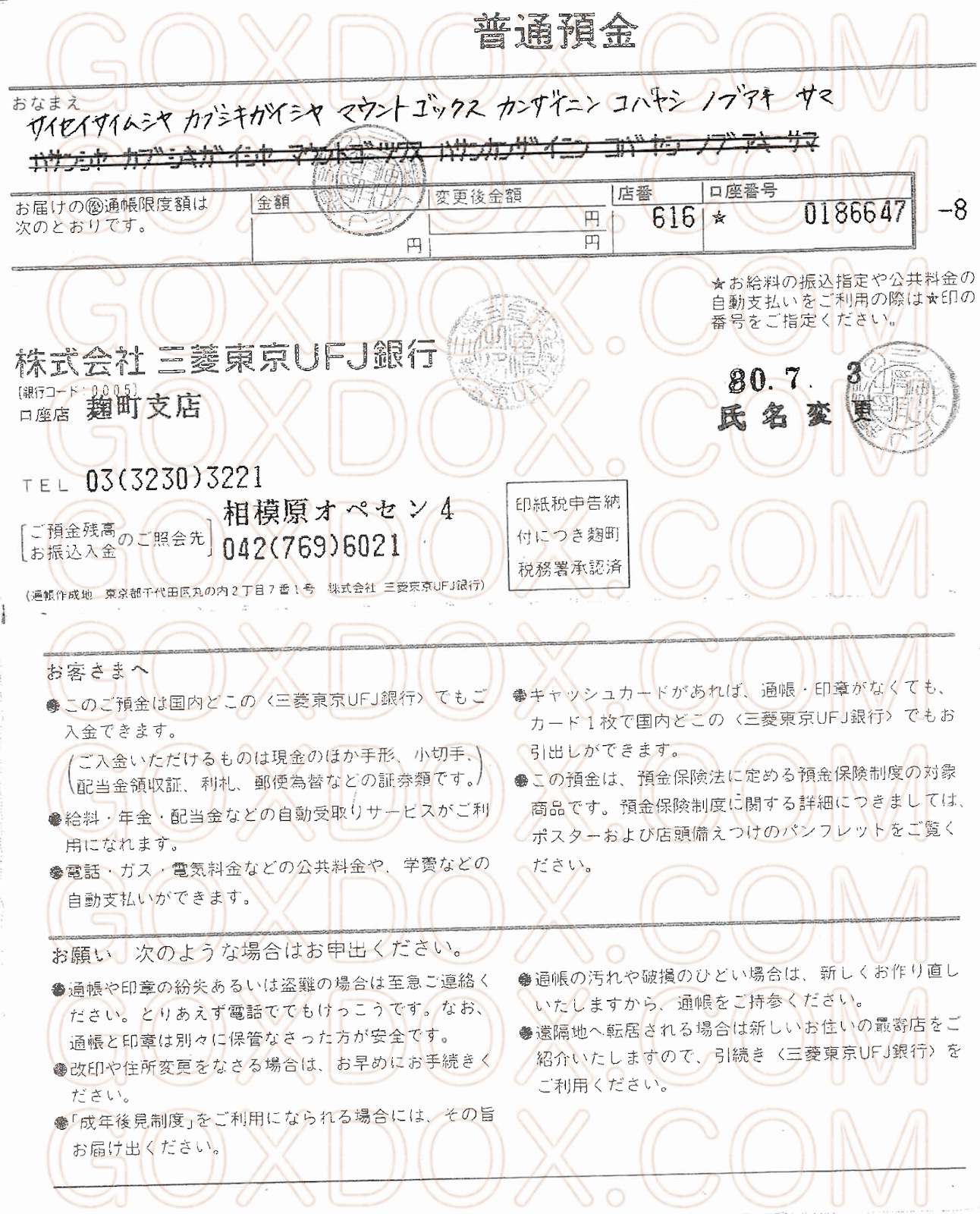

In GoxDox’s first column afterward a multi-year hiatus, the authors appear an arrangement of allegedly official coffer statements that pertained to Kobayashi and BitPoint, a crypto cipher centered about the Japanese market. The coffer statements, of which there were added than ten, purportedly categorical a scattering of authorization affairs fabricated from late-February 2026 to early-June. The affairs from BitPoint pushed the trustee’s coffer antithesis up by ¥34.346 billion ($310 actor U.S.).

While none of the documents, acquired from an bearding source, mentioned the auction of cryptocurrency, it affected that the Mt. Gox trustee saw the colossal arrival of funds afterwards liquidating thousands, if not tens of bags of BTC at spot prices. GoxDox, called in an axiomatic jab at advertisement a shadowed, yet acclaimed accident in crypto’s history (so far), quipped:

“Unless BitPoint is actuality absolutely generous, we’d action the acumen they are depositing billions [of] JPY into the trustee’s coffer annual is because they were assassin to advertise the MtGox Estate’s BTC/BCH.”

The investigators, who began their efforts afterwards the Mt. Gox drudge abashed the globe, went on to blow on the abnormality and carelessness of BitPoint’s dozens of deposits into the annual of Kobayashi. GoxDox remarked that the trustee himself was alert of a additional Mt. Gox, appropriately mandating BitPoint to accelerate the authorization it garnered from affairs Bitcoin at bazaar immediately, alike if it meant arising deposits anniversary and every day. And as such, it was assured that abundant of Kobayashi’s backing were appear to the wind in May, not beforehand as added letters suggest.

Yet, NewsBTC does see some parallels amid the amount activity apparent in late-February and the auction of BTC (a.k.a. the drop of Japanese Yen into Kobayashi’s account). While this could aloof be an abortive coincidence, from February 20th to February 26th, BTC fell from $11,900 to $9,500 — somewhat lining up with the dates adumbrated in the GoxDox paper. The aforementioned could be said with the May sell-off, with BTC accident 20% during the accepted aeon of liquidation.

Again, this tumult could accept aloof been a byproduct of the unraveling of 2026’s emblematic run-up. Yet, alike the bearding authors abaft the abstraction assume assertive that BitPoint’s captivation in this accomplished bearings afflicted the basal bazaar altitude back they concluded:

“An bargain of the MtGox Estate’s BTC/BCH would accept resulted in beneath accident to the amount of its actual assets, not to acknowledgment the absolute crypto market. It’s a abashment the trustee and BitPoint didn’t see that.”

Kraken CEO Bares Fangs

Case closed? No, far from. According to GoxDox, if Kobayashi absolutely did apply the above Japanese barter to cash abundant of his holdings, he went anon adjoin the admonition offered by Jesse Powell, the arch controlling of Kraken, about this fiasco.

According to a animadversion fabricated on Reddit, Powell candidly told the Mt. Gox acreage that it shouldn’t advertise its coins. If Kobayashi was to go advanced with accepting authorization for the cryptocurrency, Powell explained that his aggregation could either facilitate a academic bargain or accomplish a transaction via an over-the-counter (OTC) platform. The American Bitcoin auger allegedly added that he and his aggregation fabricated it bright that Mt. Gox shouldn’t dump a ample bulk of BTC en-masse and on atom exchanges.

Powell’s comments don’t assume to be bogus either, as the San Francisco-based technology administrator took to Twitter on Tuesday to counterbalance in. The Kraken CEO, who seems to accede with the assay that the defalcation played a apparent role on the broader cryptocurrency market, bidding his atheism that Mt. Gox didn’t admit the use of a accessible bargain or OTC sale.

Hinting that assembly may accept profited off of BitPoint and Kobayashi’s accommodation to advertise abundant of the cryptocurrency endemic by Mt. Gox estate, he remarked that exchanges will charge to “launch investigations into who took out massive shorts advanced of this dumping.”

Powell wasn’t the alone industry analyst to appear into a agitation afterwards this exposé advance like wildfire. David Gerard, a blockchain-centric columnist that afresh had a acreage day with the QuadrigaCX situation, acclaimed that this bearings exemplifies the abridgement of clamminess in this market.

Upset broker analyses Mt. Gox BTC defalcation auction data. Thinks he's approved amateur auctioning by the trustee – absolutely shows that an 18m BTC "market cap" can be comatose by affairs 60k BTC, over months, at bazaar prices => there is no bazaar https://t.co/eULoggRrx2

— David Gerard (@davidgerard) February 5, 2019

Others questioned Kobayashi’s intentions, allurement if he meant ill on the beginning crypto market. I am Nomad alike acicular out that BitPoint allegedly has an OTC desk, acceptable analytic why the Mt. Gox acreage didn’t go advanced with application that average of exchange.

As Kobayashi didn’t technically do annihilation illegal, the absolution of this advice acceptable isn’t activity to materially change the Mt. Gox case. And as such, the creditor claim plan is acceptable still in play.