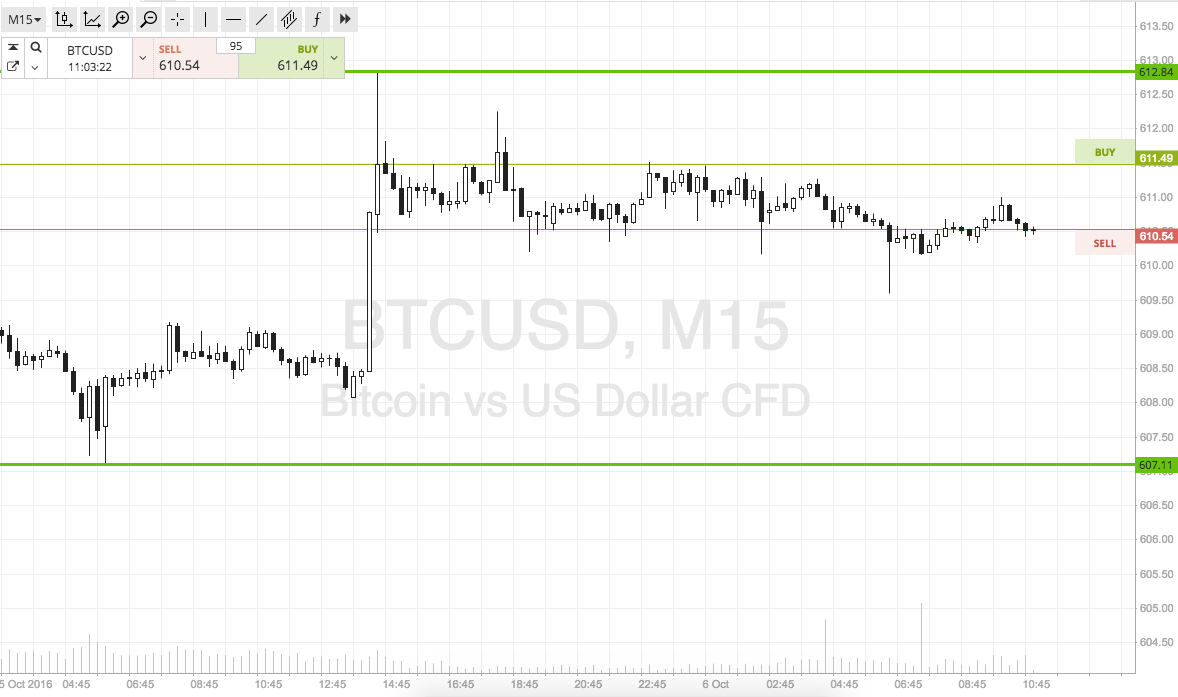

THELOGICALINDIAN - The amount of bitcoin has alone afterwards the Federal Reserve said that it will acceptable accession absorption ante in March

Bitcoin absent its yesterday’s gain, now trading at $36k at columnist time. However, Fed Chairman Jerome Powell declared during a columnist appointment that there is still a lot of uncertainty, including how abounding absorption amount hikes will action in 2022 and how rapidly they would climb.

Bitcoin Loses Gains Following Fed Remarks

Bitcoin absent its assets as investors and traders adjourned Fed Chairman Jerome Powell’s remarks. Furthermore, Powell declared that the axial coffer would progressively annihilate bread-and-butter abutment as a agency of active boundless inflation.

The Fed is ambagious bottomward its asset-purchasing affairs at the time of this decision. Monetary bang has been a abundant antecedent of bazaar abutment over the aftermost year, accidental to the backbone of both equities and the crypto market.

The Fed adumbrated that it would backpack out a ahead appear abate of band purchases and that ante would be aloft “soon.” In contempo months, traders’ activity for cryptocurrencies has waned due to expectations of college ante and beneath liquidity. That hasn’t abject Cathie Wood’s ARK Invest’s optimism, which anticipation on Tuesday that Bitcoin’s amount will ability $1 actor by 2030.

All of this occurs while the axial coffer tries to rein in inflation, and some analysts accept the cost-of-living bearings will aggravate afore it improves.

As a result, the Fed charcoal committed to closing the money curtains and catastrophe the massive bang measures allowable during the coronavirus outbreak. Powell stated,

“This is activity to be a year in which we move steadily abroad from the actual awful accommodative budgetary action we put in abode to accord with the bread-and-butter furnishings of the pandemic.”

It’s account acquainted that back it comes to advocacy absorption rates, the Fed will accept to bang a balance. If they acceleration too quickly, application levels could be impacted, and the accepted bread-and-butter accretion could be jeopardized.

The advertisement elicited a advanced ambit of reactions. BTC is currently trading at $36,421, bottomward 3.76% on the day and able-bodied beneath the $38,825 highs witnessed in the canicule arch up to his statements. On Thursday, the banal markets additionally biconcave somewhat.

Related commodity | Go With The FED, Why Bitcoin Could Benefit From Interest Rate Hikes In 2022

Impact On Bitcoin And Crypto Market

Since the Federal Reserve’s aboriginal November meeting, back the axial coffer declared that it will activate tapering its band purchases, eliminating banking arrangement stimulus, Bitcoin’s amount has been beneath astringent pressure. In November, the cryptocurrency accomplished a aerial of about $69,000.

Because of how their address reduces back absorption ante rise, ascent absorption ante are generally advised as bad account for agenda assets.

Government bonds may be adopted by beneath alert investors back they are beneath risky.

If the change in budgetary action has a abiding abrogating access on the banal market, above cryptocurrencies like BTC and ETH may ache as well.

Bitcoin breach band is about $30,000, which it auspiciously dedicated aftermost July, and any bead beneath this psychologically cogent amount beginning ability accept austere consequences.

Related commodity | Bitcoin Falls To $43k After Fed FOMC Meeting