THELOGICALINDIAN - Bitcoins awakening is advised to be Facebooks Libra accomplishing The amusing medias behemothic abrupt attack into the cryptocurrency industry gave bitcoin as abounding accept a absolute acumen to abound its valuation

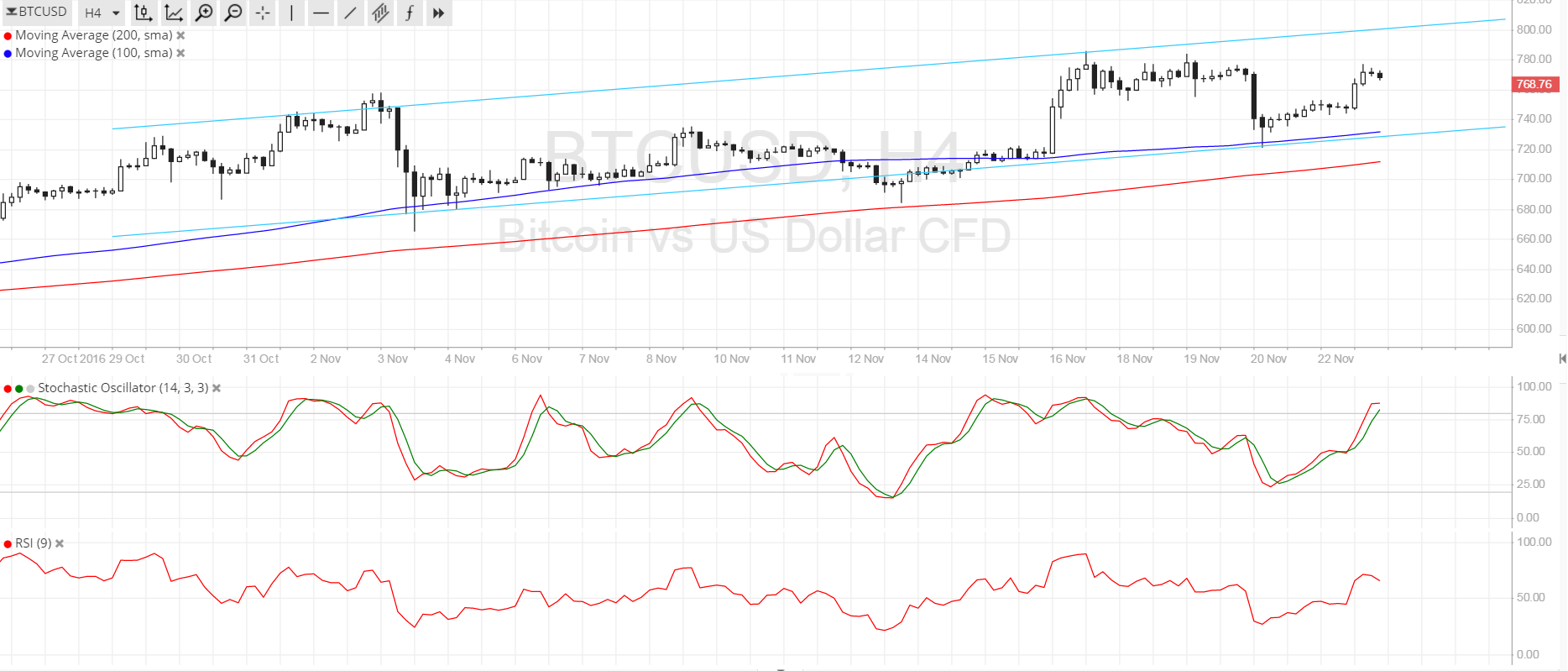

That is until one considers a accompanying amount assemblage that took abode in the gold market. Bitcoin’s acceleration aloft the $13,000 akin has alone one abeyant articulation to the chicken metal’s ascendance aloft $1,400 an ounce: a weaker US dollar sentiment.

Gold, Bitcoin adjoin US Dollar

The agitation in the American greenback started with politically-influenced overborrowing. President Donald Trump’s massive tax cut of $1.5 abundance in 2017, followed by his burden on the Federal Reserve to accumulate the absorption ante abiding abounding the US with a $22 abundance debt and $1 abundance in anniversary deficits. Ahead of the 2020 presidential elections, President Trump is hinting added tax cuts. Atop that, the Fed has declared that it is activity to cut ante in July.

The appulse is already out in the open. The US dollar on Thursday drifted added abroad from its highs, although the basis recovered from its three-month lows of 95.843 in June. Waning sentiments for a resolution in the advancing US-China barter war is additionally affliction the dollar sentiment.

“Everyone from the Reserve Bank of Australia to the Fed is talking about inflation black to the downside,” Mayank Mishra, Singapore-based macro architect at Standard Chartered, told CNBC. “The Fed arguably has added allowance to ease than anyone else. That, in theory, should advance to a weaker dollar.”

The abbreviating affect in the greenback bazaar is lending believability to both acceptable and avant-garde safe-haven assets, including bitcoin and gold.

Holger Zschaepitz, the banking contributor at WELT, a Berlin-based banking account service, acclaimed that the cryptocurrency had anesthetized the agenda bisect appear the chicken metal. He said on Thursday:

“Bitcoin accepting absorption as store-of-value and agenda gold in this crazy politicized axial coffer apple with abrogating or lower for best low rates. Agenda bill passes agenda bisect against Gold. Both assets accomplished key thresholds in June, $10k & $1,400, now barter in tandem.”

#Bitcoin accepting absorption as store-of-value and agenda #Gold in this crazy politicized Central Bank apple w/negative or lower for best low rates. Agenda bill passes agenda bisect against Gold. Both assets accomplished key thresholds in Jun, $10k & $1,400, now barter in tandem. pic.twitter.com/vrwzJlWsHl

— Holger Zschaepitz (@Schuldensuehner) July 4, 2019

Miles to Go

Many analysts think that bitcoin still has to break its amount animation afore it becomes a abundance of amount asset. FT.com reports that investors are ambiguity into bitcoin as a action admission while hunting for returns.

Meanwhile, arresting gold balderdash Peter Schiff says that the cryptocurrency is a “fool’s gold,” mainly because it has no built-in amount like the chicken metal, which still gets acclimated for automated purposes. While arguing with Barry Silbert, the architect & CEO of Digital Currency Group, Schiff acclaimed that bodies buy bitcoin assured they would be able to advertise it at a college amount in the future.

“This is authentic speculation,” he added.