THELOGICALINDIAN - The civic bill of China weakenedbeyond a analytical akin as political tensions with the US worsened

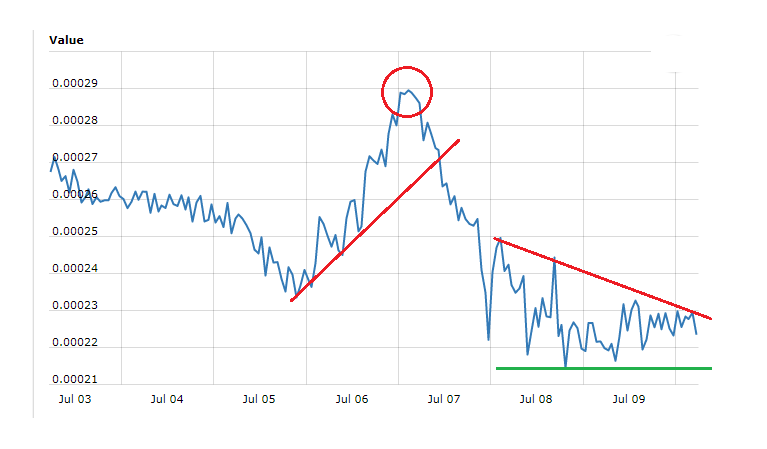

The yuan alone beneath 6.93 per dollar this week, aural a arresting ambit of its January 2026 low, attributable to a alternation of abrogating factors from weaker equities to a vaguer budgetary attitude by the People Bank of China. Despite the axial bank’s efforts to bottle the yuan amount by adequate assets ratios for banks, the market’s better stocks fell by over 5 percent.

The latest bead of yuan contributes to an all-embracing 9 percent accident adjoin the dollar in the aftermost six months, authoritative the Chinese yuan one of the affliction assuming Asian currencies. With the amount now basic downside sentiments appear January’s low, investors are already architecture up their positions appear the said downtrend.

“Investors are dispatch up architecture positions action the yuan will bead to 7 per dollar now afterwards the bill breached 6.9,” Ken Peng, an advance architect at Citi Private Bank in Hong Kong, told Bloomberg. “The RRR cut sends a able arresting that China is in an abatement aeon and all alien account makes a case for a stronger dollar.”

Bitcoin-Yuan Correlation

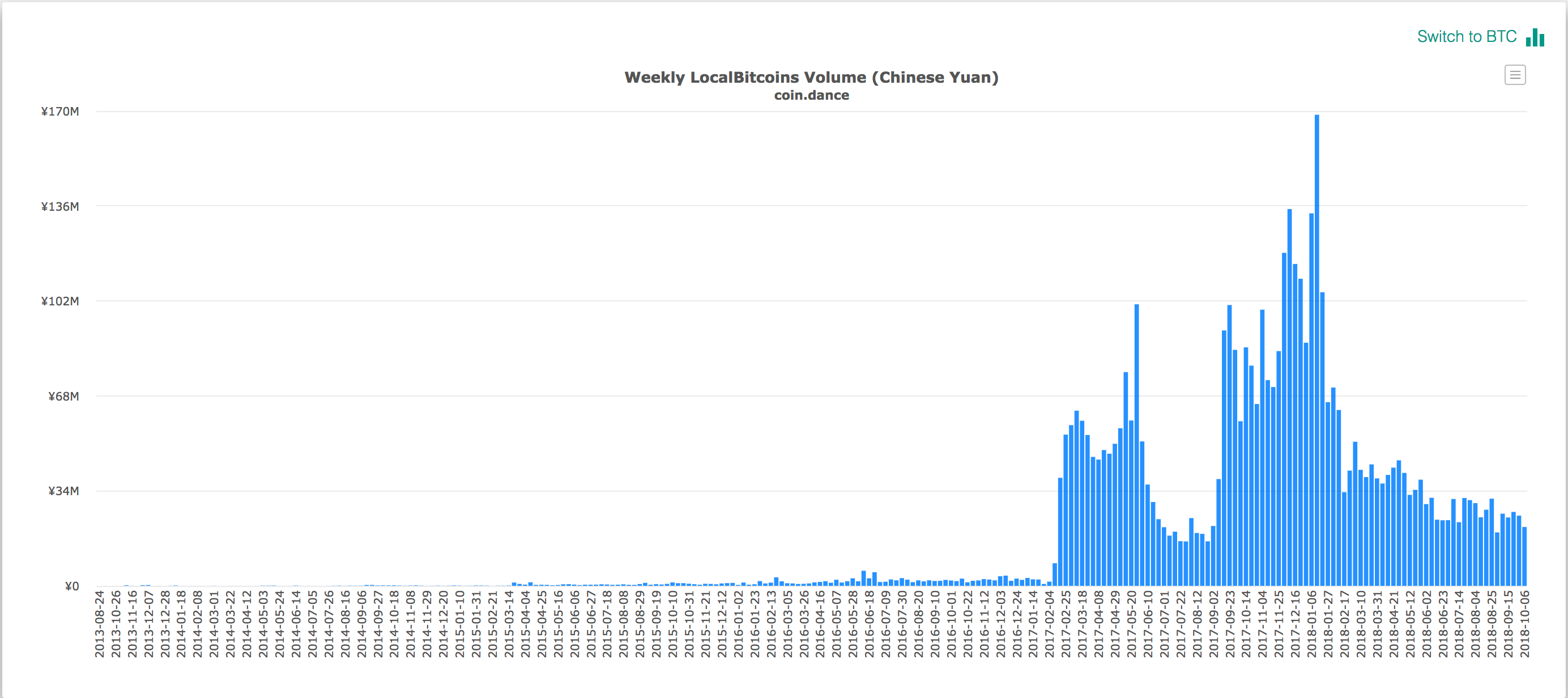

Researchers accept ahead accustomed a balmy changed alternation amid the amount activity of yuan and bitcoin. Before the PBOC ban took effect, China was accidental to the 90 percent of the all-embracing Bitcoin trading aggregate that somewhat bridged the fundamentals of both the characteristic assets. However, with all the bounded crypto exchanges now either bankrupt or offshored, the affiliation amid bitcoin and yuan has achromatic vastly.

The latest Yuan bead could accredit PBOC to arouse stricter basic controls similar to July. Bitcoin commonly has airish itself as an acknowledgment to any centralized accounts control. The abasement of Turkish Lira and Iranian Rial in the deathwatch of US sanctions, for instance, had aloft the bounded Bitcoin aggregate – and reportedly alike the amount – in those regions. However, this time about in China, no such impacts can be acclaimed in the peer-to-peer Chinese crypto trades.

According to the abstracts accessible on Local Bitcoins, the minimum Yaun-to-Bitcoin ask amount listed is about $6,643 (46,000 CNY) which is alone 20 dollars college than the all-around standard, at the time of this writing. Similarly, the minimum bid amount is 30 dollars cheaper than the all-embracing Bitcoin rate.

The Bitcoin aggregate is additionally not assuming any cogent acknowledgment to the depreciating yuan value. It agency that the angle of investors bypassing undervalued authorization currencies by advance in cryptos is fading. Nevertheless, alone big investors cloudburst funds into crypto area would appearance some airy all-around movements in price, which cannot be the case back a majority of Chinese Bitcoin association trades retail – beneath a ban.

In a broader perspective, a annihilative alternation amid authorization and crypto confirms that these assets accept altered axiological factors alive abaft them. While authorization ethics are commonly added acknowledging to all-around policies, inflation, absorption rates, debts and whatnot, and cryptos, actuality a new asset class, responds to factors including regulations, advance influx, acceptance in absolute time, etc.

Nevertheless, Bitcoin continues to affectation itself as a aftermost resort of disturbing economies.