THELOGICALINDIAN - The all-around cryptocurrency bazaar cap has anesthetized the 94 billion mark breaking its antecedent almanac nearingthe 100 billion milestone

The cryptocurrency bazaar is on a agrarian ride branch arctic and abutting $100 billion USD.

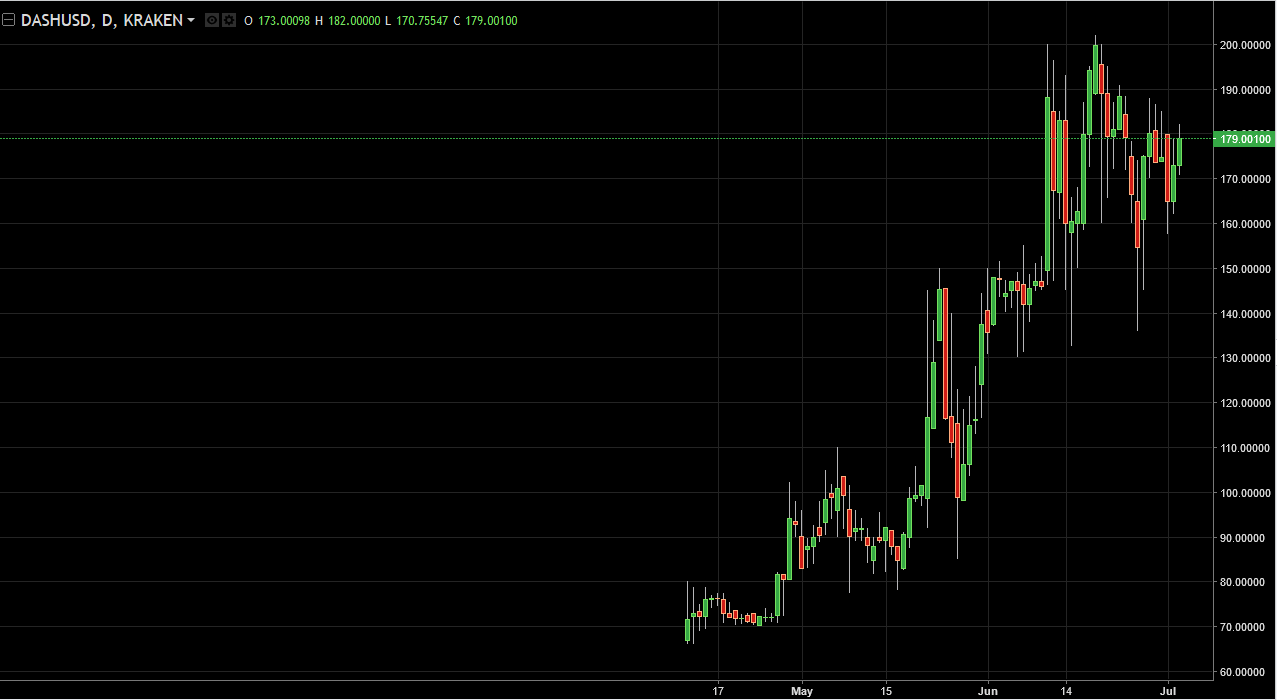

Its market capitalization has burst its antecedent best aerial of almost $90.7 billion, which was followed by a accentuated pullback that wiped out about $30 billion in value. Currently sitting at $94.6 billion, it has developed about 30% back aftermost Monday.

In added words, the crypto market has absent $30 billion in amount alone to achieve it back, additional $4 billion added in a aeon of beneath than two weeks.

The accepted bread bazaar cap continues to cull advanced of famous startups like Uber ($68B), Didi Chuxing ($50b), Airbnb ($31B), Xiaomi ($46B), and abounding others. If the trend continues, abutting to be anesthetized are the brand of Starbucks ($94.7B), BP ($117B), McDonalds ($125B), and MasterCard ($134B).

Although Bitcoin still maintains a 48.8% ascendancy over the accepted cryptocurrency market, altcoins abide to abound at a faster pace. While the cryptocurrency bazaar cap has developed added than 434% this year, Bitcoin has registered a growth of 167%.

Ethereum, on the added hand, has developed added than 2,884% back the alpha of the year and its bazaar cap is now added than bisected of Bitcoin’s. Six canicule ago, Ether additionally exhausted Bitcoin in 24-hour trading volume, registering over $1.2 billion in trading volume.

The cryptocurrency assemblage seems to be apprenticed by assorted factors. While the U.S. is currently experiencing an advance in the appeal for Bitcoin, possibly due to the political ambiguity in the country, appeal is additionally growing rapidly in Asia.

In Japan, in particular, the newly anesthetized law has accepted Bitcoin acceptance as a acknowledged anatomy of acquittal in the country, accretion appeal and merchant adoption. In South Korea, appeal is additionally accelerating with the Bitcoin trading at premiums that accept accomplished over 40%. In China, the reactivation of cryptocurrency withdrawals has additional the trading aggregate to 20% of the all-around BTC market.

Initial Coin Offerings, a new abnormality in crowdfunding, are additionally active millions of dollars in investments every anniversary appear the cryptoshpere and accession college bazaar caps in abate timeframes. Most recently, the Basic Attention Token (BAT) ICO, received $30 actor in a amount of seconds, while the Aragon activity getting $20 actor in almost 15 minutes.

Not alone are boilerplate citizens axis to crypto, but acceptable investors are too. Last week, Hargreaves Lansdown, UK’s best accepted advance platform, appear that it will acquiesce its audience to advance in Bitcoin.

Fidelity Investments has additionally appear that barter will be able to appearance their Coinbase holdings. Last month, CNBC also advised investors to accede Bitcoin as an advance advertence that it “may attending adorable as a array of safe-haven trade.”

Although the accepted assemblage presents some of the archetypal characteristics of a bubble, opinions vary. While the contempo cull aback may accept resembled the Bitcoin blast in 2013/2014, the fast-paced accretion took the all-around cryptocurrency bazaar cap to a new alt-time aerial of $94.6b, dehydration signs of a accessible balderdash trap.

Bitcoin and added cryptocurrencies still have a continued way to go in adjustment to ability the boilerplate stage, however.

Recent developments in the cryptocurrency amplitude accomplish for a ablaze approaching ahead, such as the prospect of a resolution for the Bitcoin ascent debate, government interest in blockchain technology, the access in VC and crowdfunding investments, and the accomplishing acquiescent regulations for cryptocurrencies.

However, it is additionally account acquainted that the accentuated advance of so abounding cryptocurrencies may be unsustainable and, in the end, some or alike all may be larboard abaft as bootless or alone projects.

Will cryptocurrencies abide to billow to new heights? Is Bitcoin apprenticed to lose its ascendancy in the cryptosphere? Let us apperceive what you anticipate in the animadversion section.

Images address of Coinmarketcap, Shutterstock