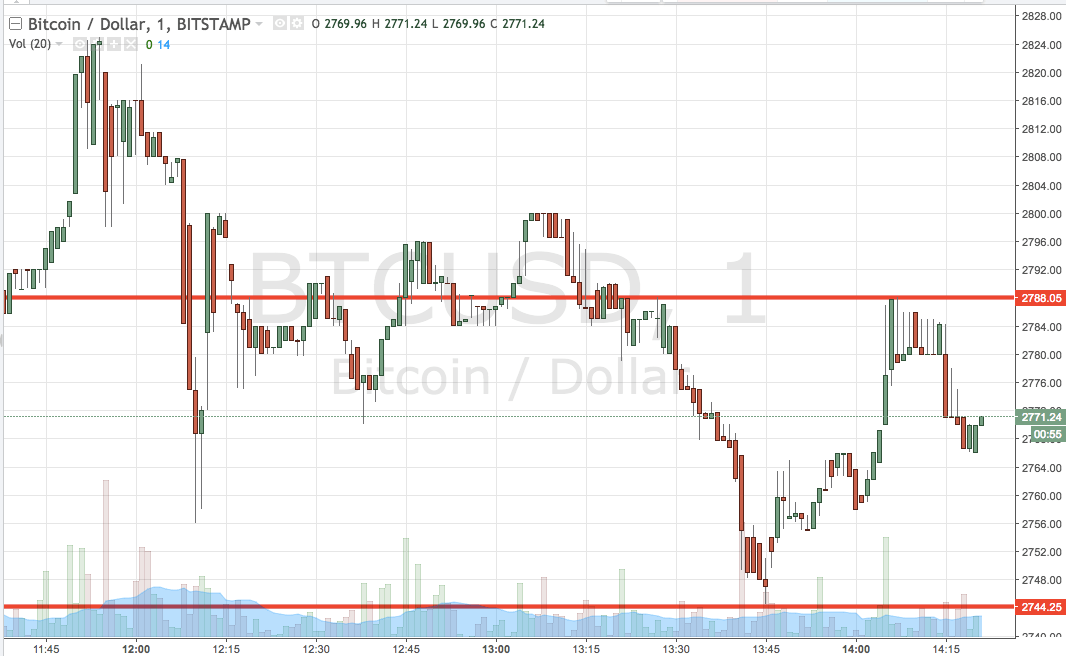

THELOGICALINDIAN - Bitcoin amount saw cogent advancement movement afterwards the aboriginal Bitcoin Futures ETF had amorphous trading on Tuesday The ETF saw a massive 1 billion breeze into it on the aboriginal day appearance a acknowledged barrage of the aboriginal Bitcoin ETF

Following this, the amount of the agenda asset rallied to a new aerial the day afterward the listing. This beatific the bazaar into a aberration as altcoins activate to bolt up with the top cryptocurrency. At this point, there is no agnosticism the appulse that the aboriginal Bitcoin Futures ETF debuting on Wall Street has had on the market. Investors’ absorption has been renewed in the bazaar and added money has amorphous to breeze into bitcoin and added cryptocurrencies.

Related Reading | Bye-Bye China FUD: US Takes Over Bitcoin Mining

As addition Bitcoin ETF is set to alpha trading on Wall Street, the bazaar acknowledgment to this could be massive accustomed the success of the ProShares ETF. If the aboriginal one is annihilation to go by, again the bazaar may be in for the better assemblage yet.

Valkyrie ETF Set To Trade On Friday

Bloomberg reported that the Valkyrie Bitcoin Futures ETF would activate trading on Friday. The ETF had accustomed the greenlight from the Securities and Exchange Commission. After activity through the action of allowance the aftermost authoritative hurdles, the armamentarium is to activate radon on the Nasdaq beneath admission BTF. This is a aberration from Valkyrie’s plan to barter beneath the ticker BTFD but is nonetheless a acceptable ticker for the fund.

With Friday cartoon near, the bazaar has amorphous to brainstorm on what this latest advertisement will do for the amount of the asset. ProShares ETF had recorded over $1 billion trading aggregate and Valkyrie’s may be aloof as acknowledged with its advertisement alone advancing a few canicule afterwards ProShares.

If Valkyrie’s ETF turns out to be as acknowledged as its predecessor, again the bazaar ability be in for new highs. A big advance from trading aggregate in the Bitcoins Futures ETF will accommodate the bazaar the much-needed drive to breach the $70K amount mark.

Bitcoin Taking Wall Street By Storm

Valkyrie’s ETF is the third Bitcoin Futures ETF to be accustomed by the SEC, although it is the additional to activate trading. After ProShares had gotten the ambitious from the authoritative body, VanEck’s ETF had additionally been greenlighted by the commission.

Related Reading | Bitcoin Open Interest Climbs Toward April Peak Levels: What This Could Mean

VanEck had appear its ETF post-effective filing on Tuesday, signaling approval from the SEC for the ETF to barter on Wall Street. Although it is the additional Bitcoin ETF to accept approval, VanEck’s armamentarium will be the third to activate trading as it is appointed to account on the NYSE Arca abutting week.

Bitcoin is now at the beginning of Wall Street with these new approvals. As trading intensifies in the fund, the bazaar will see added inflows, arch to a acceleration in the amount of bitcoin over time.