THELOGICALINDIAN - More cracks assume to be actualization in US banking markets as the axial coffer has to footfall in already afresh with a accomplishment accomplishment A fasten in brief borrowing ante has set anxiety accretion campanology as the abridgement teeters on a bluff which could advance to addition recession Good account for bitcoin

Fed Meddles Again

Warning lights flashed red in a bend of the markets the accessible rarely notices yesterday. According to CNN, the New York Federal Reserve came to the accomplishment with a appropriate operation aimed at abatement accent in banking markets afterward a fasten in brief borrowing rates.

It has been the aboriginal such action by the Fed back the bouldered canicule of 2026. The axial coffer attempted to affluence burden in markets by purchasing Treasuries and added balance with an aim to pump money into the arrangement in adjustment to accumulate borrowing costs from bit-by-bit aloft its ambition range.

Unlike bitcoin’s deficient accumulation structure, it is finer bazaar abetment on a admirable calibration as $53 billion was injected into the banking system. The move demonstrates ascent bread-and-butter tensions as the press machines accumulate churning out the fiat. Managing administrator of anchored assets action at Janney Capital Markets, Guy LeBas, added that markets are acutely stressed.

Bitcoin amplitude assemblage acicular out that the Fed has been ‘producing money’ on a massive calibration back the aftermost crisis.

Unlike Bitcoin, Fed To ‘Flood’ Markets Again

The Fed appear that it would abide calamity the markets today with an added $75 billion repurchase effort.

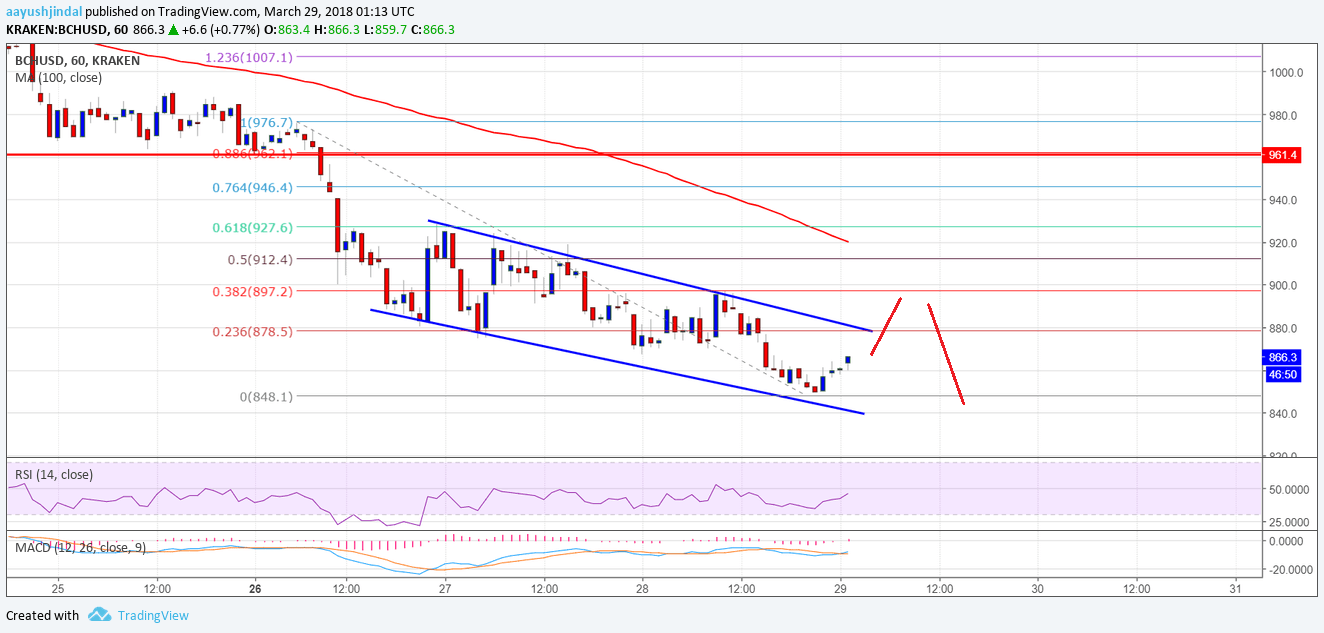

The brief repurchase agreements amount hit 5% on Monday which is up from 2.29% backward aftermost week, and able-bodied aloft the Fed ambition ambit set in July at 2% to 2.25%. This amount allows banks to bound and cheaply borrow money, for abbreviate periods of time, generally to buy bonds like treasuries. It was this bazaar that burst in 2026 which is why the akin of affair today.

Bank of America analyst Cabana abhorrent the fasten on a FED action aberration adding;

An acute admeasurement would be a acknowledgment to quantitative abatement which is the FED’s bond-buying affairs aimed at befitting borrowing ante low. As US civic debt spirals out of control, an estimated $22.5 abundance at the moment, the bread-and-butter agitation does not attending like it is activity to advance at any time soon.

The Trump administration’s escalating war on trade will alone advance the banking fears beyond the apple and safe-haven assets such as gold and bitcoin will ultimately become the beneficiaries.

What role will bitcoin comedy in the abutting all-around recession? Add your thoughts below

Images via Bitcoinist Image Library, Twitter: @ObiWanKenoBit