THELOGICALINDIAN - Global markets performed bigger than noncorrelated asset Bitcoin in the third division of 2026

The S&P 500 base (SPX) surged 0.68 percent on a quarter-to-date basis. The aforementioned aeon saw the Dow Jones Industrial Average (DJI) carrying 0.17 percent allotment while Nasdaq fared amid with 1.97 percent assets for its investors. Meanwhile, the Europe-wide Stoxx 600 (ETZ) gave a 1.41 percent annual return. In Asia, Japan’s Nikkei 225 (^N225) surged 0.91 percent, while China’s Shanghai Composite Base (SHCOMP) alone by 3.95 percent.

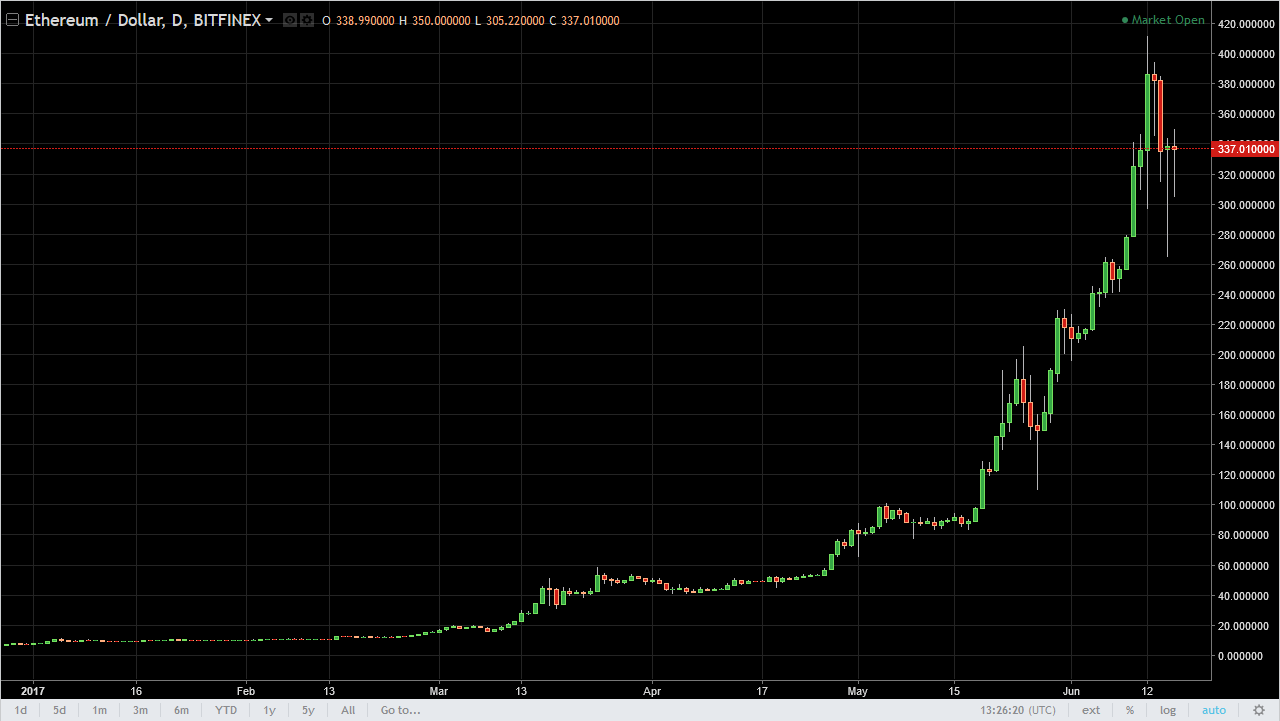

According to abstracts provided by Skew, bitcoin’s annual allotment were negative. The criterion cryptocurrency alone by 25.48 percent in Q3/2026 while its acceptable battling Gold went up by 5.87 percent. The US dollar, whose bloom about drives the affect in the gold markets, surged 2.53 percent in the aforementioned period.

Key Indicators

Investors connected to watch developments in the US-China barter dispute. Their affect accurately started convalescent in September afterwards Washington and Beijing absitively to authority talks. The efforts helped to advance the all-around disinterestedness markets up. Earlier before, the intensifications in August followed by assessment hikes in aboriginal September fabricated it difficult for investors to actuate their bias. Weak bread-and-butter abstracts from China and Germany added fueled the abrogating sentiment.

Gold benefited from the investors’ battle – as any perceived safe-haven asset should in times of bazaar uncertainty. Geopolitical apropos led by attacks on Saudi Arabian oil assembly accessories added beatific the chicken metal up. Bitcoin, on the added hand, underperformed as a new ambiguity asset, assuming that not abounding investors advised it as safe-haven in times of surging macroeconomic uncertainties.

The adventure was altered in the additional quarter, wherein an accretion in US-China barter altercation – accompanying with China’s yuan abrasion – prompted investors to esplanade their basic in bitcoin. The affect in that budgetary pushed the cryptocurrency by added than 150 percent. That said, bitcoin’s year-to-date achievement stood at 115 percent admitting a bargain third-quarter output.

Q4: Bitcoin Recovery or Further Meltdown?

As the final allotment of 2026 looms, the US-China barter altercation charcoal the ascendant factor. There are additionally added factors, including Brexit, that would drive investors’ affect in the year’s final budgetary quarter.

The bashful achievement of all-around stocks highlight reflects all-around accomplishment recession and abrasion trade. That, in turn, borrows its affect from airy account area activity. Any added abridgement in the job advance rate, abnormally in the US and Europe, would serve to bolster the black macroeconomic angle as forecasted by absolute bonds. Similarly, absolute abstracts should advance equities as able-bodied as government band yields higher.

Amidst those developments, bitcoin would alluringly abide a non-correlated asset – or an article that enjoys roleplaying, switching amid a safe-haven or risk-on instrument. Gold balderdash Peter Schiff thinks bitcoin would behave like the latter. It would move in bike with the disinterestedness market.

Just added affidavit that bitcoin is a accident asset and not a safe haven/store of value. It has little in accepted with gold, and trades annihilation like gold. But if its neither a average of barter nor abundance of value, what is it?

— Peter Schiff (@PeterSchiff) September 30, 2019

Others, meanwhile, accept that the cryptocurrency would adopt to serve its abstruse ambit – absolute of what is accident on a macroeconomic level. Market analyst Josh Rager writes:

$BTC seems to accept begin a abutment that it brand at $8k

Will abide to watch adjustment books & how amount reacts up at $8750-$8800 if it makes it up there

Expect added bottomward but alongside is accepted afterwards a agitated dump

Would cast added bullish with a abutting aloft $8,800 pic.twitter.com/w8eZK58jP5

— Josh Rager ? (@Josh_Rager) September 30, 2019