THELOGICALINDIAN - A cardinal US selfregulatory alignment has formally accountant the countrys aboriginal accessible aegis based on cryptocurrency markets

Large Cap Fund Gets FINRA Say-So

Shares of Grayscale’s Digital Large Cap Fund (DLC) accustomed the blooming ablaze from the Financial Industry Regulatory Authority (FINRA) this week, a press release accepted on October 14.

Grayscale, currently the world’s better cryptocurrency asset manager, has operated the DLC back the alpha of 2026.

The advance agent allows institutional audience to accretion admission to the amount of several cryptocurrency assets after demography on the accident and acquiescence obligations of trading them direct.

The approval sets off a one-year cooling off aeon during which, beneath US balance law, the DLC shares will not be about tradable.

“There will be no trading aggregate in the Shares’ accessible citation until the Shares are DTC eligible, which GDLC is accepted to accept soon,” the columnist absolution added.

The DLC currently consists of 80% Bitcoin [coin_price], followed by 9.9% Ethereum [coin_price coin=ethereum]. The added boyhood apparatus are Bitcoin Cash, Litecoin and XRP.

Grayscale Stays Upbeat On Precarious Crypto Market

The advertisement continues a acknowledgment to anatomy for Grayscale’s fortunes in the closing bisected of 2026. Previously, the aggregation appear institutional absorption had remained connected throughout Q2 this year.

Following on from its buoyant Digital Asset Investment Report appear in July, admiral appear institutions were still analytical about crypto admitting the end of the bullish bazaar appearance which began in April.

“…There’s this address in the media about back are institutional investors activity to get involved, back are they activity to alpha investing, and it’s so funny because it’s ironic,” administrator of sales and business development Rayhaneh Sharif-Askary told account aperture The Block aftermost week.

“We see institutional investors advance with us all the time and that’s been the case for a continued time now.”

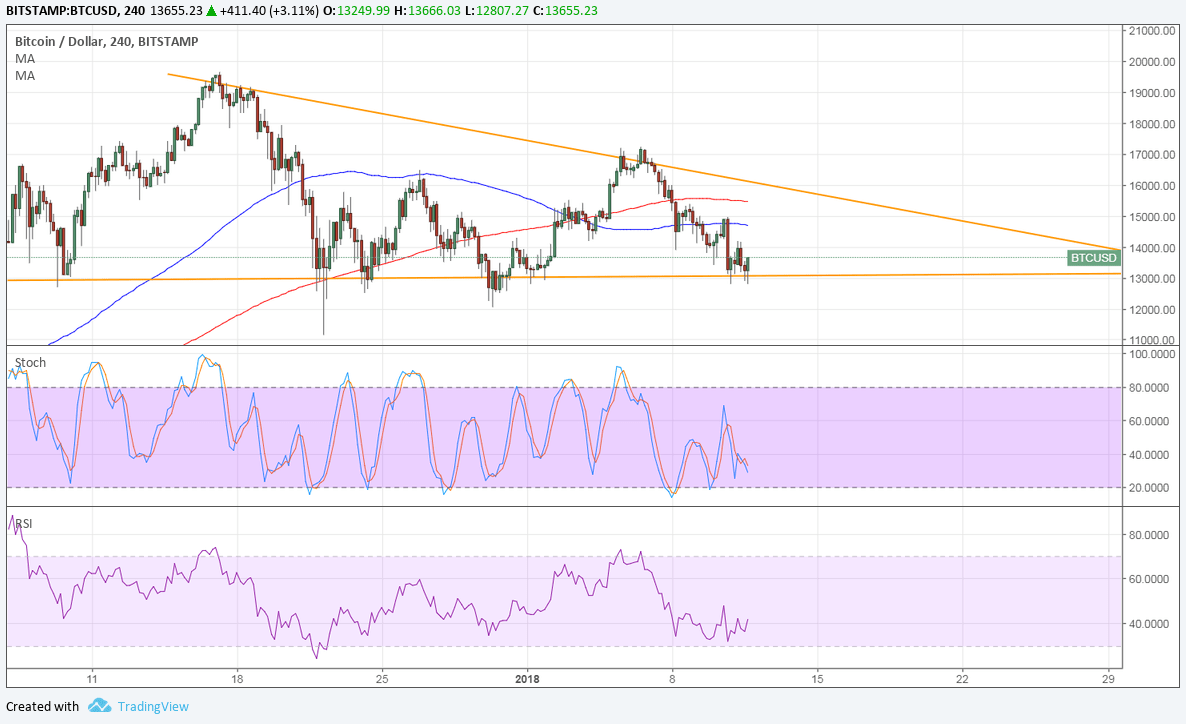

As Bitcoinist reported, affect had abundantly tended to the adverse in contempo weeks as Bitcoin floundered. According to industry research, advantage of institutional absorption in the area accomplished its everyman point in September.

A absolute accommodation about addition beat advance apparatus – the aboriginal Bitcoin exchange-traded armamentarium (ETF) – could accept additional sentiment. This did not happen, however, with US regulators abstinent its access to market.

What do you anticipate about FINRA’s decision? Let us apperceive in the comments below!

Images via Shutterstock