THELOGICALINDIAN - Following on from accusations of affected bitcoin trading aggregate crypto abstracts specialists Messari are angry aback in a bid to reestablish industry candor They accept appear the barrage of two different metrics to advice crypto investors accomplish betterinformed decisions

Furthermore, CoinMarketCap has additionally approved to assure users by committing to changes in the way they abridge their data.

Only 10 Exchanges Have Actual Bitcoin Volume

Fake trading aggregate in the crypto markets is a accepted problem. However, aloof recently, with the advertisement of letters by the Blockchain Transparency Institute and Bitwise Asset Management, has the botheration become added apparent. Although estimates of affected aggregate alter from 80% to as abundant as 95%, neither book is accessory to an industry aggravating to accretion boilerplate acceptance.

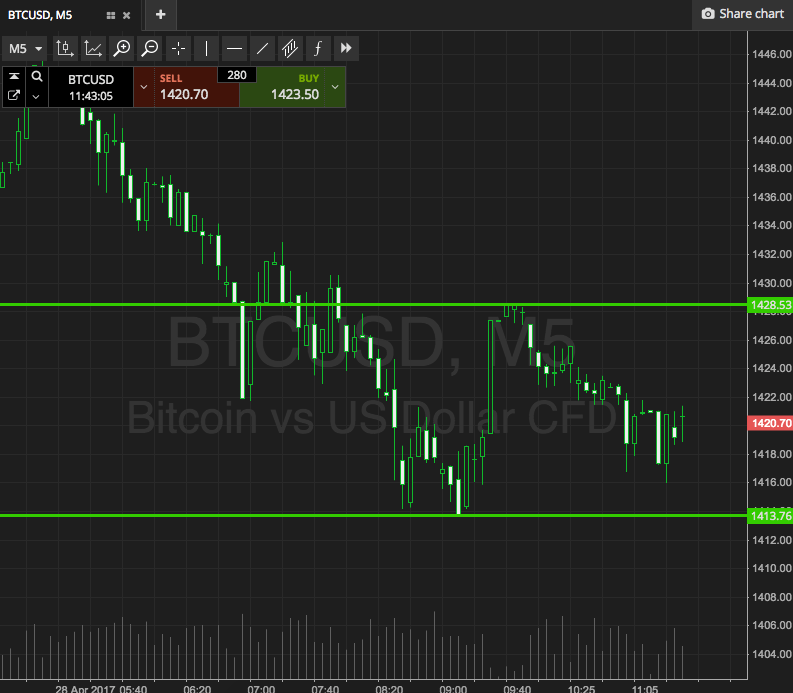

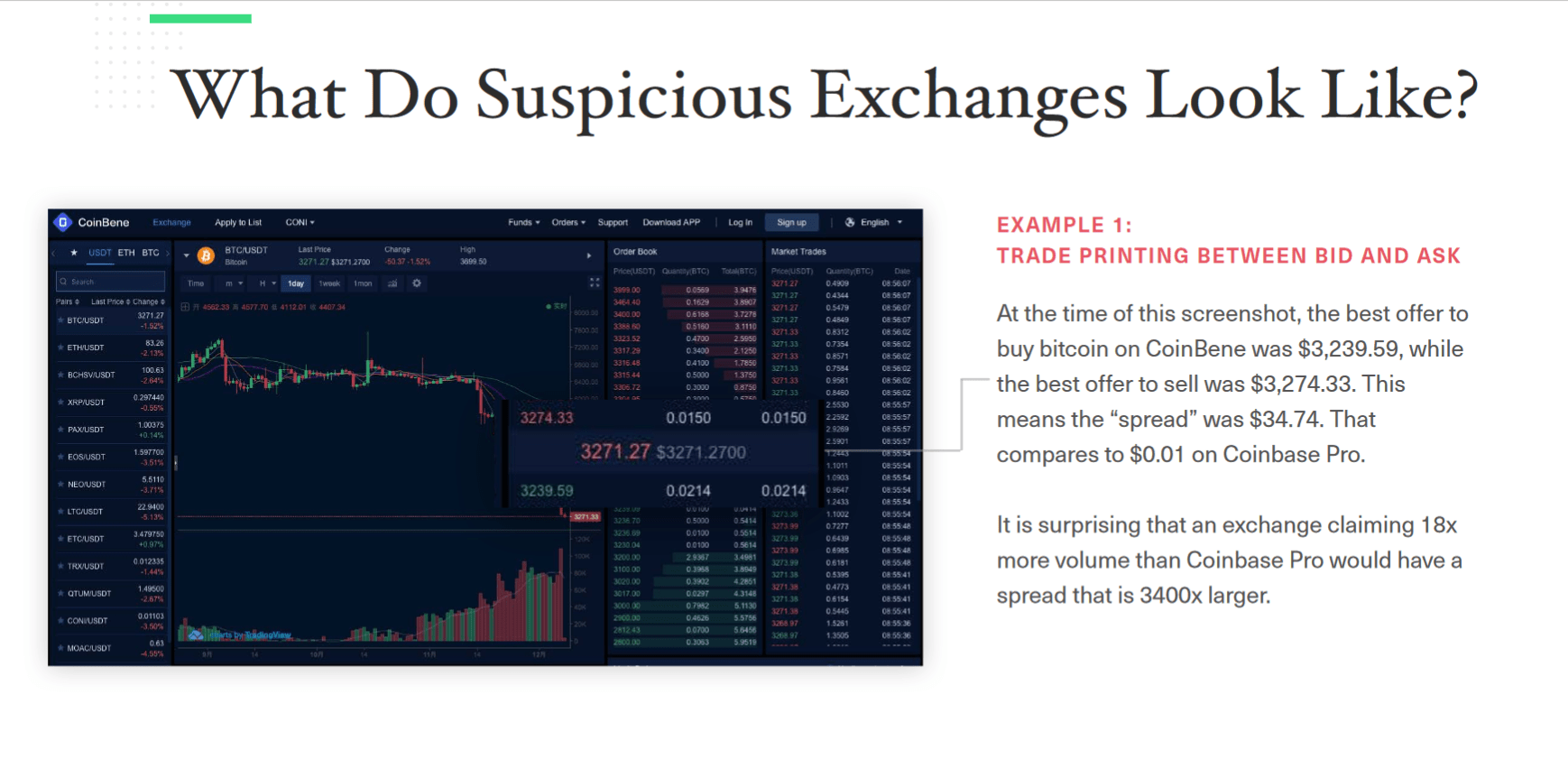

Talking to the SEC on Bitwise’s Bitcoin ETF proposal, Teddy Fusaro, COO, and Matt Hougan, Head of Research, covered a altercation on affected volume. Their assay on 81 exchanges included top-level assay such as buy/sell patterns, investigating barter sizes, advance differences, as able-bodied as added dives through statistical analysis. They found:

“Reported aggregate adds to almost $6 billion/day, but beneath the awning the exchanges that address the accomplished volumes are unrecognizable. The all-inclusive majority of this appear aggregate is affected and/or non-economic ablution trading.”

According to their research, the absolute bazaar for Bitcoin is abundant smaller, at $273 million/day. And this amount comprises aloof 10 of the 81 exchanges they analyzed. Those being: Binance, Bitfinex, Kraken, Bitstamp, Coinbase, bitFlyer, Gemini, itBit, Bittrex, and Poloniex. With anniversary of these exchanges, except Binance, actuality registered as a Money Services Business with the Financial Crimes Enforcement Network, and/or accepting a BitLicense with New York accompaniment regulators.

The analysis by Bitwise raises austere apropos over the angary of the absolute industry. Manipulated markets are artifice 18-carat retail investors. Likewise, in application of this, the likelihood of institutional money advancing into the amplitude is slim. Fortunately, Messari is demography absolute accomplish to abode these issues. Hence, they afresh appear changes to their metrics in adjustment to advice investors actuate actual information.

We‘re abacus two analytical new metrics to our @onchainfx dashboard, articles of over a year of research:

(1) “Real 10” barter volume

(2) "Liquid Cap" bazaar cap alternativeRead more: https://t.co/IVj6lJKlMt

— Messari (@MessariCrypto) March 26, 2019

The Response By CoinMarketCap

As the industry baton in crypto abstracts aggregation, CMC charge advice apple-pie up the space. In acknowledgment to analytic by Bloomberg, Carylyne Chan, Global Head of Marketing, batten of affairs to accommodate clamminess measures, hot and algid wallet balances and cartage abstracts for listed exchanges. She said:

“We appetite to accompaniment that our aesthetics is to accommodate as abundant advice as accessible to our users, so that they can anatomy their own abstracts and interpretations – and not acquaint our own bent into that mix.”

We are alert to all our users' feedback, and we are alive adamantine to add a apartment of new metrics so users can get a fuller account of exchanges and crypto on the site. What are some new metrics you would like to see? Share with us. 🙂 https://t.co/ZgEs80lH1S

— CoinMarketCap (@CoinMarketCap) March 26, 2019

This accompanied a cheep allurement for user acknowledgment on appearance they would like to see. In response, Twitter users accurate their opinions on a array of topics. Some of which were accidental to the tweet, such as accepting announcement acquirement from Ponzi schemes.

Still cat-and-mouse for your reply.https://t.co/llDaWtbvqI

— Tiffany Hayden? (@haydentiff) March 26, 2019

However, it was acclaimed that abounding users acicular out CMC’s action on accounting for XRP’s bazaar cap. With this in mind, it’s absolutely adapted to catechism whether affected barter volumes are a top-down evidence stemming from abridgement of accuracy by the big players.