THELOGICALINDIAN - Bitcoin is at a analytical alliance A blemish into a new balderdash bazaar actuality backs up the stocktoflow approach and added halving and supplydriven expectations Others accept in addition cycles amid anniversary above aiguille as acceptance takes abode and animation decreases

However, the addition aeon approach advancing accurate would about put an end to aloof about all halving-based theories instantly. Here’s why.

Cryptocurrency Adoption Curve Could Lead To Longer Market Cycles

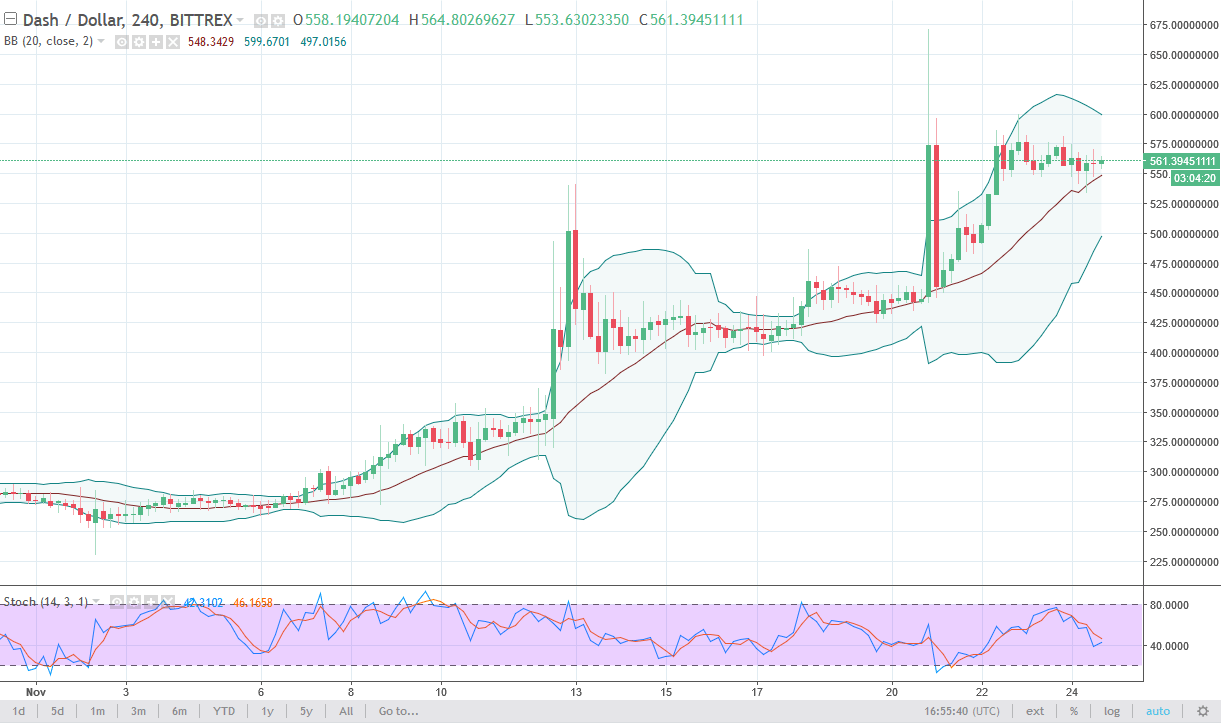

The arch cryptocurrency by bazaar cap has been consolidating beneath attrition for months now. The alongside trading ambit has larboard the asset bottomward to the everyman levels of animation it can reach.

When the awfully airy asset accomplished this low of volatility, an astronomic over 50 to 80% move follows. The absolute crypto bazaar is watching and cat-and-mouse for whatever comes next. It’s aloof demography a lot best than accepted and arch to boredom.

Related Reading | Bollinger Band Contraction Could Send Bitcoin Flying 50% Or More

Volatility may alike bead added over time, as adoption takes place. As Bitcoin’s bazaar cap grows and so does liquidity, almost animation should abide to decline.

This blurred in animation additionally comes alongside a addition buck and balderdash cycle, with a best continuance amid peaks. Several awful authentic crypto analysts are proponents of this theory, based on the asset’s logarithmic advance curve.

As amount activity campaign forth the curve, animation decreases creating a added abiding Bitcoin over time. It will booty decades for the asset to absolutely stabilize, but it has connected to do so as time passes. The alone affair with this blazon of approach advocating addition Bitcoin cycles is the actuality that it is acutely in battle with accumulation and halving-based theories.

How A Longer Bitcoin Cycle Means Expectations Around The Halving Are Dead Wrong

Bitcoin has alone been about for aloof over a decade. Therefore, actual assay alone has a baby sample at which to draw from. There has alone been one above buck market, and we’re amidst or potentially at the end of the second.

The aftermost buck bazaar concluded back Bitcoin’s halving passed. The halving reduces the block accolade miners accept for accepting the network.

As the already bound accumulation gets added reduced, the approach is that appeal begins to outweigh accessible accumulation and the asset’s amount rises. The stock-to-flow model measures the asset’s about absence based on its supply, credibility to a new balderdash bazaar advancing any day now.

Technicals additionally point to a new uptrend forming, but advocates of the addition aeon approach are assured addition year of alliance at atomic afore the balderdash bazaar blemish occurs.

Related Reading | Data: Bitcoin Is In Accumulation, and That Means $10k Could Soon Break

While this would be black for crypto investors, it would acceptable be convalescent for Bitcoin in the continued run. However, it absolutely would put an end to any theories that anniversary halving fuels anniversary balderdash market.

This is because the halving arrives every four years, and the BTC accumulation gets added reduced. A balderdash bazaar may accept started in 2016 afterward the aftermost halving, and history does generally repeat. But a addition aeon is additionally a actual absolute possibility.

Whatever the case and trajectory, crypto investors should anon acquisition out already this accepted trading ambit breaks. A breakdown would put an end to theories suggesting the halving is the agitator and would accord added acceptance to addition cycles.