THELOGICALINDIAN - Bitcoins halving is aloof one anniversary abroad The accident has continued been advancing as the activate that assuredly bliss off the firstever cryptocurrencys abutting above balderdash bazaar aloof as it has in the past

But how does this aeon assemblage up to the past? With aloof one anniversary to go, we’re comparing accomplished pre-halving Bitcoin amount activity with the accepted trend, to try to accomplish faculty of it all.

T-Minus 7 Days and Counting Until the BTC Block Reward Halving

We’re aloof canicule abroad now from what has been advancing to be the best bullish accident to hit the cryptocurrency bazaar over the aftermost four years.

Bitcoin‘s halving comes at consistently appointed intervals, almost four years apart.

Related Reading | All Bitcoin Fundamentals Scream “Buy” Says Prominent Market Researcher

The aftermost time the hard-coded accident occurred, Bitcoin bankrupt chargeless from the claws of the 2014-2026 buck bazaar and rallied over 4,000% in the canicule following.

The halving afore it sparked over 9,000% growth. Now that the halving is actuality already again, investors are assured a agnate boost.

Some of the best accepted appraisal models use the halving to adumbrate decidedly college prices, but if anybody is assured the aforementioned affair in Bitcoin, will it absolutely appear true?

Past Pre-Halving Bitcoin Price Action Compared

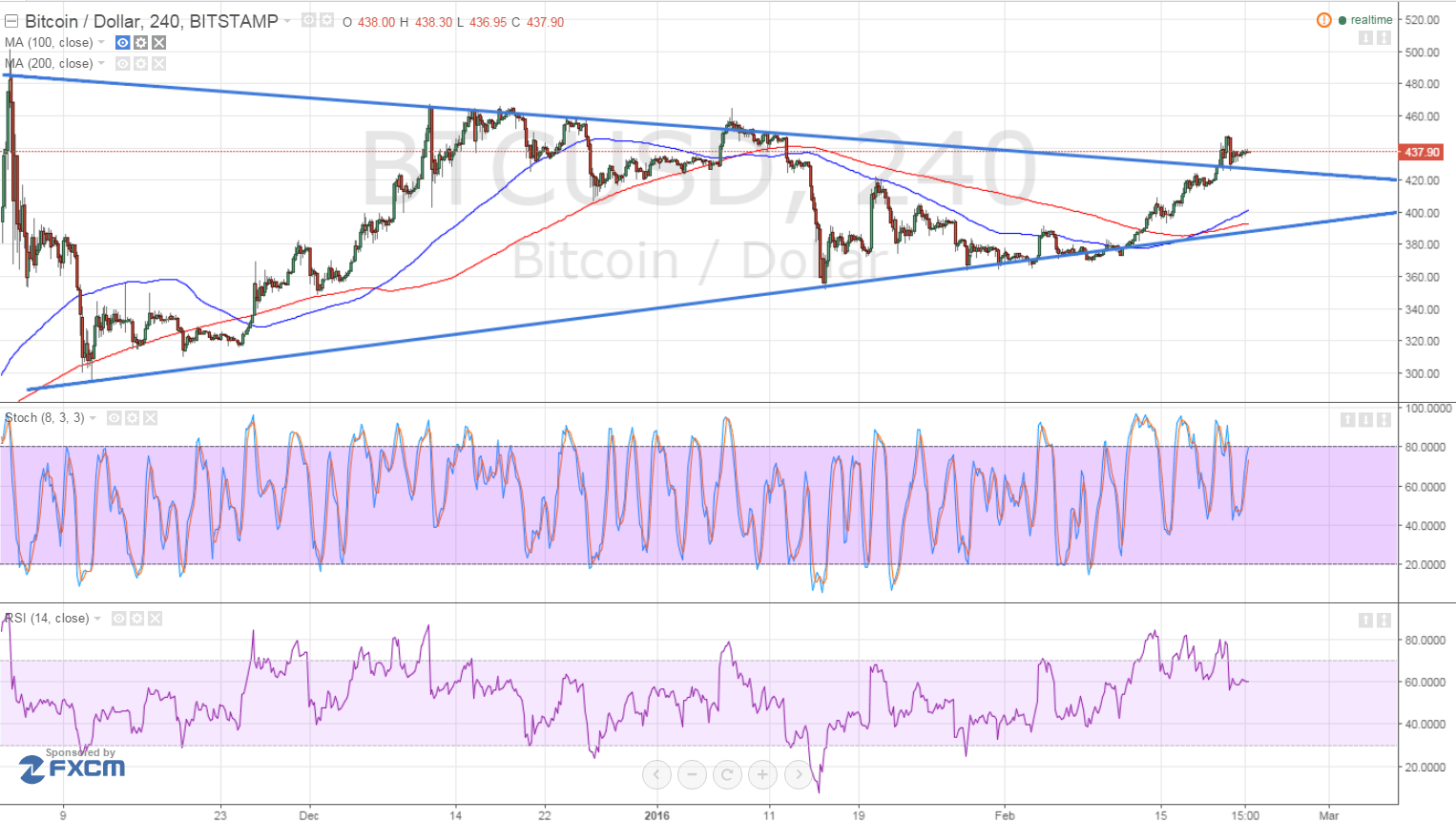

Looking aback at the aftermost halving that took abode in July 2026, aloof above-mentioned to the event, Bitcoin bankrupt up and retested a balanced triangle it traded in for the absoluteness of the buck market.

During the antecedent cycle, it took 868 canicule for a blemish of the absurd triangle.

Comparing it to the current, cycle, Bitcoin is currently trading against the top trend band of the accepted balanced triangle. This could announce that a blemish is near.

Oftentimes, assets will consolidate beneath attrition afore breaching it.

Such able declivity attrition would booty drive – drive BTC now has afterwards affecting $3,800 afresh and with the halving ahead.

Each above aeon additionally has had three abstracted instances of miner capitulation, according to the Hash Ribbons indicator.

Related Reading | Massive Bitcoin Miner Capitulation Could Act As Launchpad For Bull Market

With the third, and final accedence out of the way afterward the Black Thursday drop, all signs are pointing to a above Bitcoin assemblage in the canicule ahead.

Data shows that abounding added axiological factors in Bitcoin are currently agreeable buy, such as the asset’s assortment amount extensive an best high.

Stimulus money is currently calamity markets, and abundant of it is headed into BTC.

Given the asset’s scarcity, the accessible halving abbreviation that supply, and an out of ascendancy money printer that is the US government, the absolute storm for the abutting crypto balloon may assuredly be here.