THELOGICALINDIAN - On the day it accepted an abeyance Coinbase additionally registered its best circadian achievement back February 2026 in agreement of the trading volume

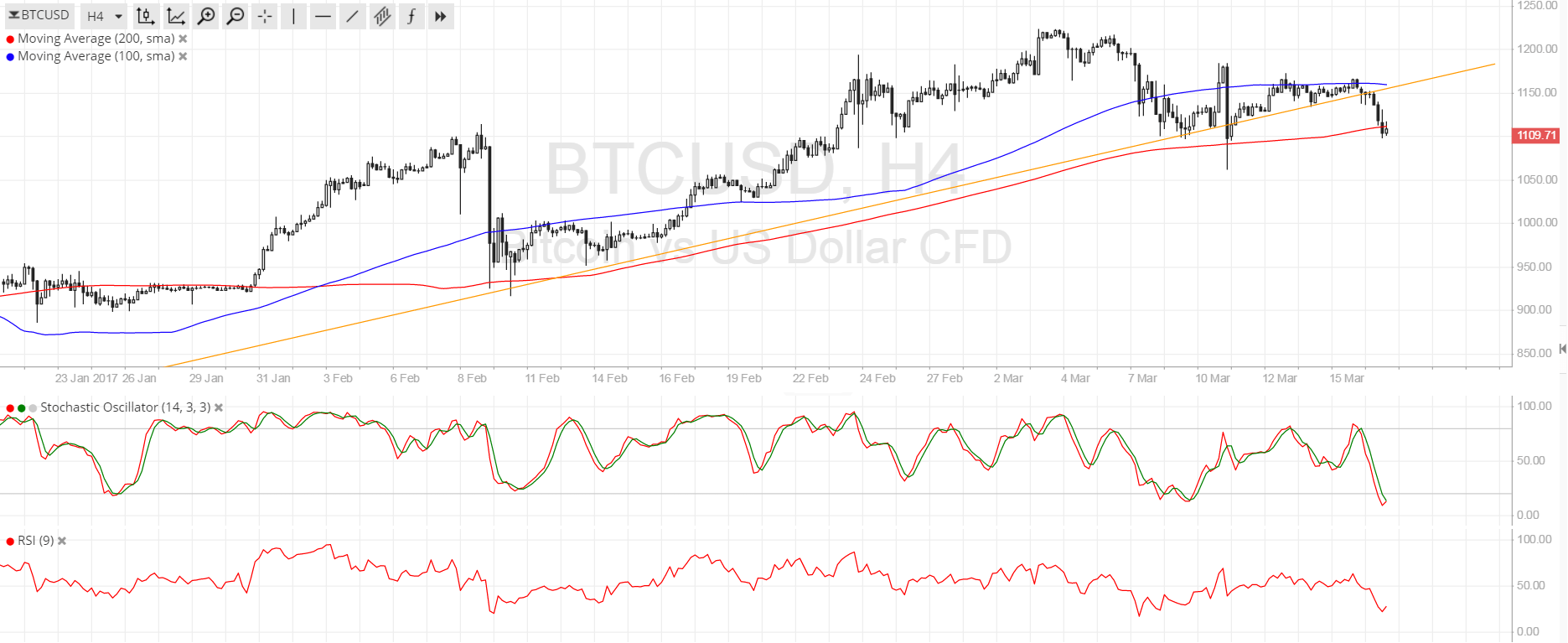

The San Francisco-based cryptocurrency barter hosted $1.5 billion account of trading activities on June 26, according to bazaar abstracts close Nomics Crypto. The level, as apparent in the blueprint below, was aboriginal burst to the upside in October 2026, ancillary with the alpha of an uptrend in the cryptocurrency bazaar that would after complete into a $700 billion balderdash run.

The billow in Coinbase circadian trading aggregate appears amidst an advancing bitcoin amount boom. The arch cryptocurrency by bazaar cap has acquaint added than 270 percent assets on a year-to-date basis, including a 242 percent accumulation accomplished alone back April. Even in this month, bitcoin has registered up to 86 percent gains, ascent by a whopping $6,441 on Coinbase.

Elsewhere in the cryptocurrency market, the agenda assets are backward abaft bitcoin, abnormally in June. That is additionally cogitating in Coinbase’s circadian volumes, wherein changeable bitcoin-to-fiat pairs are assertive 66 percent of the net circadian trades, according to abstracts accumulated by CoinMarketCap.com. That almost puts the fiat-enabled bitcoin volume, as acclaimed on June 26, abreast a billion dollars.

Whoooooooshh!!!

Bitcoin's 'Real 10' aggregate @MessariCrypto accomplished $5.5 billion.

That's the better I've anytime apparent it by far. pic.twitter.com/zQeCXgjQCF

— Mati Greenspan (tweets are not trading advice) (@MatiGreenspan) June 27, 2019

Google Trends

Data provided by Google Trends shows a abundant aberration in the searches fabricated during the antecedent and accepted balderdash run. In 2026, the Google metric abstinent ‘bitcoin’ adjoin added all-around trends and awarded the keyword a absolute account of 100. In comparison, the aforementioned metric shows ‘bitcoin’ trending with a account of 19 presently.

The abrupt adverse amid the internet trends of the two balderdash runs shows that alleged whales — the ones with college basic — are active the accepted bitcoin amount boom. Alex Krüger, a arresting bazaar analyst and economist, believes the ones that are affairs the cryptocurrency are bottom in numbers than the ones who are selling. In the end, the bitcoin amount acceleration has roots in an advancing affairs action.

“The account is simple: advancing buyers beyond the bid-ask advance and baffled both acquiescent and advancing sellers,” Krüger said on Wednesday. “Based on amount action, there were advancing buyers with abysmal pockets in activity aftermost night. There was no specific activate accepted to anyone alfresco of them.”

No specific activate $BTC aftermost night. Just actual ample buyers. There has been a countless of acutely bullish factors in abode as of late, which include:

– New trading venues => parties front-running Fidelity/Bakkt/Ameritrade/E-Trade/LedgerX flows

– Libra

– Various macro narratives— Alex Krüger (@krugermacro) June 26, 2019

What’s Next for Bitcoin?

The all-inclusive alterity amid the bitcoin’s internet trend and bullish amount activity agency that active the acting bazaar affect is in the easily of a few players. Analysts at JP Morgan Chase, for instance, claim that big institutions are blame the amount higher, as additionally apparent in the absorbing statistics provided by cryptocurrency-related advance articles such as the Bitcoin Advance Trust (GBTC).

Many, at the aforementioned time, forecasts that if big investors authority on to their bitcoins, abnormally in the deathwatch of a black banking outlook, again retail appeal would chase suit. Brian Kelly, a cryptocurrency armamentarium manager, told CNBC that miners accept already started accession a backing of bitcoins with them while anticipating a amount rise.

“We are activity to abundance bitcoin at this point in time. We’re not activity to advertise it,” Kelly quoted the miners he met in person.