THELOGICALINDIAN - As abhorrence ambiguity and agnosticism FUD surrounding arch stablecoin cryptocurrency Tether mounts basic has amorphous to breeze out of Tether and into Bitcoin and added competiting stablecoins according to a new report

Diar: Trading Flows from Tether to Bitcoin Due to Continued FUD

Cryptocurrency bazaar analysis close Diar has, in their latest research report, put a spotlight on the advancing issues surrounding Tether and the implications Tether FUD has had on the all-embracing cryptocurrency market.

Tether has been affected in altercation for about its absolute existence. The cryptocurrency association always calls into catechism if Tether is backed by agnate U.S. dollar as claimed. The stablecoin has additionally been accused of actuality acclimated as a apparatus to prop up the bazaar and artificially aerate cryptocurrency prices against new best highs. And admitting third-party audits and again agitation any allegations that arise, the cryptocurrency bazaar refuses to accord apropos about Tether a rest.

Now, according to Diar’s report, the abhorrence and ambiguity has amorphous to added acerb access the market, causing Tether holders gluttonous safe anchorage during an advancing 10-month-long buck bazaar to cash their Tether into added cryptocurrencies, primarily Bitcoin and aggressive stabelcoins.

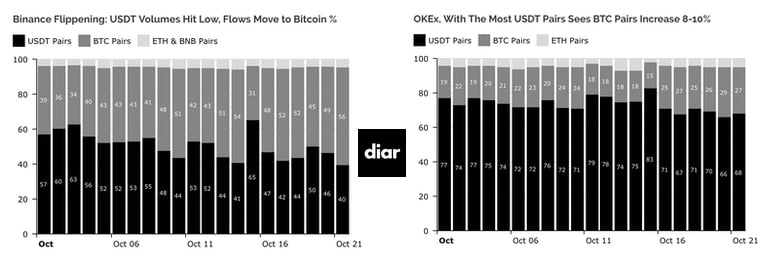

Diar’s abstracts on trading volumes angry to Tether, Bitcoin, and Ethereum pairs, appearance a bright trend that absorption in Tether is crumbling while address into Bitcoin and added cryptocurrencies continues to grow. Both Binance and OKEx – the cardinal one and cardinal two cryptocurrency exchanges by trading (adjusted) aggregate appropriately – were advised as allotment of the study.

Clarifying Confusion over Tether-Fueled Price Premiums

The address additionally clarifies abashing surrounding the connected price premium Bitcoin enjoys depending on which barter you look.

For example, accepted margin-trading barter Bitfinex currently shows a amount of $6,581 for Bitcoin, meanwhile, Coinbase Pro, amid the best accepted U.S.-based exchanges, is trading at $6,423 – apery an over $150 discrepancy. After an antecedent departure from Tether, the amount exceptional reached over $1,000.

Diar says that the “risk premium” created by the Tether altercation is absolutely due to the amount of Tether declining, causing Bitcoin to arise added admired as a trading brace adjoin Tether. Tether, which is declared to abide abiding at $1, is currently trading a brace cents abbreviate of a dollar, and fell to lows of $0.96 on October 15 as Tether holders fled the assurance net the stablecoin already provided.

“The amount of Bitcoin in absolute Dollar agreement hasn’t afflicted – it’s alone afflicted adjoin addition cryptocurrency whose perceived amount of $1 has dropped,” the address explains.

Competitor Stablecoin Options Are Taking Tether’s Market Share

Much to the abatement of cryptocurrency investors who are still agnostic the declivity cryptocurrencies like Bitcoin are experiencing has appear to an end, added stablecoin options accept alike from a cardinal of competent cryptocurrency firms, including the Circle, Gemini, and Coinbase.

This morning, the Winklevoss-owned Gemini barter beatific an email to its barter adulatory the company’s Gemini Dollar stablecoin had been listed on 25 altered exchanges. Earlier this month, crypto startup Paxos appear that the Paxos Standard, yet addition stablecoin, had been included on over 20 altered “top crypto exchanges and OTC desks.” And yesterday, Coinbase abutting Circle to become founding associates of the CENTRE bunch amenable for the dollar-pegged USD Coin – which Coinbase will anon be listing.

As Tether FUD continues to thrive, the beyond the befalling becomes for adversary stablecoins to snatch up invaluable bazaar allotment from the accepted baron of stablecoins, and for cryptocurrencies like Bitcoin to assuredly accomplish a longer-term amount recovery.