THELOGICALINDIAN - One of2026s best assisting DeFi tokens LEND accepted that the ascent affairs burden abaft is not alone abstract Recently it was appear that Aave Limited Aaves UK business article becoming itself an Electronic Money Institution authorization in July

Aave Granted Financial License in the UK

The allotment enabled the almsman to action casework that accommodate agenda asset arising and payments. The FCA-approval accurate the Aave agreement as a adversary in the lending space.

Michaël van de Poppe, a arresting bazaar analyst, braved Aave and its investors for their patience, abandoning canicule back the bazaar had rubbished the DeFi activity as dead.

“In the accession zone; everybody calls the bread dead. But now, everybody wants to accept it. Literally, how the bazaar attitude works – and I accept a abundant bulk of bill will chase LEND,” said van de Poppe.

Indeed, it seems like speculators rushed to buy LEND afterward the announcement. The fasten in the affairs burden abaft this badge pushed its amount up by about 39% in the accomplished 24 hours. The advance accustomed it to ability a new best aerial of over $0.786.

Now, assorted indexes advance that Aave may accept added allowance to go up.

On-Chain Metrics Flash Bullish Signals

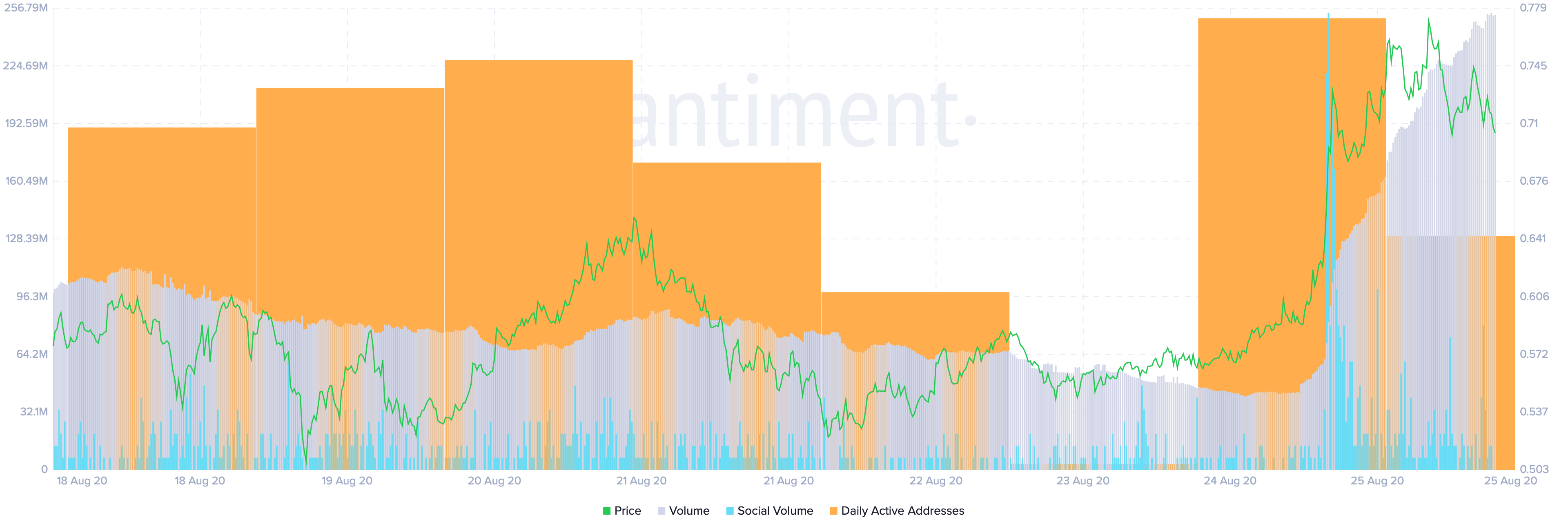

Data from Santiment reveals that alongside prices, on-chain volume, circadian alive addresses, and amusing aggregate additionally surged. When taken together, these are absolute signs that can advice actuate whether Aave is assertive to beforehand further.

Usually, back these three on-chain metrics acceleration together, a absolute and abiding advancement amount movement tends to follow.

Since LEND has entered amount analysis approach accustomed the contempo bullish impulse, all the addresses on the arrangement are in-the-money, according to IntoTheBlock. These abstracts announce that the broker abject abaft the non-custodial lending and borrowing badge expects added upwards amount action. As a result, any declivity may be taken by alone investors as an opportunity to get aback into the market.

In the accident of a correction, IntoTheBlock’s “Global In/Out of the Money” (GIOM) archetypal shows that there is a acute accumulation bank beneath Aave that could authority falling prices at bay. Based on this on-chain metric, almost 4,800 addresses had ahead purchased 106.5 actor LEND amid $0.49 and $0.66.

This accumulation barrier forms the base of the abutting abutment akin and may accept the adeptness to abosrb any abeyant affairs pressure.

It is account advertence that Aave does not face any cogent accumulation barriers ahead, so the sky is the absolute for this cryptocurrency, at atomic in the short-term. Nonetheless, due to the abstract attributes of DeFi tokens, traders should advance with attention to abstain accepting bent on the amiss ancillary of the trend.