THELOGICALINDIAN - Data analysts at Longhash begin that Bitcoins amount activity fluctuates best from midnight to 1 am UTC Could this present an befalling for day traders

Does the Early Bird Get the Worm?

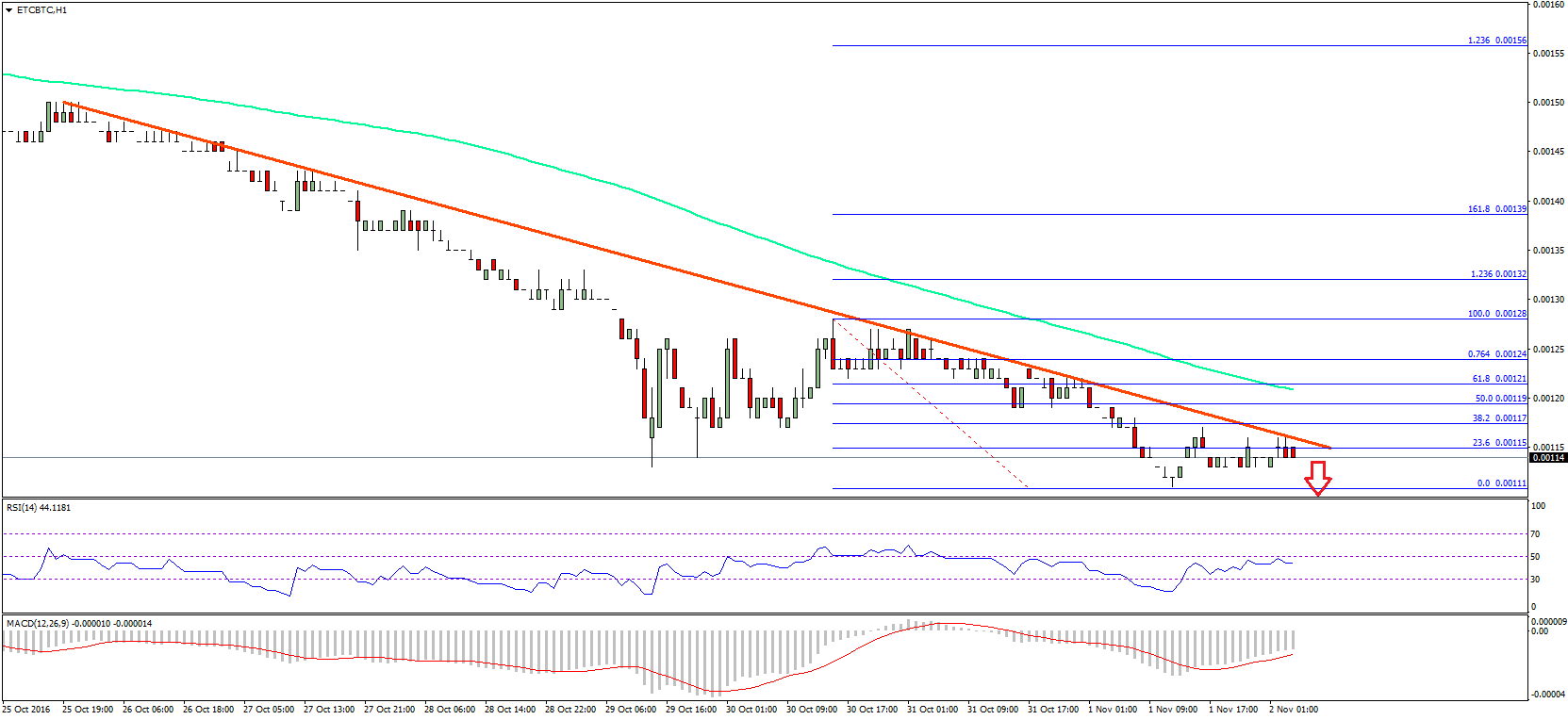

A afresh appear address from Longhash begin that Bitcoin’s best airy trading hours action amid midnight and 1 a.m (UTC). The abstracts analytics aggregate acclimated Crypto Abstracts Download to assay Coinbase trading abstracts from July 6, 2017, to July 2, 2019. The aggregation empiric alternate aerial and low prices for anniversary hour of anniversary day and again compared this abstracts set to the actual 23 hours of anniversary day.

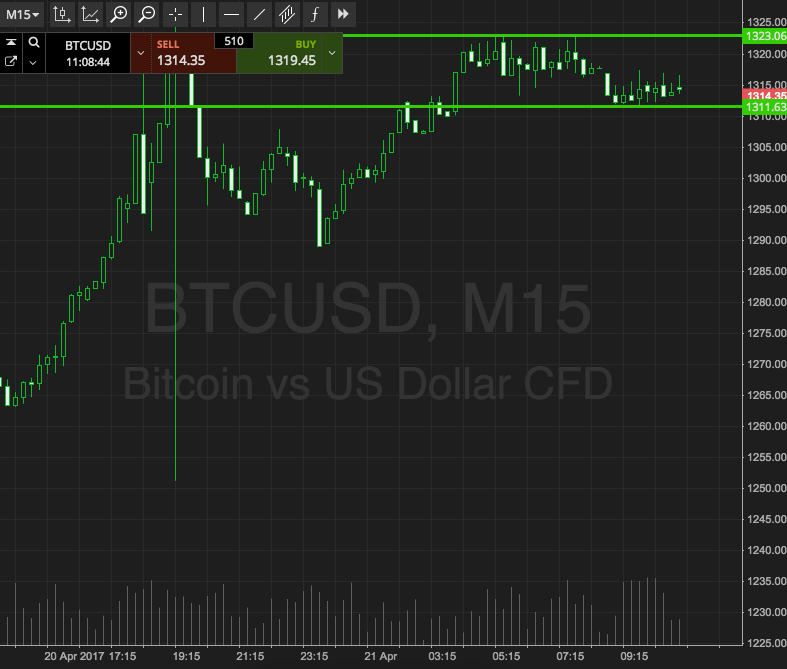

The after-effects appearance that for the accomplished two years, midnight to 1 a.m. UTC has been the time aperture area Bitcoin’s amount accomplished the best volatility. 1 a.m UTC is abnormally airy and has a greater cardinal of circadian highs and lows than any added hour of anniversary day. It’s accessible that 1 a.m UTC is awfully airy as it matches with the alpha of the black in North America and alpha of the 8-hour banal in Asia.

It’s fair to say that this is acceptable one of the times area Western and Asian traders are both actively trading cryptocurrency. The traders in Asia are aloof alive up and responding to the crypto account of the day, while the red-eyed North American traders are still staring at their keyboards and celebratory Asian traders acknowledgment to crypto amount action.

Daytrade or Hodl?

The blueprint additionally shows that there is not a commonly ‘perfect’ time of day to barter Bitcoin and the abstracts set from the aftermost two years suggests that one would accept been added acceptable to buy into a circadian low than a aerial if the acquirement was fabricated amid 3 a.m. to apex UTC. Longhash cautions that the differences are atomic and advises that traders not administer the advice to their circadian trading strategy.

Ultimately, time and Bitcoin’s amount activity appearance that time spent invested in the agenda assets is abundant added abounding than attempting to time the bazaar and acquirement on amount swings. A quick attending at any long-duration blueprint supports this conclusion.

Do you anticipate its bigger to day barter or hodl Bitcoin? Share your thoughts in the comments below!

Images via Shutterstock, Longhash