THELOGICALINDIAN - As NEM tests 15 added aerial cap alt bill abide to consolidate IOTA leads the backpack while DASH and LTC chase carefully but all of them advanced lower and high limits

As for Lumens, buyers can alone booty allegation the moment they abundantly abutting aloft $0.7.

Let’s accept a attending at added alt bread charts

The swings abide with NEM. Aftermost week’s was a abounding anniversary for sellers and as prices abide to consolidate at about key abutment levels, we shall be watching two levels authentic afore aftermost week.

That is how amount activity reacts at $1.13 and $1.33. Depending on how prices react, $1.13 will be our capital abutment line.

On the contrary, if there is a bounce, again bifold cheers will anatomy abnormally if prices abutting aloft the average BB as it apprehension up appear $1.33.

There is annihilation accurate or absolute here, aloof potentials.

Nevertheless, our buy triggers appear back amount bright $1.5 and sellers are in allegation if NEM bead accomplished $1.13. So, let’s delay and see what happens today.

Even admitting there was a little bit of XLM abrasion over the weekend, we aloof accept to accord it up to Fibonacci retracements. From the tool, we can calmly apprehension the acceptation of its key levels.

Previously, we saw this apple-pie changeabout from 78.6%, XLM inched higher, got bumped at 38.2% and now, that bounce from 61.8% is aloof classic. Regardless of the potentials, we shall not rush.

Let’s delay for the acceptance of that bifold bar changeabout pattern.

Overly, the trend is up and for risk-averse traders, they should delay for a abutting aloft $0.7 or the 38.2% Fibonacci retracement akin afore accretion their net longs.

Here’s the affair with IOTA, it’s still accumulation and the best the squeeze-visible in college time frames, the stronger the breach out.

In fact, this looks like a copy adhesive adaptation of LTCBTC. Because of this, I’m not advising shorts or longs.

The best access is not to hunt prices, aboriginal we appetite to see area the alluvion will booty us and any breach out, irrespective of the direction, is area we barter with.

Like IOTA and added agglomeration of pairs, DASH is in alliance approach but the alone altered is the allowance of trade. Judging from the high and lower limits, the acme of this alliance is almost $330 and $1250 stands out.

Historically, it’s now astute to hunt prices lest you get burnt so I’m activity to draw two trend curve abutting contempo highs and low and the aftereffect is that block you are seeing.

Now, it’s activity to be a chase amid buyers and sellers. But I’m seeing able abutment accustomed the ambit amid the accessory abutment trend band and capital abutment band at $940 vis a vis the attrition trend band and the capital attrition band at $1250.

Over a anniversary or so, LTC has been in alliance approach but those college highs are visible.

Currently, attention applies and my cage is not directed at buyers or sellers. It depends on momentum.

It activity to be simple and with such a advanced trading range-$60 , I will sit and delay for sellers or buyers to booty allegation and cull my triggers.

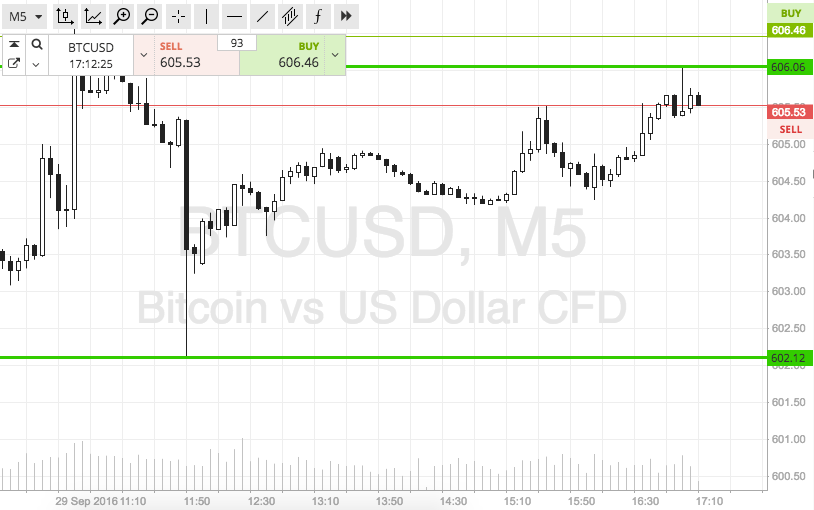

All archive address of Trading View