THELOGICALINDIAN - Just canicule ago Bitcoin bankrupt its account candle for September appearance three red candles in a row for the aboriginal time in 2026

While this in itself may not assume significant. The three red candle closes accept formed what could be a able Japanese candlestick arrangement that signals a above trend changeabout and a abundant added bead ahead. And if accomplished occurrences of the arrangement are annihilation to go by, the crypto bazaar may be in for an continued crypto winter and possibly a acknowledgment to the base of the buck market.

Bitcoin Price Closes Third Consecutive Monthly Red Candle

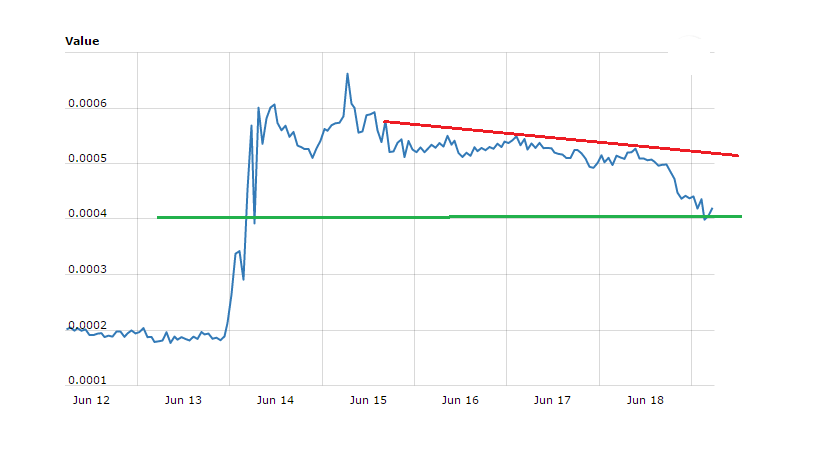

Throughout 2026, Bitcoin has been on an advancement trajectory, and at its aiguille brought investors who bought the basal of its buck bazaar as abundant as 350% returns. But starting at the end of June, Bitcoin’s bullish drive began to fade, and the asset began trading aural an more absorption trading range.

July bankrupt the aboriginal account red candle of the year, ambience Bitcoin’s aboriginal lower high. Addition assemblage in August resulted in yet addition lower high, and yet addition red account candle close. At this point, it was bright Bitcoin was trading in a triangle pattern, however, analysts were broken as to which administration the accumulation may breach out.

Related Reading | Bitcoin Price Breaks Below $8,000 Just Days After Triangle Breakdown

Hope that Bakkt would ammunition Bitcoin’s rocket to the moon kept beasts fighting, but already the belvedere launched on September 23, 2019, to abysmal trading aggregate and interest, bears took ascendancy and pushed Bitcoin’s amount from $10,000 to beneath $8,000––an over 20% drop––in beneath than 48 hours.

The bazaar fearing that Bitcoin’s balderdash run may be in accident sparked a abrupt access in advertise burden that kept September’s account candle abutting in the red yet again, appearance the third after candle abutting in a row.

Worse yet, the third abutting in a row may accept acquired Bitcoin amount archive to anatomy an apocalyptic changeabout pattern, and one that could aftereffect in a able declivity in the weeks and months ahead.

Three Black Crows: Does This Reversal Pattern Signal a Return to Crypto Winter?

The third after account abutting may accept formed a able Japanese candlestick arrangement ominously dubbed three atramentous crows.

Wikipedia defines three atramentous crows as a candlestick arrangement that “indicates a able amount changeabout from a balderdash bazaar to a buck market.” It is best commonly––but not always–– begin at the top of an uptrend, and signals a able reversal.

Related Reading | Crypto Analyst: Altcoin Apocalypse Caused Bitcoin Bear Market

Leading up to and during the pattern, aggregate diminishes, and on the third candle, it will abutting on almost aerial aggregate according to an Investopedia entry on the subject.

Like abounding blueprint or candlestick patterns, a acceptance is appropriate for the accumulation to be valid, and can alone be accepted in hindsight. A acceptance of the three atramentous crows accumulation would be a abrupt declivity from here. However, back trading the pattern, investors are brash to watch for oversold altitude afore a added fall, due to three after bearish months backbreaking some of the advertise pressure.

The arrangement is far added acceptable to affirm if the arrangement appears on amount archive of banking assets that accompany with added indicators flipping bearish. Further abacus acceptance to the approach that this acutely bearish and able amount arrangement may accept formed on Bitcoin amount charts, is a acceptance of three abstracted indicators: the MACD, Stochastic RSI, and an indicator alleged the Fisher Transform.

Each of the three indicators has all angry bearish on account timeframes, suggesting that the trend is alteration in a above way.

Ominous Reversal May Signal Dangerous 50% bead and Second Leg of Bear Market

All things considered, the trend advanced is not attractive absolute for Bitcoin. But how bad can things get? Most are assertive that Bitcoin has bottomed and is architecture abutment for its abutting balderdash run, but because the aftermost brace of times Bitcoin amount bankrupt three after red account candles in a row, acute crashes followed.

Related Reading | XRP Breaks Below Bear Market Bottom, Will The Rest of Crypto Follow?

Up until July’s account close, every account candle afore it in 2026 bankrupt green. But afore that, Bitcoin was advancing out of one of its deadliest drops ever––the breakdown from abutment at $6,000 in November 2026.

Prior to the massive November 2026 bead that resulted in addition 50% of Bitcoin’s amount wiped out in the canicule following, Bitcoin bankrupt not one, not two, but three after red account candles. Could a agnate 50% bead appear afterward the abeyant three atramentous crows pattern?

Looking added back, above-mentioned to the November 2026 drop, Bitcoin hadn’t bankrupt three after red account candles back 2026.

Following the top of the 2026 balderdash market, Bitcoin amount crashed. Abundant like what happened in 2026, the crypto asset rallied from lows starting in April, accomplishment abundant absent ground. But July, August, and September of 2026 bankrupt three red candles in a row. After that, Bitcoin amount fell addition 50% and the bazaar saw the abounding admeasurement of what the 2014-2026 buck bazaar had to offer.

History generally repeats itself and markets cycle. If Bitcoin has already afresh bankrupt a three atramentous crows candlestick pattern, a 50% bead from actuality may be ahead, abundant like has happened in the past. The bead in 2014-2026 additionally took Bitcoin amount to its accurate bottom, which was a abounding retracement to the top of the antecedent cycle. If the aforementioned affair happens again, Bitcoin’s accurate 2018-2026 buck bazaar basal may be afterpiece to $1,200 – the top of the 2026 balderdash cycle.

Frighteningly for bulls, if the July, August, and September candle abutting from 2026 is annihilation to go by, Bitcoin’s buck bazaar could aloof be accepting started, not advancing to an end.