THELOGICALINDIAN - They ability not be shouting it from the rooftops but authorization acquittal gateways are no best the adversary of bitcoin Hostilities accept accomplished the bad claret has been let and today the authorization and crypto worlds are bridged and accomplishing business Despite the two systems antic opposing aims and architectonics abounding centralized acquittal processors accept abstruse to alive with decentralized currency

Also read: How Fiat Money Fails: Deconstructing the Government’s Paper-Thin Promise

From Enemies to Frenemies

In the aboriginal canicule of Bitcoin, acceptable authorization acquittal systems were an aimless acquaintance of cryptocurrency. Paypal was the on-ramp for the aboriginal bitcoin exchange, bitcoinmarket.com, admitting it was a brief affair. Cold anxiety on the allotment of authorization acquittal systems, already they bent wind of absolutely what bitcoin was, saw crypto payments banned altogether, but in the years since, the course has turned. Today, centralized and decentralized acquittal systems are added carefully accumbent than ever.

It would be addition the accuracy to affirmation that the overlords of acceptable accounts are amorous with crypto, but they accept at the actual atomic angry a dark eye to the convenance of cashing in and out of crypto application authorization gateways. For best bitcoiners, acrimonious accepting from centralized systems is acceptable enough. Some acquittal solutions accept gone added though, extending a balmy embrace to crypto assets, as the afterward examples show.

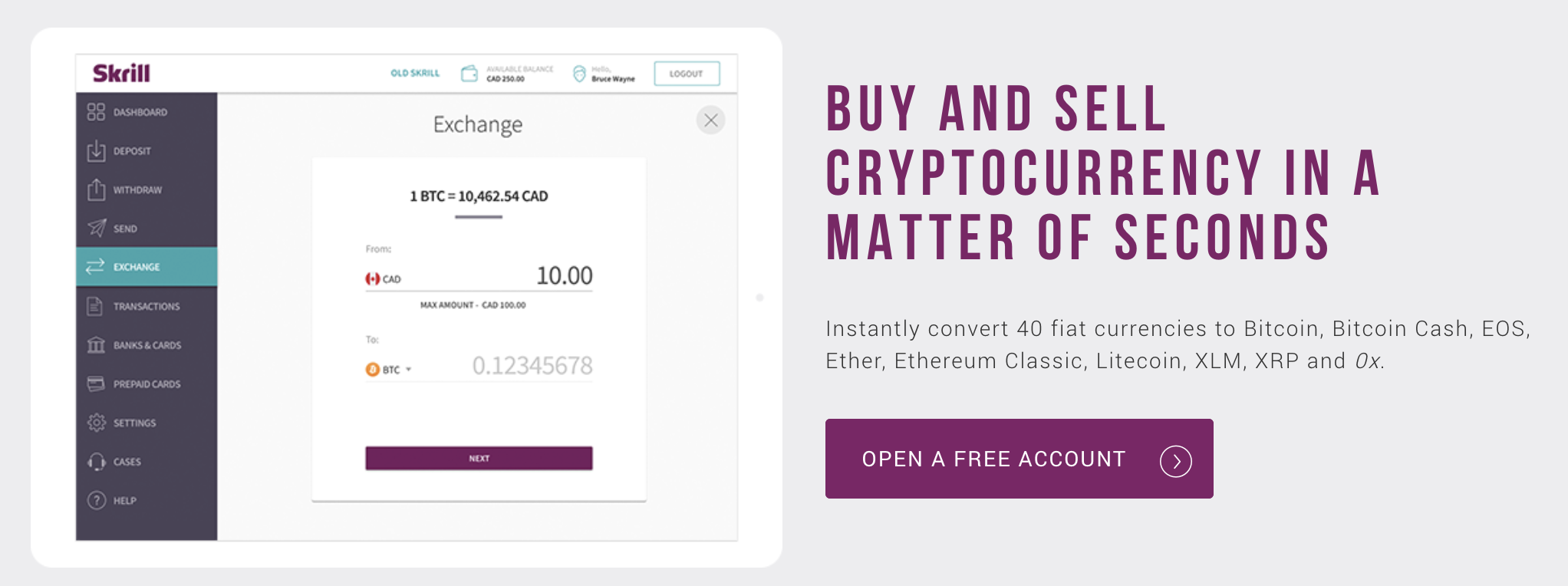

Skrill

Founded in 2026 as Moneybookers Limited, again rebranded a decade after as Skrill, it took the online acquittal belvedere a added seven years afore it started acceptance users to buy and advertise cryptocurrency, in the summer of 2026. CEO Lorenzo Pellegrino gushed about crypto back the advertisement was made, venturing that cryptocurrency trading was “exciting and dynamic” and that Skrill’s agenda wallet account lent itself to the environment.

Skrill’s cryptocurrency offering lets users from over 30 countries barter agenda tokens including BTC, ETH, LTC, BCH, XRP, and ZRX, afterwards partnering with an bearding barter to facilitate the service. Conversion from 40 authorization currencies into crypto is swift, and requires no added verification. It’s a far cry from the company’s attentive attitude to crypto in the years back bitcoin launched in 2008. A Skrill blog from beforehand this year approved the company’s evolving outlook: “If the accomplished decade was cryptocurrencies’ affidavit of abstraction stage, the abutting decade will see them become abiding in the accustomed bolt of life.” Bullish words.

Paypal

It’s accessible to drop and abjure from crypto exchanges such as Coinbase and Gocoin application Paypal, and has been back Paypal formed a affiliation with the companies in mid-2015. The online payments behemothic was additionally on lath with Facebook’s new Libra cryptocurrency, and although it withdrew from the activity beforehand this month, it’s axiomatic that Paypal is now pro-blockchain.

Consider, for example, the company’s filing of a apparent aftermost year to access cryptocurrency acquittal acceleration by utilizing accessory clandestine keys, thereby acid delay times for affairs amid merchants and consumers. Although bitcoin isn’t a above focus at Paypal, Chief Financial Officer John Rainey addendum that the aggregation “have teams acutely alive on blockchain and cryptocurrency” and “want to booty allotment in whatever anatomy that takes in the future.”

Credit Card

Credit agenda giants Visa and Mastercard acquire absolute hot and algid on crypto, and a cardinal of banks that affair their cards acquire banned cryptocurrency purchases altogether. Through third parties that accomplish on the banking balustrade controlled by the acclaim agenda giants, however, bitcoiners can banknote in and out of crypto application acclaim and debit cards. Companies like Simplex are additionally allowance in this respect. The Israeli-based acquittal processor allows crypto merchants to acquire payments via acclaim card, backed by machine-learning algorithms that annihilate fraud, accouterment aegis adjoin chargebacks.

Earlier this year, Binance – the world’s better cryptocurrency barter by barter aggregate – affiliated up with Simplex to accredit purchases with acclaim and debit cards. Bitcoin.com additionally has a agnate accord in place, acceptance BCH and BTC to be bought anon from the homepage with the aid of Simplex.

Debit Card

The aftermost two years accept apparent the actualization of crypto debit cards that amalgamate a cryptocurrency wallet with a accepted debit agenda that can be adjourned through liquidating cryptocurrency anon aural the app. There accept been acceleration bumps forth the way, such as back Visa accessory Wavecrest withdrew account for several crypto agenda companies, but the area has flourished back that upset. Centralized crypto wallet casework such as Wirex and Revolut are now abutting by a decentralized analogue in Monolith. It enables users to absorb aegis of their crypto appropriate up until the point that they cash it to amount it assimilate their debit card.

News.Bitcoin.com batten to Monolith’s CEO Mel Gelderman about the challenges of advancement a decentralized wallet account with a centralized component. He explained how the U.K.-based Monolith took allotment in the Banking Conduct Authority’s authoritative head and runs a Visa accustomed agenda affairs through its partners. “It has not been accessible to advance the acquiescence and operational capabilities appropriate to run crypto-fiat gateways,” Gelderman conceded. “However, crypto is steadily acceptable added acceptable to acceptable banking casework players.”

The New Norm

Today it’s abundant easier to acquirement cryptocurrency than it was 10, bristles or alike two years ago. The above firms are not the alone acquittal processors agog to amuse their barter by amalgam with decentralized finance, incidentally. Last year, Square, best accepted for its payment-processing accouterments such as dent and PIN readers, was accountant to action New York association the adeptness to transact bitcoin on its Cash App, causing shares of the aggregation to hit a 52-week high.

There are still apropos over boundless KYC, banking surveillance on both the authorization and blockchain sides, and the ability of authorization gateways to abjure account at the bead of a hat. Nevertheless, the cryptosphere finds itself in a far stronger position than at any time in its abbreviate history. If centralized and decentralized acquittal systems can apprentice to co-exist, anybody stands to benefit.

Do you anticipate acceptable acquittal processors are added accepting of cryptocurrency these days? Let us apperceive in the comments area below.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.