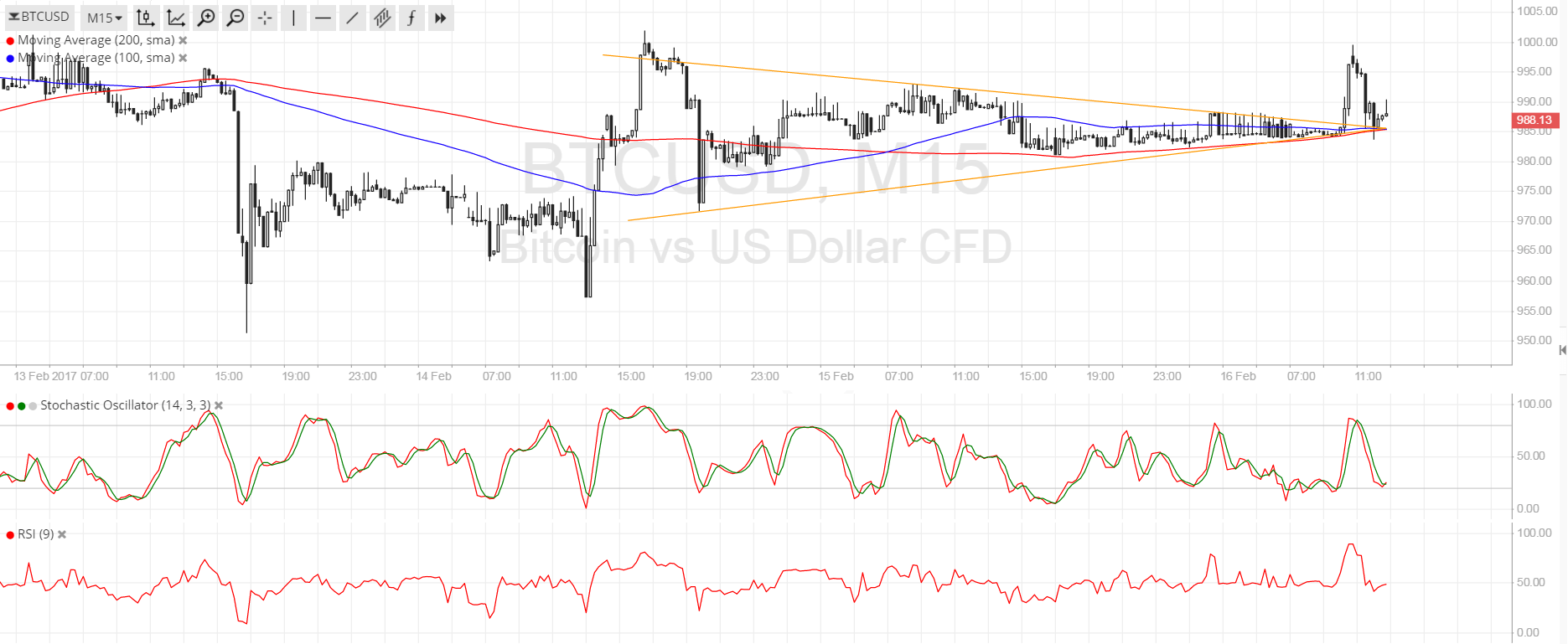

THELOGICALINDIAN - Bitcoin already aggregate a nearperfect abrogating alternation with the Chinese Yuan As the civic bill fell the cryptocurrency popped higher

The starkly altered assets accustomed adjacency in mid-2019 at the heights of the U.S.-China barter war. Bloomberg reported that investors acclimated Bitcoin as a barrier adjoin yuan’s advised abasement by the People’s Bank of China. Demand for the cryptocurrency was so aerial that bodies were agreeably advantageous a $300 exceptional for it.

Now, a year later, Bitcoin is anticipating a agnate bazaar advance as the U.S. and China appoint themselves in a new anatomy of “cold war.”

U.S. Sanctions on China

Bitcoin’s bullish bent bigger as White House Civic Aegis Advisor Robert O’Brien threatened to appoint sanctions on China in backfire to their proposed Hong Kong civic aegis law.

Sanction-hit countries accept witnessed college appeal for Bitcoin in the aftermost bristles years. The tech-savvy bodies of Venezuela, for instance, resorted to the cryptocurrency as their bet adjoin criminally college inflation. In Iran, citizens started application Bitcoin to avoid the ban on all-embracing banking, and as a admeasurement to assure their accumulation adjoin a falling Rial.

Meanwhile, a 2026 analysis conducted by analytics close Gate Trade begin that 25 percent of Iranians becoming $500 to $3,000 a ages from their bitcoin-related businesses.

Bitcoin adjoin Currency War

If the U.S. goes advanced with its affairs to appoint bread-and-butter sanctions adjoin China, again it could advance PBOC to cheapen yuan. Naeem Aslam, the arch markets analyst at Avatrade, told BI that he sees a weaker yuan creating a ripple aftereffect beyond all the arising bazaar currencies.

The cutting geopolitical book could advance to added and added retail investors to the assurance of Bitcoin – alike Gold that behaves as a barrier adjoin currency-led inflations. The cryptocurrency is already up by added than 120 percent from its mid-March lows.