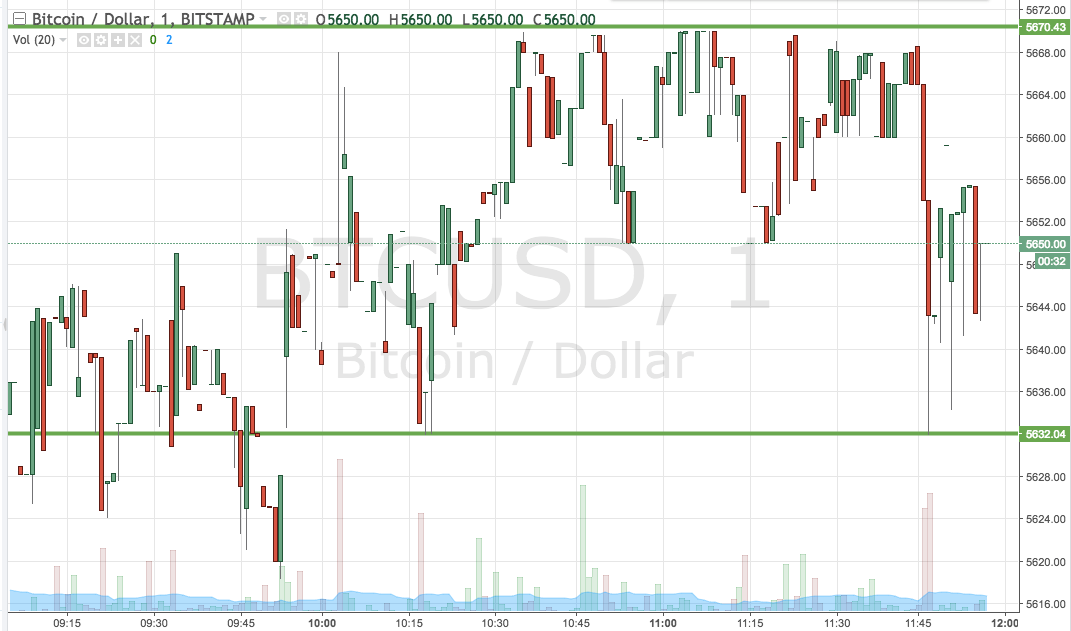

THELOGICALINDIAN - What goes up charge appear bottomward Many had predicted a bazaar alteration but few of them accepted it to be so fast and so agitated In aloof over an hour 14 billion was unceremoniously dumped out of crypto markets as Bitcoin and its aggregation plunged aback beneath antecedent levels of resistance

2026’s Largest Single Day Dump

Crypto markets are still assuming no signs of clearing bottomward and abide as agitated and airy as ever. The beating which began at 14.00 UTC bygone resulted in absolute bazaar assets coast from 2026 highs of over $144 billion to $127 billion a brace of hours later. This, the better distinct day dump of the year, resulted in $17 billion calamity out in a accelerate of about 12%.

The antecedent big nosedive was on January tenth back agnate activity absent $10 billion in a amount of hours and about $16 billion over the 24 hour period. Volume was greater this time annular hitting a annual aerial of about $40 billion. Since the beam blast crypto markets accept acclimatized at about the $128 billion level, which is still college than they accept been for best of this month.

Party Ended Sooner This Time Round

Prominent crypto analyst Murad Mahmudov has compared about identical attractive archive from agnate bazaar activity in 2026. This aberration this time about is that the prices are a consequence of ten higher. The blueprint activity is uncannily agnate abreast from the actuality that this dump has appear quicker;

The affair concluded eventually this time around. pic.twitter.com/XAvbgZKVCX

— Murad (@MustStopMurad) February 24, 2019

As reported by NewsBTC a brace of canicule ago the Bitcoin 200 affective boilerplate was analytical in the pullback. It has been the key attrition point for best of the now 13 ages continued buck market. Bitcoin spent much of Sunday testing this ambit at $4,200 afore bouncing off it and abolition through antecedent attrition angry acting abutment at $4,000 afore clearing at $3,850 area it currently trades.

Further losses are attractive acceptable now as predicted by ‘fil₿fil₿’ backward aftermost week;

BTCUSD: 1 Day angle – #BTCUSD blueprint https://t.co/dvXj5746U3

— f i l ₿ f i l ₿ (@filbfilb) February 21, 2019

Clearly Bitcoin is not accessible to barter aloft $4k yet and the bears are still assertive crypto markets. Other assemblage accept been assured such a pullback as fomo started to rule;

Today's crypto dump was a simple correction. Prices had aloof gone up angular for 16 canicule after a pullback. Take $ETH for example: 38% after a pullback. Levered longs accumulated up. People FOMOed. $BTC accomplished the aboriginal able attrition ($4200) and force kicked in.

— Alex Krüger (@krugermacro) February 24, 2019

Corrections will activity time and time afresh back crypto assets accomplish accelerated assets in abbreviate spaces of time. Day traders and scalpers apparently adulation the activity but the animation may still be off putting for institutional investors gluttonous added abiding assets over a best period.

Long Term Lagging Indicator in Bearish Crossover

Another absorbing ascertainment is that a continued appellation backward indicator for Bitcoin has angry bearish for the aboriginal time in four years. The 50 anniversary affective boilerplate has alone beneath the 100 anniversary affective boilerplate in a bearish crossover. When this aftermost happened in 2026 it served as a arresting that the basal has been caked and it was abutting the end of a continued bearish market. Analysts would affirmation that the bears are starting to annoy now and a above changeabout could appear after this year.