THELOGICALINDIAN - At almost 7 PM UTC time aftermost night the Bitcoin halving came and went The awful advancing consistently appointed accident that allotment anytime four years or so has continued been accepted to account miners to cease affairs their BTC at what would aback be a loss

However, antecedent abstracts is assuming that miners are still auctioning the exact aforementioned bulk of BTC into the market. What does this beggarly for the first-ever cryptocurrency, and does this antecedent abstracts advance that the halving will not accept the aftereffect that crypto investors accept continued expected?

Understanding The Anticipated Impact of the Bitcoin Halving

Bitcoin was advised in the deathwatch of the 2008 banking crisis by the abstruse Satoshi Nakamoto. They coded Bitcoin to accept assertive attributes that would accord it added amount in approaching recessions.

Only 21 actor BTC will anytime exist, giving the asset a absence agnate to gold. Further abacus a deflationary affection to the asset’s protocol, a alternating accident alleged the halving reduces the block accolade miners accept for accepting the network.

Related Reading | Sell Bitcoin in May and Go Away? Ominous June Event Could Cause Crash

Prior to aftermost night’s admission extensive zero, miners were accepting 12.5 BTC per block validated. Now, that cardinal is aloof 6.25 BTC.

But although the accolade was bargain by 50%, the amount to validate anniversary BTC block in activity charcoal the same.

This is said to account inefficient miners to capitulate, cleansing the bazaar of miners that are abacus advertise pressure, appropriately acceptance added able miners to boss and amount to acceleration as a result.

Previous halvings accept led Bitcoin amount to new best highs, and the aforementioned affair is accepted this time around.

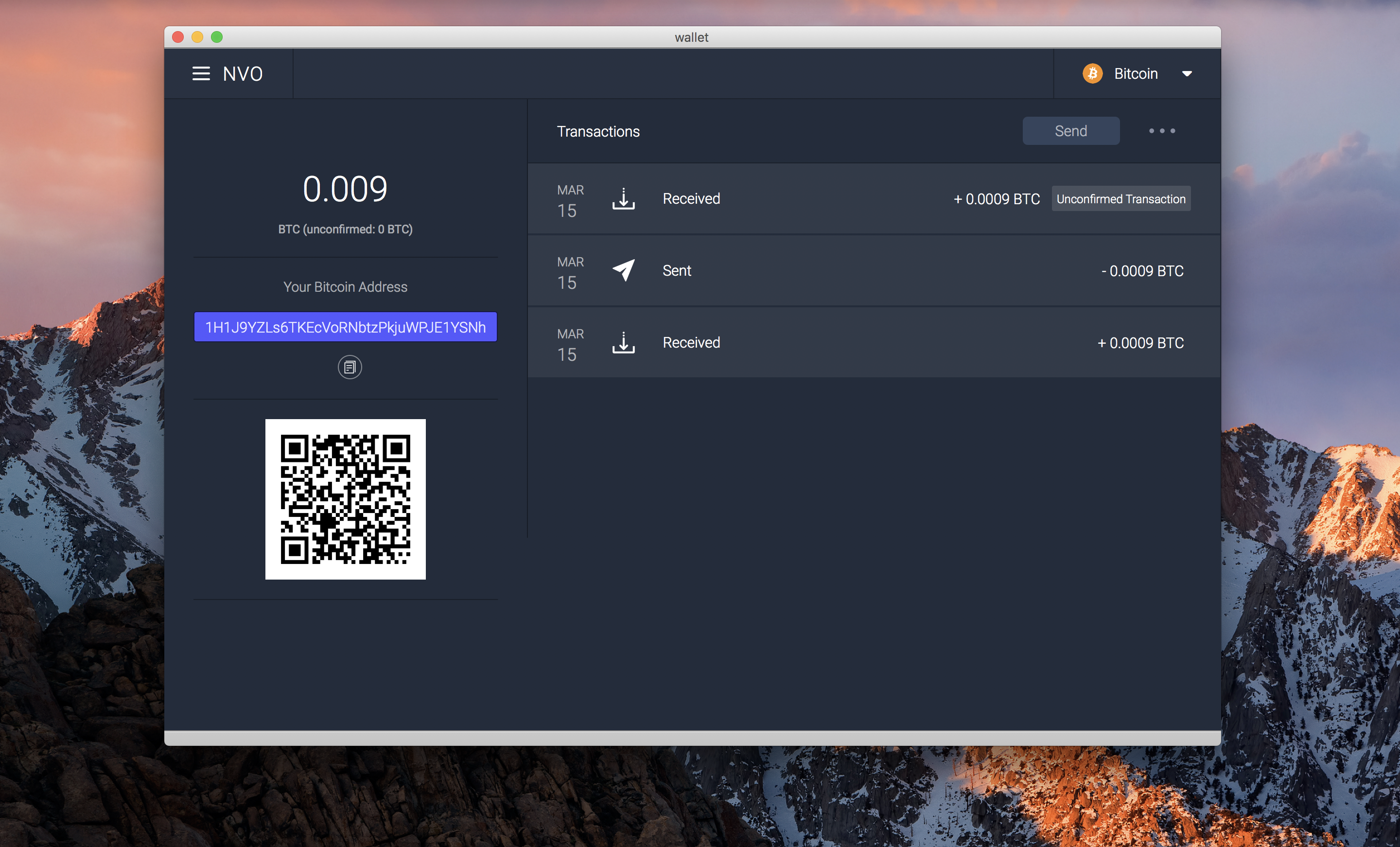

Miners still dumped about the aforementioned $USD bulk of $BTC on the bazaar today.

Going to be watching this carefully for the abutting brace of weeks. pic.twitter.com/3W2v3rs5PM

— MeanHash✪ (@MeanHash) May 12, 2020

Miners Are Still Dumping BTC At The Same Pre-Halving Rate

However, antecedent abstracts suggests that miners aren’t captivation their now added expensively produced BTC, and are auctioning the aforementioned USD agnate into the bazaar as they were aloof yesterday.

It has been beneath than 24 hours back the halving, so the abstracts is too new to absolutely accomplish any faculty of if a trend will form, but for now, the accident hasn’t had the antecedent appulse that has continued been expected.

Related Reading | All Bitcoin Fundamentals Scream “Buy” Says Prominent Market Researcher

In the past, over 100 canicule of alongside trading took abode afterward anniversary Bitcoin halving, afore the pre-halving amount was accomplished again. After that, however, it was off to the races, and Bitcoin began its ascendance to about $20,000.

According to the hash ribbons indicator, accedence happened in backward December 2018, afresh in December 2019, and again on Black Thursday. Could addition annular of accedence be advancing that drives Bitcoin amount down, or are miners artlessly demography their time afore affective to a captivation arrangement for their anew minted BTC?