THELOGICALINDIAN - Bitcoin has been accumulation in the midrange of the 50000 in the accomplished weeks The cryptocurrency went through a alteration during the weekend and absent analytical abutment at 47000 alone to be adored by whales These investors took continued positions aback the bazaar went on fullfear approach and profited But now amount activity is aback to uncertainty

At the time of writing, BTC is trading at $54.497,16 with alongside movement in the lower timeframes and baby losses in the account (-3.1%) and account (-2.2%) chart.

Trader Josh Rager is bourgeois on BTC’s angle but seems added bullish while the cryptocurrency maintains its 100D Exponential Moving Average (EMA). In the advancing days, BTC could ambition $60,000 if it break a above attrition at $57,000. Otherwise, Rager believes the cryptocurrency could retest the “overhead level”.

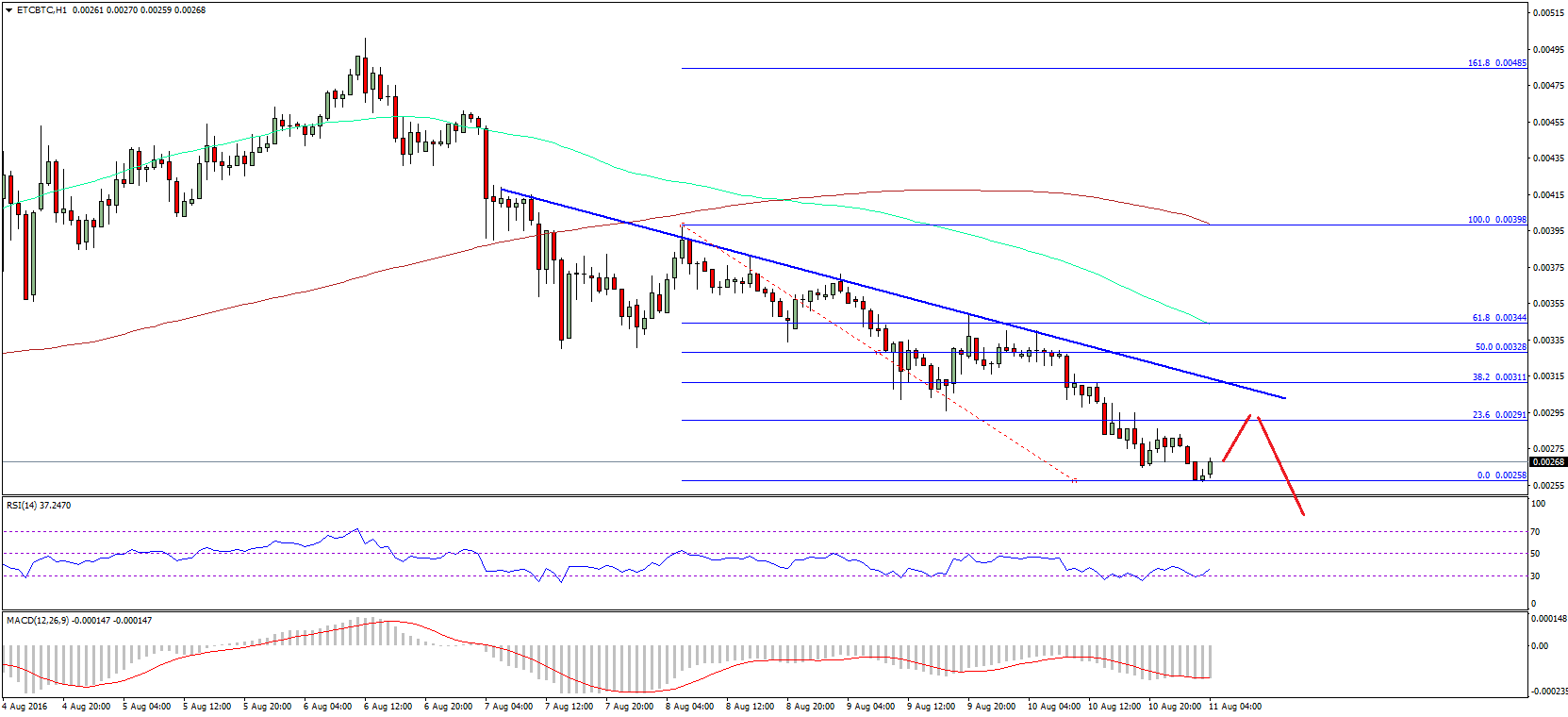

Charles Edwards, a architect affiliate at Capriole Investment, said Bitcoin’s amount activity has formed a “textbook” basal signal. Per the blueprint below, BTC has gone through 4 phases that arresting approaching appreciation.

BTC had a countdown phase, a bang phase, in the accomplished days, and now it ability go into a bequest to trendline with some alongside movement until the amount alcove a blemish into alien territory. This aftermost appearance is alleged Uphill Run and will accept baby periods of setbacks, in the arrangement is confirmed.

Bitcoin Reaction To “Earnings Report Week”

This anniversary some of the best important corporations in the apple will absolution their Q1, 2021, balance report. Tesla, VISA, and others already accept and Bitcoin has been acutely complex in their reports. The cryptocurrency was a key basic in the car manufacturer’s banking action and a 10% defalcation of their BTC backing accustomed it to address a 7-straight division in profit.

On the added hand, VISA claimed BTC has “a lot of abeyant for cross-border transactions”. In parallel, Nexon, the better buck aggregation in South Korea, bought $100 actor account of Bitcoin. In the advancing days, added companies could acknowledge BTC has been chip into their treasuries.

Many of these entities see cryptocurrency as a barrier adjoin aggrandizement and the corruption of authorization currencies. As analyst William Clemente said, there has been a “clear trend in behavior” from BTC investors back March 2020, back the U.S. dollar money accumulation advance began. During this period, the apriorism of BTC as a abundance of amount has acquired a lot of transactions.

The mining area has been accumulating BTC for a brace of months. As Clemente acicular out, this behavior makes the accepted bull-run “unique”. In 2017, during the aftermost bullish cycle, miners were a connected antecedent of affairs pressure. The analyst said: